February 2026

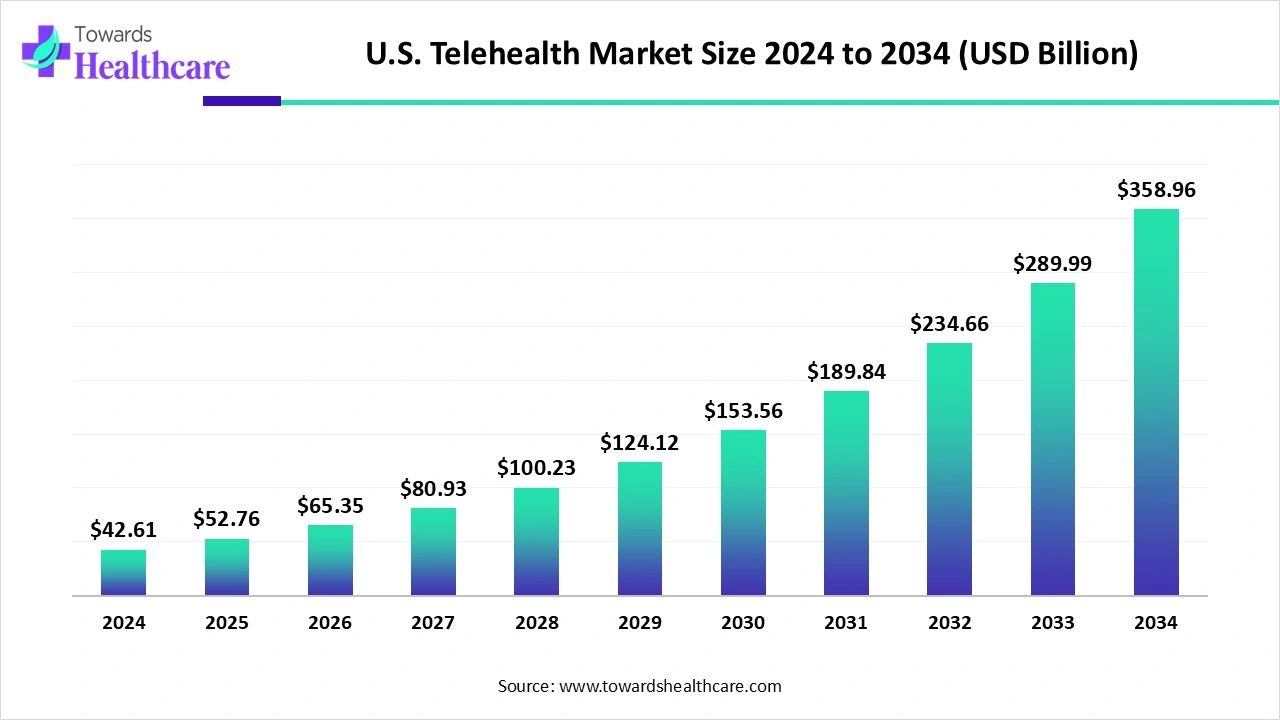

The U.S. telehealth market size reached US$ 42.61 billion in 2024 and is anticipate to increase to US$ 52.76 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 358.96 billion, growing at a CAGR of 23.84%.

The U.S. telehealth market is expanding as healthcare providers increasingly adopt digital platforms to improve patient access and reduce operational costs. Rising awareness of virtual care benefits, integration of mobile health apps, and enhanced broadband connectivity are accelerating usage. Furthermore, the shift toward value-based care, coupled with investments in secure and user-friendly telehealth solutions, is driving market growth across urban and rural regions, making remote healthcare more widespread and efficient.

| Table | Scope |

| Market Size in 2025 | USD 52.76 Billion |

| Projected Market Size in 2034 | USD 358.96 Billion |

| CAGR (2025 - 2034) | 23.84% |

| Market Segmentation | By Component, By Application, By Mode of Delivery, By End User, By Payer Type, By Region |

| Top Key Players | Teladoc Health, Inc., Amwell (American Well), MDLIVE (Cigna), Doctor on Demand, 98point6, HealthTap, PlushCare, American TelePhysicians, Zipnosis, GlobalMed, SOC Telemed, Medtronic, Philips Healthcare, GE HealthCare Technologies Inc., Siemens Healthineers, Cerner Corporation (Oracle Cerner), Epic Systems Corporation, Walmart Health, Amazon Clinic, Walgreens Boots Alliance |

Telehealth refers to the delivery of healthcare services using telecommunications technology, including video consultations, remote monitoring, mobile health apps, and digital therapeutics. It plays a key role in improving access to care, reducing hospital admissions, lowering healthcare costs, and enhancing patient convenience. Growth in the U.S. is driven by aging populations, physician shortages, rising chronic disease prevalence, strong reimbursement support (Medicare, Medicaid, private insurers), and adoption of AI-enabled digital platforms.

