January 2026

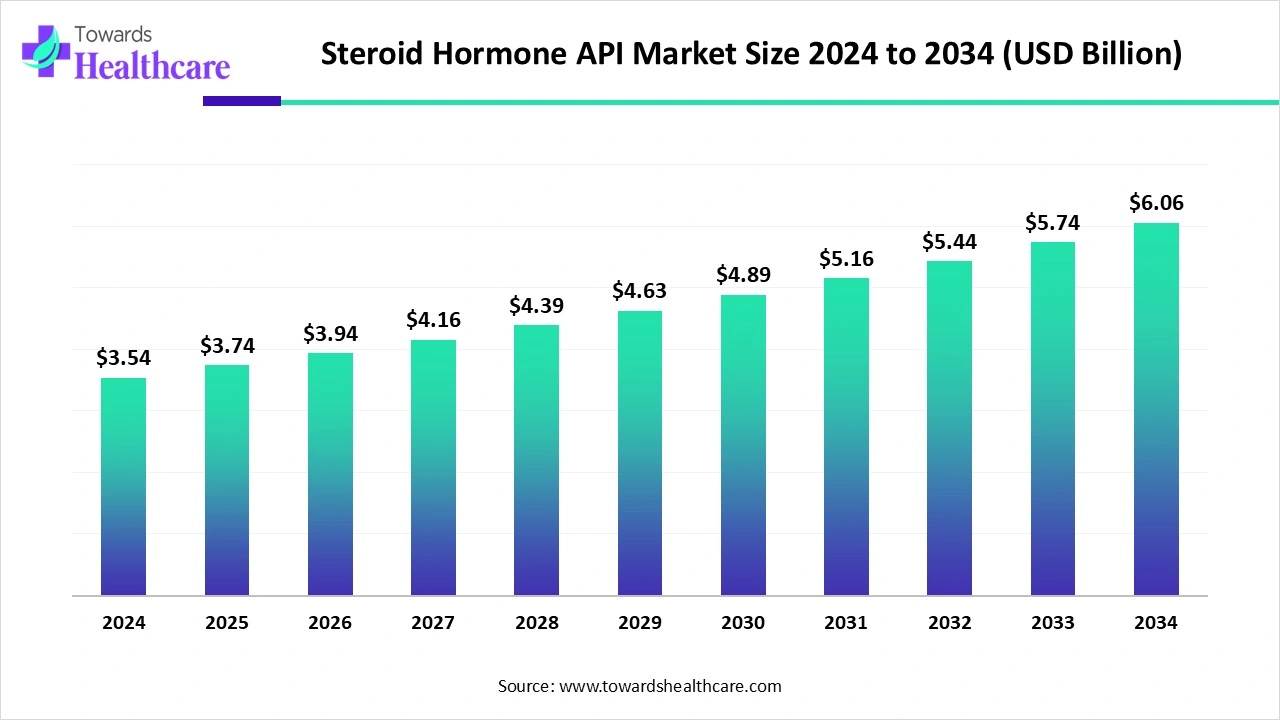

The global steroid hormone API market size is calculated at US$ 3.54 billion in 2024, grew to US$ 3.74 billion in 2025, and is projected to reach around US$ 6.06 billion by 2034. The market is expanding at a CAGR of 5.54% between 2025 and 2034.

Due to the growing demand for steroid-based drugs and the rising incidence of chronic illnesses, the market for steroid active pharmaceutical ingredients or APIs is expanding significantly. Steroids, which have anti-inflammatory qualities, are essential for treating a number of illnesses, including hormonal imbalances, asthma, and arthritis. A factor in the dynamics of this market is the increasing use of steroids in therapeutic domains such as autoimmune diseases and cancer. As a result of the approval by the FDA of a number of steroid-based medications, both patients and medical professionals are now more likely to embrace them.

