February 2026

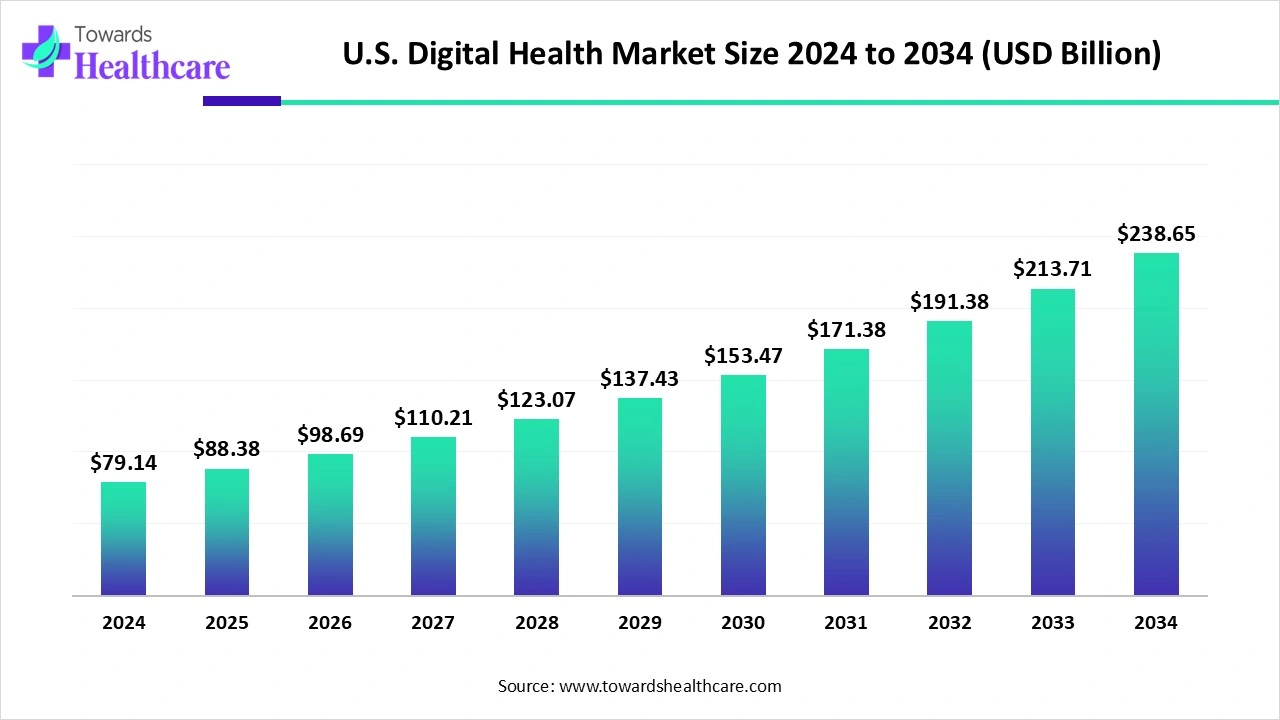

The U.S. digital health market size recorded US$ 88.38 billion in 2025, set to grow to US$ 98.69 billion in 2026 and projected to hit nearly US$ 266.5 billion by 2035, with a CAGR of 11.67% throughout the forecast timeline.

The U.S. digital health market is rapidly expanding, driven by growing adoption of telemedicine, wearable devices, mobile health apps, and remote patient monitoring solutions. Increasing demand for personalized and accessible healthcare, rising investment in health technology, and supportive government initiatives are fueling growth. Additionally, integration of AI and data analytics into healthcare services is enhancing efficiency, improving patient outcomes, and solidifying the U.S. as a leading market in digital health innovation.

| Table | Scope |

| Market Size in 2026 | USD 98.69 Billion |

| Projected Market Size in 2035 | USD 266.5 Billion |

| CAGR (2026 - 2035) | 11.67% |

| Market Segmentation | By Technology, By Application, By End User, By Business Model, By Region |

| Top Key Players | Teladoc Health, Amwell (American Well), MDLIVE (Cigna subsidiary), Doctor on Demand, Livongo (Teladoc subsidiary), Omada Health, Pear Therapeutics, Akili Interactive, Propeller Health, Fitbit (Google), Apple Health, amsung Health, Epic Systems, Cerner (Oracle), Athenahealth, Philips Healthcare (U.S. ops), Medtronic Digital Health, Dexcom (connected glucose monitoring), iRhythm Technologies, Hims & Hers Health |

The digital health refers to technology-driven healthcare solutions that use software, connected devices, telecommunication, and analytics to improve clinical outcomes, enhance patient engagement, and reduce healthcare costs. It encompasses telehealth, mobile health apps, wearable devices, electronic health records (EHRs), AI-driven platforms, and remote monitoring tools. Growth is propelled by regulatory support, high healthcare expenditure, consumer demand for convenience, chronic disease prevalence, and digital-first insurance models.