The U.S. Telehealth market is evolving as healthcare providers adopt hybrid care models combining in-person and virtual services. Growing patient demand for flexible, on-demand consultations, coupled with the rise of wearable devices and remote monitoring, is driving innovation. Increased investments in cybersecurity, interoperability, and cloud-based platforms are enhancing telehealth capabilities. Furthermore, insurance and employers are promoting virtual care solutions to reduce costs and improve outcomes, accelerating the transformation of the healthcare delivery landscape.

For Instance,

Introduction of Specialized Programs: Companies are launching targeted telehealth services for areas like obesity, mental health, or chronic disease management to cater to unmet patient needs.

Advancements in Digital Health Technology: Innovations like AI-driven diagnostics, wearable devices, mobile health apps, and secure telehealth platforms improve service delivery and patient monitoring.

AI is transforming the market by enabling real-time remote patient monitoring and intelligent virtual consultations. It supports early detection of health issues through data analytics, improves workflow efficiency for healthcare providers, and enhances patient experience via personalized care recommendations. AI-powered tools also facilitate remote chronic disease management, reduce hospital readmissions, and streamline telehealth operations. These innovations are driving wider adoption of virtual care and expanding the scope and effectiveness of telehealth services across the country.

Growing demand for Accessible and Convenient Healthcare

The push for accessible and convenient healthcare drives the U.S. telehealth market as patients increasingly look for care options that fit into their daily lives. Virtual platforms allow individuals to consult providers outside traditional clinic hours, supporting those with busy schedules or mobility challenges. This flexibility also reduces missed appointments and enhances continuity of care. As more people prioritize ease of access, providers are compelled to strengthen telehealth services, contributing significantly to market expansion.

For Instance,

Data Privacy and Security Concerns

Data privacy and security concerns are a major restraint in the U.S. telehealth market, as many platforms struggle with interoperability across different healthcare systems, increasing the risk of data leaks during healthcare transfers. Frequent reports of ransomware attacks and inadequate encryption methods create skepticism among patients and providers. Additionally, smaller telehealth startups often lack the resources to build strong cybersecurity frameworks, making them more vulnerable. These challenges discourage wider adoption, as trust in the safe handling of personal health data remains limited.

Integration of Advanced Remote Patient Monitoring (RMP) and Wearable Technologies

The integration of RMP and wearable technologies is a future opportunity in the U.S. telehealth market because it supports seamless data sharing between patients and providers, enhancing clinical decision-making. These tools empower, enhancing clinical decision-making. These tools empower patients to actively engage in managing their health and improving adherence to treatment plans. Additionally, the vast amount of health data collected through wearables creates opportunities for predictive analytics and early intervention, driving innovation in personalized telemedicine services and expanding value-based care models across the healthcare system.

For Instance,

The services segment captured the largest shares of the market in 2024 as providers prioritized end-to-end care delivery rather than just technology adoption. Services offered continued patient support, care coordination, and follow-up management, which were critical for chronic disease treatment and post-acute care. Moreover, the ability of service providers to customize solutions for diverse patient groups and ensure seamless user experience positioned this segment ahead, making it the backbone of virtual healthcare delivery.

The software platforms segment is projected to expand at the fastest CAGR in the U.S. telehealth market because of growing reliance on modular and customizable solutions that adapt to diverse clinical needs. Increasing focus on user-friendly interfaces, mobile integration, and multilingual support is enhancing patient engagement. In addition, rising investments in cybersecurity and compliance-focused platforms are boosting adoption, as providers seek secure, flexible digital ecosystems that can evolve with changing demands and regulatory requirements.

The teleconsultation segment dominated the U.S. telehealth market in 2024 as it became the first point of contact for patients seeking timely medical advice. Its ability to reduce appointment wait times, triage cases efficiently, and connect patients to the right level of care drove adoption. Employees and health systems also promoted teleconsultations as cost-saving tools, while their ease of use through smartphones and integrated apps boosted widespread acceptance, ensuring market growth.

The mental health & behavioral therapy segment is projected to grow at the fastest CAGR in the U.S. telehealth market as providers increasingly integrate digital tools like mood-tracking apps, AI chat support, and virtual group therapy sessions. These innovations expand access beyond traditional one-on-one therapy and appeal to tech-savvy users seeking continuous support. In addition, rising employer-backed wellness programs and insurance coverage for online mental health services are boosting adoption, positioning this segment for rapid expansion.