| Table | Scope |

| Market Size in 2025 | USD 3.74 Billion |

| Projected Market Size in 2034 | USD 6.06 Billion |

| CAGR (2025 - 2034) | 5.54% |

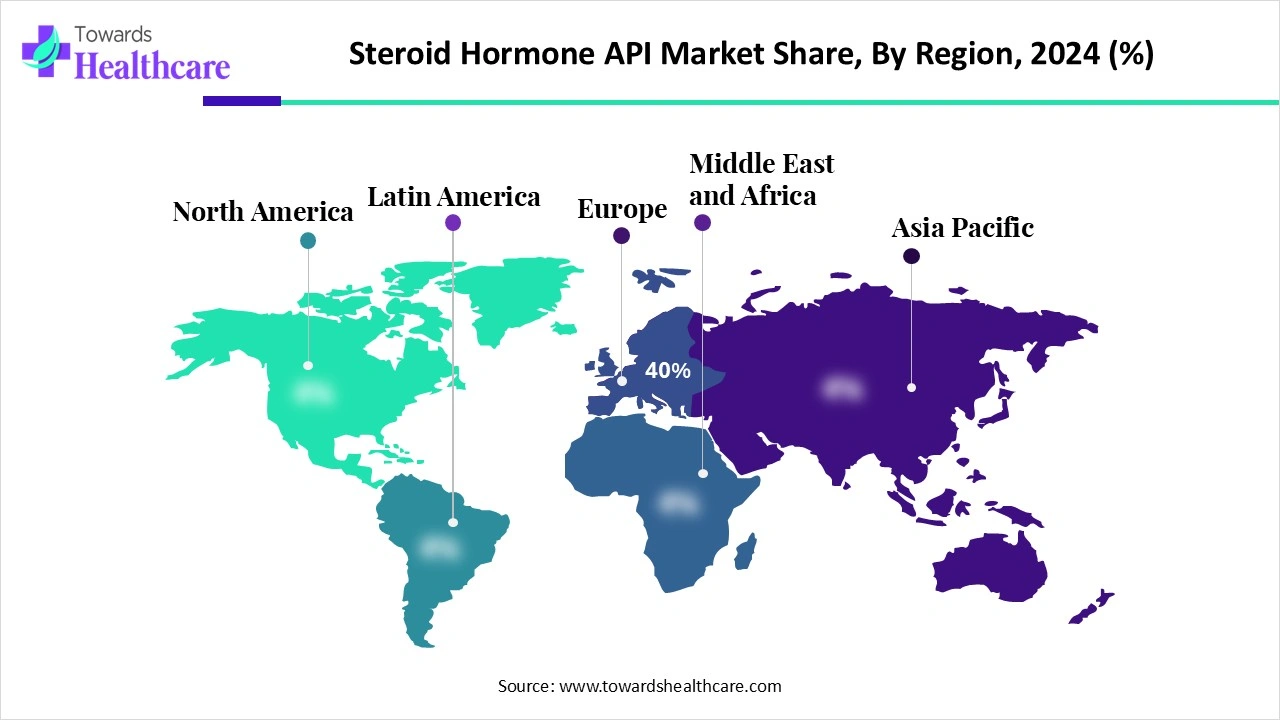

| Leading Region | Europe 40% |

| Market Segmentation | By Product Type, By Source, By Application, By End User, By Region |

| Top Key Players | Pfizer CentreOne, Merck KGaA, Novartis AG, Sanofi S.A., GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., Bayer AG, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Pharmaceuticals, Torrent Pharmaceuticals, Zhejiang Xianju Pharmaceutical Co., Ltd., Wuhan Yuancheng Gongchuang Technology Co., Ltd., Tianjin Tianyao Pharmaceuticals, Symbiotec Pharmalab Pvt. Ltd., Aspen Pharmacare, Hikma Pharmaceuticals PLC, AdvaCare Pharma, Shandong Xinhua Pharmaceutical Co., Ltd. |

The steroid hormone API market refers to the production and supply of raw steroid hormone compounds used in the formulation of pharmaceutical drugs. These APIs include corticosteroids, sex hormones, and anabolic steroids, which play vital roles in treatments related to endocrine disorders, inflammation, autoimmune diseases, reproductive health, and hormone replacement therapy (HRT). Steroid hormone APIs are used by pharmaceutical manufacturers to produce tablets, injectables, creams, and other dosage forms. Market demand is fueled by the increasing prevalence of hormonal disorders, aging populations, growing demand for contraceptives, and the expansion of generic steroid-based therapies.

