January 2026

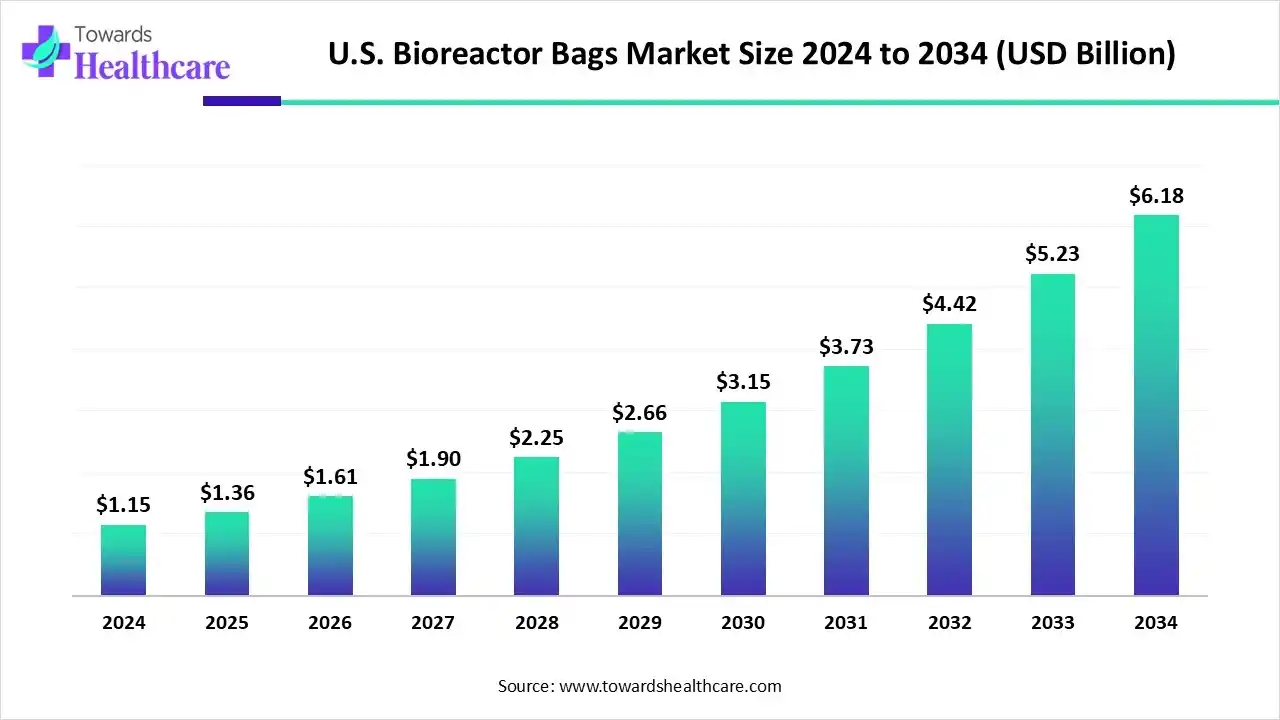

The U.S. bioreactor bags market size is calculated at USD 1.36 billion in 2025, grew to USD 1.61 billion in 2026, and is projected to reach around USD 7.33 billion by 2035. The market is expanding at a CAGR of 18.34% between 2026 and 2035.

The U.S. bioreactor bags market is primarily driven by the growing demand for personalized medicines and the increasing adoption of single-use bioreactor bags. The U.S. has a strong presence of pharmaceutical and biotechnology companies with advanced manufacturing facilities. Prominent players collaborate with contract development and manufacturing organizations (CDMOs) to access advanced technologies and develop innovative products. Artificial intelligence (AI) can revolutionize the manufacturing and distribution of bioprocess bags. The shifting trends towards advanced manufacturing technologies present future opportunities for market growth.