The web/cloud-based platforms segment led the U.S. telehealth market in 2024 because it allows healthcare providers to quickly deploy services without heavy on-site infrastructure. Cloud solutions enable easy integration with mobile apps, wearable devices, and remote monitoring tools, enhancing patient engagement. Their flexibility supports multi-specialty care, real-time analytics, and secure data sharing, while subscription-based models lower costs for smaller practices. These advantages make cloud platforms the preferred delivery mode for scalable, efficient, and accessible telehealth services.

The mobile applications segment is projected to grow fastest in the U.S. telehealth market as patients increasingly demand instant, flexible access to healthcare from anywhere. Mobile apps enable secure messaging, virtual check-ins, and integration with fitness trackers and home monitoring devices, enhancing patient engagement and adherence. Healthcare providers also favor apps for streamlined workflow, automated reminders, and analytics-driven insights. Rising smartphone penetration, app-based wellness programs, and convenience-driven patient behavior are driving rapid adoption and fueling segment growth.

The healthcare providers segment commanded the largest revenue share of the U.S. telehealth market in 2024 as medical institutions increasingly relied on telehealth to enhance service delivery and maintain continuity of care. Providers adopted virtual platforms to manage high patient volumes, reduce hospital overcrowding, and improve patient engagement. Investments in specialized telehealth teams, training, and digital infrastructure allowed providers to offer scalable, multi-specialty virtual services. This extensive integration into routine healthcare operations solidified the segment’s leading position in market revenue.

The payers & employers segment is projected to grow fastest in the U.S. telehealth market increasingly implement telehealth programs to improve healthcare accessibility for employees and members. Virtual care helps monitor wellness, manage chronic conditions, and provide behavioral health support, reducing absenteeism and overall medical expenses. Additionally, insurers and corporations are investing in customized telehealth platforms and mobile solutions to enhance engagement, track outcomes, and offer flexible care options, driving rapid adoption and positioning this segment for significant growth during the forecast period.

The private insurance segment led the U.S. telehealth market in 2024 because insurers actively promoted virtual care to offer competitive benefits and improve patient retention. By covering telehealth services, private payers enabled wider access to preventive care, follow-ups, and specialty consultations. Integration with digital health platforms and incentive programs for members further boosted adoption. This proactive approach in funding and facilitating telehealth solutions positioned private insurance as the top revenue-generating payer segment in the market.

The Medicare/Medicaid segment is projected to grow fastest as government programs focus on expanding telehealth access for seniors and underserved communities. Increased funding for virtual visits, remote monitoring, and home-based care allows beneficiaries to receive timely healthcare without travel. Policymakers’ push for cost-efficient, preventive care models, along with growing digital literacy among older adults, drives adoption. These factors position Medicare and Medicaid as key growth segments, accelerating telehealth utilization and contributing to a higher CAGR during the forecast period.

The U.S. telehealth market is driven by rising demand for convenient, accessible healthcare and advances in digital health technologies. Hospitals, clinics, and telehealth providers are increasingly adopting virtual consultations, remote patient monitoring, and mobile applications to improve patient care and reduce operational costs. Supportive regulatory policies, expanding insurance coverage, and growing awareness of chronic and mental health management are further fueling adoption. With ongoing technological innovation and increased investment, the market continues to expand rapidly, transforming healthcare delivery nationwide.

The South U.S. led the telehealth market as regional healthcare providers increasingly embraced virtual care to reach rural and underserved populations. Strong adoption of mobile and web-based platforms, combined with supportive local initiatives and partnerships between hospitals and technology companies, fueled service expansion. Rising awareness of telehealth benefits and growing investment in digital health solutions across the region enabled more patients to access timely care, securing the South’s position as the highest revenue-generating region in the U.S. market.

The West U.S. is projected to grow at the fastest CAGR in the telehealth market because of its large urban population, high demand for convenient healthcare, and early adoption of innovative digital health technologies. Regional initiatives promoting virtual care, combined with strong venture capital investment in telehealth startups, are accelerating service rollout. Additionally, tech-savvy consumers and increasing focus on preventive and mental health care contribute to rapid market expansion, making the West a leading growth region during the forecast period.