The production of APIs is changing dramatically due to artificial intelligence. AI systems examine enormous production line information to find trends, forecast results, and streamline procedures. Regulatory agencies are revising their requirements to take into account the automation, artificial intelligence, and sustainability that are becoming essential to the production of APIs. While sustainability assures long-term survival, artificial intelligence opens up new efficiencies. These pillars are working together to create a more intelligent, robust, and clean API production environment.

Rising Bodybuilding Trends

A well-known and established problem in bodybuilding is the use of performance-enhancing drugs. A billion-dollar industry and millions of fans have made bodybuilding a worldwide phenomenon. These drugs help athletes gain more muscle mass, boost their strength and stamina, and improve their physical attributes. To obtain an advantage over their competitors, athletes today use a variety of drugs, such as insulin, human growth hormone, stimulants, diuretics, and others.

High Production Cost

The problem is that steroid hormone APIs are expensive to produce. The production of these hormones frequently entails intricate and specialised manufacturing procedures, which might raise operating expenses. Costs may also be increased by the high cost of the raw ingredients needed to produce steroid hormones. This poses a big problem, especially for producers of generic APIs, who have to strike a compromise between cost-effectiveness and upholding high standards of quality.

MOFs are Shaping the Future of the Steroid Hormone API Market.

Because of their distinct structural properties and functionalization potential, Metal–Organic Frameworks (MOFs), a novel class of porous material, have garnered a lot of interest in the domains of chemistry, materials science, and biology. MOFs have attracted a lot of interest in the steroid detection sector because of their versatile design and pore structure tweaking. Because of these properties, MOFs have a lot of potential for sensing, enrichment, and separation—particularly for steroid analysis in complicated biological samples.

By product type, the corticosteroid APIs segment was dominant in the steroid hormone API market in 2024. A crucial class of pharmacological APIs, corticosteroids have potent immunosuppressive and anti-inflammatory effects. They are widely used to treat a wide range of illnesses, helping people all over the world.

By product type, the sex hormone APIs segment is estimated to be the fastest-growing during the forecast period. Propelled by elements such as the rising incidence of hormone-related illnesses, expanding knowledge of hormone replacement therapy, and developments in formulation technologies. The need for HRT is fueled by the growing elderly population, especially in industrialised countries, which is a major growth driver. Additionally, segment development is aided by the growing use of combination treatments that incorporate progesterone and oestrogen APIs.

By source, the synthetic steroid APIs segment led the steroid hormone API market in 2024. Synthetic steroids, often known as corticosteroids or anabolic steroids, are synthetic compounds designed to mimic the effects of hormones that are naturally present in the body. The medical industry is one area where synthetic steroids are often used. For the treatment of a number of illnesses, including autoimmune diseases, allergic responses, and inflammatory diseases, corticosteroids like prednisone and hydrocortisone are advised.

By source, the natural/plant-derived steroid APIs segment is anticipated to grow at the highest rate during the upcoming period. Natural steroids are derived from substances present in nature, as opposed to their synthetic equivalents, which are produced in labs. These drugs are frequently used to improve muscle growth, boost testosterone and other hormone production, and improve athletic performance.

By application, the hormone replacement therapy (HRT) segment held the major share of the steroid hormone API market in 2024. As a woman approaches or enters menopause, hormone replacement treatment (HRT) helps to regulate her hormones. Over 85% of postmenopausal women globally are thought to have had menopause-related symptoms at some time in their lives. It is projected that 1.2 billion women worldwide will be perimenopausal or postmenopausal by 2030, an increase of 4.7 million each year.