The U.S. bioreactor bags market is experiencing robust growth, driven by the growing demand for biologics, technological innovation, and increasing investments. Single-use bioreactor bags (also called single-use bags, media/storage bags, mixer bags, transfer/harvest bags, or bioprocess bags) are flexible, sterile film assemblies used across upstream bioprocessing (cell culture/fermentation seed-train, production bioreactors, perfusion vessels), media preparation, storage/transport, mixing, and downstream transfer.

Single-use bioreactor bags replace stainless-steel or reusable vessels for many unit operations, reducing cleaning/validation burden, accelerating changeover speed, and lowering the risk of cross-contamination. This makes them core consumables in the single-use bioprocessing value chain (bags themselves, tubing & fittings, assemblies, and pallet/tote containment).

AI can revolutionize several functions of bioreactor bags and enhance their efficiency. AI-based sensors are embedded to monitor vital parameters about cell culture. They can send real-time updates to manufacturers and researchers, enabling them to take necessary actions. AI and machine learning (ML) algorithms can analyze vast amounts of data and identify the interaction patterns between different parameters, thereby determining their timing in the culture process.

MilliporeSigma’s ProCellics Raman Analyzer with Bio4C PAT Raman Software leverages sensors, enabling real-time monitoring and automation of the bioprocess. This also eliminates the need to collect samples and send them to QC labs. Such innovations accelerate the speed of bioprocessing and reduce manual errors.

Demand for Biologics

The major growth factor for the U.S. bioreactor bags market is the growing demand for biologics. The rising prevalence of chronic, genetic, and rare disorders necessitates researchers to develop targeted treatment. Biologics offer highly effective treatments for disorders that are otherwise challenging to manage with conventional small-molecule drugs. They cure a disease from its root cause, preventing its recurrence and reducing systemic side effects.

The table below demonstrates different Food and Drug Administration (FDA) approved biologics in 2025. Between January 2025 and August 2025, the U.S. FDA approved a total of eight biologics.

| Biologics | Company | Indication |

| Papzimeos | Precigen, Inc. | Recurrent respiratory papillomatosis |

| Mnexspike | Moderna TX, Inc. | Prevention of COVID-19 |

| Nuvaxovid | Novavax, Inc | Prevention of COVID-19 |

| Zevaskyn | Abeona Therapeutics, Inc. | Treatment of wounds in patients with recessive dystrophic epidermolysis bullosa (RDEB) |

| Encelto | Neurotech Pharmaceuticals, Inc. | Treatment of adults with idiopathic macular telangiectasia type 2 |

| Vimkunya | Bavarian Nordic, Inc. | Prevention of disease caused by the chikungunya virus in individuals 12 years of age and older |

| Penmenvy | GlaxoSmithKline Biologicals | Prevent invasive disease caused by Neisseria meningitides |

| Automated C3d Plate | Immucor, Inc. | For Echo Lumena and Galileo Echo in automated direct antiglobulin tests (DAT) |

Scalability Challenges

Bioreactor bags face scalability challenges, as large-scale bioprocessing is not feasible due to the increased weight and pressure of larger fluid volumes and the difficulty in maintaining constant mixing and oxygen transfer. This challenge limits the use of bioreactor bags for large-scale operations.

What is the Future of the U.S. Bioreactor Bags Market?

The market future is promising, driven by the increasing use of 3D printing technology. 3D printing is an advanced manufacturing technique that helps design and develop customized solutions based on manufacturers’ requirements. It can also develop bioreactor accessories, such as rotors and magnetic stirring bars. This enhances the workflow efficiency of bioreactor bags and helps reduce waste. Appropriate biomaterials are used for the construction of bioreactor bags to ensure biocompatibility and safety.

| Table | Scope |

| Market Size in 2026 | USD 1.61 Billion |

| Projected Market Size in 2035 | USD 7.33 Billion |

| CAGR (2026 - 2035) | 18.34% |

| Market Segmentation | By Product Type, By Bag Film/Material Type, By Volume/Capacity, By Application/Use Case, By End-User/Buyer Type, By Channel/Business Model, By Region |

| Top Key Players | Culture Biosciences, Vonco Products, LLC, Repligen Corporation, Parker Bioscience, Liquidyne Process Technologies, Inc., STERIS Corporation, PBS Biotech, Dow Chemical Company |

Which Product Type Segment Dominated the U.S. Bioreactor Bags Market?