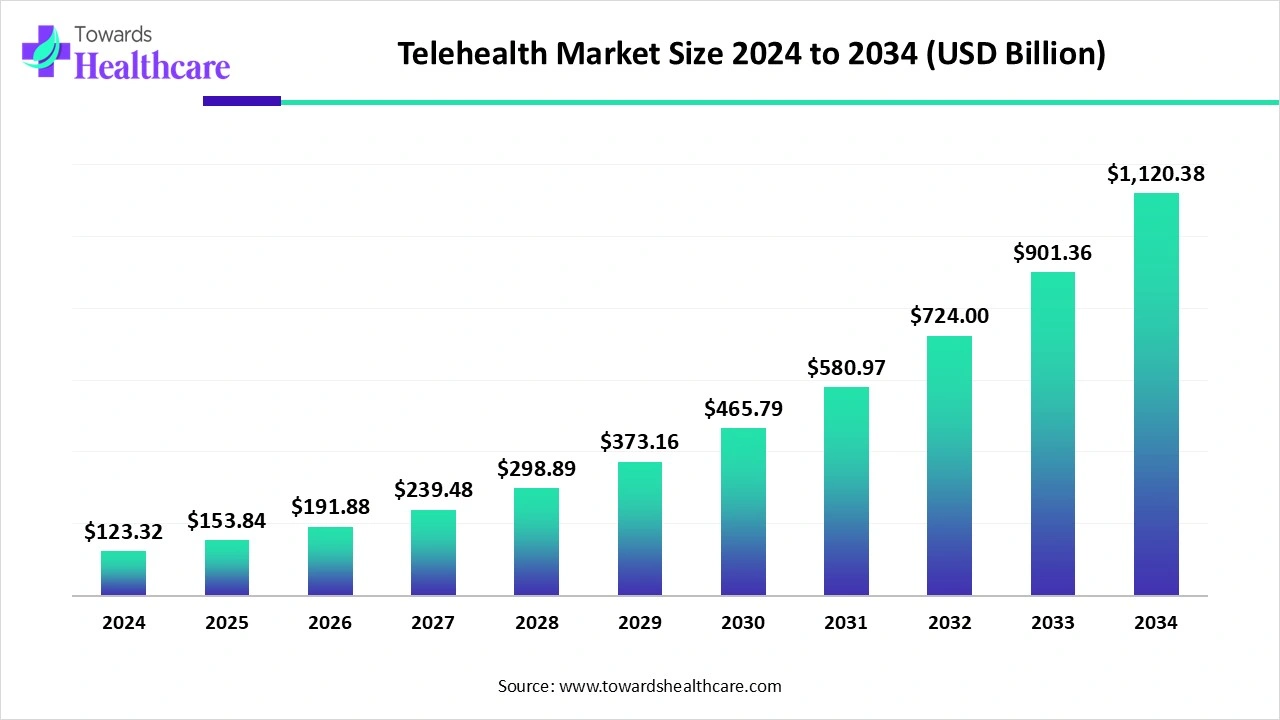

The global telehealth market is valued at USD 123.32 billion in 2024 and is expected to grow to USD 153.84 billion in 2025. Looking ahead, the market could reach nearly USD 1,120.38 billion by 2034, expanding at a strong CAGR of 24.73% from 2025 to 2034.

Clinical Trials- Clinical trials in the U.S. telehealth sector, which gained momentum during the COVID-19 pandemic, leverage remote tools such as video visits, digital monitoring, and electronic data capture to enhance patient participation, accessibility, and engagement in research studies.

Regulatory Approvals- In the U.S., telehealth regulations are managed by multiple federal and state agencies, including CMS, FDA, and HHS, each overseeing different aspects. The COVID-19 pandemic led to the temporary relaxation of several telehealth rules, some of which, especially for behavioral and mental health, have now become permanent, while others continue to be reviewed and adjusted.

Patient Support and Services- U.S. telehealth patient support includes technical help, clinical guidance, and administrative assistance to ensure patients can access and navigate remote healthcare smoothly. These services address challenges like platform use, scheduling, and technology access. Key aspects involve educating patients on using telehealth tools, supporting those with limited digital skills or in underserved areas, and helping with insurance and billing, all aimed at improving patient experience and promoting equitable access to virtual care.

In January 2025, the U.S. Drug Enforcement Administration (DEA) introduced three new rules to make some temporary telemedicine flexibilities from the COVID-19 pandemic permanent, while also enhancing patient safety. These rules ensure telemedicine remains accessible, particularly for prescribing controlled medications to patients who have not previously had an in-person visit with a provider. DEA Administrator Anne Milgram emphasized that the goal is to improve access to needed medications while preventing misuse. The rules also require online telemedicine platforms to register with the DEA and support a nationwide Prescription Drug Monitoring Program (PDMP). Telemedicine visits without prescriptions, or for patients already seen in person, are not affected.

By Component

By Application

By Mode of Delivery

By End User

By Payer Type

By Region

February 2026

February 2026

February 2026

February 2026