By application, the contraceptives segment is estimated to witness the fastest CAGR during 2025-2034. One of the main forms of birth control in the U.S. and many other nations is the use of contraceptive steroids. Oral progestin/estrogen combinations are the most used steroidal formulations for contraception due to their favourable patient acceptance and efficacy.

By end-user, the pharmaceutical companies segment led the steroid hormone API market in 2024. Since APIs make up about half of the medicine itself, they play a significant role in the pharmaceutical production industry. The demand for Active Pharmaceutical Ingredients (APIs), the essential ingredients that give drugs their therapeutic benefits, is steady and increasing, according to pharmaceutical corporations.

By end-user, the contract manufacturing organizations (CMOs)/CDMOs segment is anticipated to grow at the highest CAGR during the forecast period. In the pharmaceutical sector, CDMOs provide integrated services for drug discovery, process scaling up, and manufacturing, including the production of Active Pharmaceutical Ingredients (APIs), whereas CROs manage clinical trials and early-stage research. Pharmaceutical businesses might outsource specialised work to CROs and CDMOs to expedite drug development, control costs, and adhere to laws.

Europe dominated the steroid hormone API market share 40% in 2024, due to the existence of significant market participants in this area and the increase in funding for research initiatives. The expansion of research and development initiatives by European pharmaceutical and biopharmaceutical businesses is expected to contribute to the expansion of the API market in this area.

Due to a number of dynamic market drivers and new trends, the German steroid hormone API market is expected to continue growing. The growing emphasis of the government on the healthcare industry, with regulatory frameworks that prioritise safety and efficacy, is a major motivator.

Official statistics show that in only one year, the number of patients in England undergoing hormone replacement therapy (HRT) increased from 1.8 million to 2.3 million, representing a nearly one-third increase. It follows celebrity awareness efforts on menopause, such as Davina McCall, and government action in response to a recent shortage of some HRT drugs.

Asia Pacific is estimated to host the fastest-growing steroid hormone API market during the forecast period. It is anticipated that the growing accessibility and awareness of anabolic steroids in nations like China and India would accelerate the expansion of the regional market. The increased prevalence of breast cancer in nations like India is the primary driver of this awareness-raising. Female patients with advanced, incurable metastatic breast cancer are treated with anabolic steroids like methyltestosterone. Over the course of the projected period, this is anticipated to accelerate the market expansion in the region.

A complicated, multi-stage research and development procedure subject to stringent regulatory regulations is needed to develop an Active Pharmaceutical Ingredient (API) for steroid hormones. The process, which is frequently based on biotechnology or chemical synthesis, moves from preliminary route exploration and optimisation to validation of full-scale manufacture.

Companies: Lupin Ltd., Aurobindo Pharma, Symbiotec Pharma, Axplora, and Brichem Sciences

Instead of requiring independent clinical studies for the Active Pharmaceutical Ingredients (APIs) used in steroid hormone medication formulations, regulatory requirements concentrate on manufacturing quality and site approval. To obtain regulatory clearance, the manufacturing method and quality of the API must be demonstrated to be dependable, even though clinical studies are carried out on the finished therapeutic product.

Companies: Lupin Ltd., Aurobindo Pharma, Symbiotec Pharma, Axplora, and Brichem Sciences

The process of offering steroid hormone treatment, patient assistance, and services is complex and includes everything from initial education to ongoing monitoring. Comprehensive patient education, individualised medication management, side effect monitoring and treatment, lifestyle support, and ongoing communication between the patient and their healthcare team are all crucial components.

In October 2024, the FDA approved Estradiol Gel, 0.06% of ANI Pharmaceuticals, and it went on sale. We are happy to introduce another limited-competition product to the market and make sure that customers and patients in need have ready access with the FDA approval and commercialisation of Estradiol Gel, 0.06%, said Nikhil Lalwani, President and CEO of ANI.

By Product Type

By Source

By Application

By End User

By Region

January 2026

December 2025

November 2025

November 2025