By product type, the 3D container/production bags segment held a dominant presence in the market with a share of approximately 46% in 2024. This segment dominated because 3D containers are commonly used for large-scale upstream production and bulk storage. 3D bioreactor bags can perform a variety of functions, such as preparation, storage, and transport of biopharmaceutical solutions. They enable the scale-up of bioprocessing solutions. Manufacturers can customize 3D bioprocess bags to meet process requirements.

By product type, the palletank/tote bags segment is expected to grow at the fastest CAGR in the market during the forecast period. 3D bioreactor bags are designed for the storage and shipping of large volumes of biopharmaceutical fluids in Palletank. Palletank/tote bags possess a capacity of 1000-3000 L and are widely used for storage, sampling, shipping, and transfer in all process steps. Customizable bioprocess totes are developed for storage.

Why Did the Multilayer Laminated Film Segment Dominate the U.S. Bioreactor Bags Market?

By bag film/material type, the multilayer laminated film segment held the largest revenue share of approximately 62% in the market in 2024. This is due to the need for strong and durable bioreactor bags. Multilayer films are made of different materials, including polyethylene (PE), polyethylene terephthalate (PET), and polyamide (PA). Apart from high strength and durability, multilayer laminated films provide leak resistance. They possess excellent visibility and aesthetics, enabling researchers to clearly view the contents of the bag.

By bag film/material type, the specialty low extractable/USP-class films segment is expected to grow with the highest CAGR in the market during the studied years. Specialty low extractable/USP-class films are used to ensure that extractables and leachables do not interfere with biological materials. They undergo a range of biocompatibility tests to ensure there are no adverse effects on any biological material.

How the Production Segment Dominated the U.S. Bioreactor Bags Market?

By volume/capacity, the production (200-2000 L) segment contributed the biggest revenue share of approximately 40% in the market in 2024. Bioreactor bags with a capacity of 200-2000 L are widely used for upstream and downstream processing. They are primarily preferred during pilot-scale operations to bridge the gap between laboratory scale and industrial scale. This helps manufacturers to optimize bioprocessing workflow, reducing errors during large-scale production.

By volume/capacity, the totes/palletanks (>2000 L) segment is expected to expand rapidly in the market in the coming years. Totes/palletanks are used for large-scale production of biopharmaceuticals, as well as for storing and transferring biopharma fluids. They provide flexible and cost-effective alternatives to reusable stainless steel containers. This eliminates the need for cleaning containers, thereby reducing cross-contamination.

Which Application/Use Case Segment Led the U.S. Bioreactor Bags Market?

By application/use case, the upstream production bioreactors & seed train segment led the market with a share of approximately 52% in 2024. This is due to the significance of upstream bioprocessing for initial sample preparation and cultivation. Upstream bioprocessing refers to the first phase of the bioprocess, from cell line development and cultivation to culture expansion of the cells through harvest. Bioreactor bags are designed in such a way that they are used in seed train and production applications without pH and DO control.

By application/use case, the mixing/buffer preparation segment is expected to witness the fastest growth in the market over the forecast period. A disposable mixing system contains a superconducting drive unit compatible with different disposable containment tanks. Single-use process steps include media and buffer preparation, filtration, and purification. Mixing and buffer preparation are essential to maintain stable pH levels and uniform distribution of nutrients and reagents.

What Made Biotechnology & Biopharmaceutical Manufacturers the Dominant Segment in the U.S. Bioreactor Bags Market?

By end-user/buyer type, the biotechnology & biopharmaceutical manufacturers segment held a major revenue share of approximately 56% in the market in 2024. The segmental growth is attributed to the presence of favorable infrastructure and suitable capital investment. The increasing competition among key players encourages them to develop innovative biopharmaceuticals, potentiating the demand for bioreactor bags. Biopharmaceutical manufacturers prefer single-use bags compared to traditional stainless steel bioreactors.

By end-user/buyer type, the contract development & manufacturing organizations (CDMOs/CMOs) segment is expected to show the fastest growth over the forecast period. Large and small biopharma companies collaborate with CDMOs and CMOs to access advanced manufacturing technologies. CDMOs possess skilled professionals to provide relevant expertise and solutions to complex manufacturing problems. Biotech startups lack specialized manufacturing infrastructure, necessitating them to outsource their research and manufacturing of biologics.

How the OEM-branded Bags & Consumables Segment Dominated the U.S. Bioreactor Bags Market?

By channel/business model, the OEM-branded bags & consumables segment accounted for the highest revenue share of approximately 70% in the market in 2024. This is due to the increasing collaboration between companies and original equipment manufacturers (OEMs). OEMs directly provide high-quality bioreactor bags to the concerned biopharma companies at affordable costs. This eliminates the need for distributors and wholesalers. OEMs also provide customized bags according to the requirements.

By channel/business model, the distributors & lab suppliers segment is expected to account for the highest growth in the upcoming years. Dedicated distributors and lab suppliers are aware of the supply chain infrastructure, ensuring the timely delivery of bioreactor bags. Biopharma companies can purchase bioreactor bags from a wide range of options based on their bioresearch needs.

The market is influenced by several growth factors, including the availability of state-of-the-art biologics manufacturing infrastructure, the presence of key players, and favorable regulatory support. Government organizations launch initiatives and provide funding for the development and adoption of advanced bioreactor bags in biotech companies. The FDA and the Department of Agriculture (USDA) impose regulations to ensure bags meet industry standards for biopharmaceutical manufacturing.

The increasing number of biopharma startups and venture capital investments also contributes to market growth. The U.S. is home to around 4,870 active biopharma companies. The U.S.-based companies account for 55% of the global biopharma R&D investment and 6 out of every 10 FDA-approved therapies. The rising number of patents also demonstrates the need for bioreactor bags in the U.S. The Patent Public Search database contains 794 patents that mention the use of bioreactors.

East Coast Region Market Trends

The East Coast region dominated the market in 2024. It constitutes a large number of biopharma companies that host the largest installed base of biomanufacturing & process development capacity. Massachusetts and New York alone contain approximately 6,000 life science companies. Massachusetts-based companies received a massive $7.89 billion in venture capital (VC) funding in 2024, accounting for 28.3% of the total VC funding.

Southeastern Region Market Trends

The Southeastern region is expected to host the fastest-growing market in the coming years. This is due to the development of new commercial plants and CDMO expansion. There are approximately 3,500 life science companies in the Southeast region of the U.S. The number of bioscience establishments in the region rose by 61.2% between 2019 and 2023.

R&D

Clinical Trials and Regulatory Approvals

Packaging and Serialization

Distribution to Hospitals, Pharmacies

Patient Support and Services

The current research highlights the significance of bioreactor bags in the U.S. market owing to a well-established research and manufacturing infrastructure. The rising preference for biologics as personalized therapeutics necessitates the use of bioreactor bags for the development of high-quality products. The shifting trends suggest the use of bags made from recyclable materials, contributing to environmental sustainability. These aspects offer opportunities for large- and mid-sized companies by offering customized solutions.

By Product Type

By Bag Film/Material Type

By Volume/Capacity

By Application/Use Case

By End-User/Buyer Type

By Channel/Business Model

By Region

January 2026

January 2026

January 2026

January 2026