The U.S. is the largest and most advanced digital health market globally, with robust investment and adoption across healthcare stakeholders. The U.S. Digital Health Market is growing due to the rising adoption of telehealth, mobile health apps, and wearable devices for remote monitoring and personalized care. Increasing investments in healthcare technology, supportive government policies, outcomes, and operational efficiency are further driving market expansion.

For Instance,

Enhanced Healthcare Efficiency – Digital tools streamline administrative processes, patient scheduling, and data management, increasing efficiency and reducing costs for providers.

Integration of AI and Data Analytics – AI-driven tools enhance diagnostics, predictive healthcare, and personalized treatment plans, improving outcomes and operational efficiency.

AI can significantly impact the market by enhancing diagnostics, personalized treatment, and predictive healthcare. It streamlines clinical workflows, reduces administrative burdens, and improves patient monitoring through data-driven insights. AI-powered tools also enable more accurate disease detection, optimize resource allocation, and support telehealth and remote patient management. Overall, AI adoption increases efficiency, lowers costs, and drives innovation, accelerating growth and transforming the digital health landscape.

Rising Telehealth Adoption

Rising telehealth adoption is driving the U.S. digital health market as it allows healthcare providers to handle larger patient volumes efficiently and manage chronic disease through regular virtual follow-ups. It supports rapid triaging in emergencies, minimizes hospital overcrowding, and reduces infection risks by limiting in-person visits. Moreover, telehealth integrates seamlessly with digital platforms like remote monitoring and AI-driven tools, creating a connected ecosystem that improves overall healthcare outcomes and accelerates market expansion.

For Instance,

Data Privacy and Security Concerns

Data privacy and security concerns hinder the U.S. digital health market as fragmented digital systems often lack strong interoperability safeguards, leaving patient data vulnerable during transfer across platforms. Additionally, frequent ransomware attacks on healthcare networks highlight the sector's susceptibility to cyber threats. Many providers, especially smaller clinics, struggle to maintain updated defenses, creating gaps in protection. These vulnerabilities erode users' confidence in digital platforms, slowing broader adoption despite the market's significant potential.

Expansion of Remote Patient Monitoring

Expansion of remote patient monitoring (RPM) presents a strong future opportunity in the U.S. digital health market as it enables continuous, real time tracking of patients with chronic condition like Diabetes, heart disease, and respiratory disorders like diabetes, heart disease, and respiratory disorders. RPM reduces hospital readmission, lowers healthcare costs, and enhances patient engagement by allowing care at home. With rising demand for value-based care and aging populations, the integration of connected devices and wearables will accelerate RPM adoption, creating significant growth in digital health.

For Instance,

The telehealth & virtual care segment dominated the market in 2024 because providers increasingly adopted hybrid care models, combining in-person visits with digital platforms to enhance patient engagement. Advances in video conferencing quality, integration with electronic health records, and multilingual support tools made telehealth more inclusive. Additionally, employers and insurers embraced virtual care as part of wellness programs, driving broader usage across preventive health, specialty consultations, and follow-up care, securing its lead in the market.

The digital therapeutics segment is projected to grow at the fastest CAGR as it leverages gamification, behavioral analytics, and AI-driven interventions to improve patient adherence and outcomes. Employers and players are increasingly adopting these tools for preventive health and chronic disease management, lowering long-term costs. Additionally, the rise of mobile-first platforms and integration with wearable devices enables real-time progress tracking, making digital therapeutics more engaging, scalable, and effective compared to conventional approaches, fueling rapid market growth.

The chronic disease management segment dominated the U.S. digital health market in 2024 as healthcare providers increasingly relied on AI-powered analytics and predictive tools to identify disease progression and treatment gaps. Integration of mobile health apps with medication reminders and lifestyle coaching improved adherence and patient engagement. Moreover, collaboration between payers and digital health companies focused on bundle care models for long-term conditions, which strengthened adoption and secured the segment's lead in overall market revenue.

The mental health segment is projected to grow at the fastest CAGR in the U.S. digital health market as advanced technologies like VR-based therapy, biofeedback devices, and digital CBT programs gain traction. The younger population is showing strong acceptance of app-based mindfulness and emotional wellness tools. Additionally, pharmaceutical and tech partnerships are integrating mental health solutions into broader care ecosystems, expanding reach and effectiveness, which is expected to accelerate growth through the forecast period.

The healthcare providers segment dominated the market in 2024 as providers increasingly leveraged connected devices, remote monitoring, and virtual care platforms to enhance patient engagement and continuity of care. Growing demand for operational efficiency, real-time data analytics, and population health management drove adoption. Additionally, collaborations with digital health startups and technology vendors enabled providers to implement innovative solutions, solidifying their position as the largest end-user segment in the market.

The patient & consumer segment is projected to grow fastest because of the rising preference for direct-to-consumer digital health solutions, including fitness trackers, mental health apps, and teleconsultation platforms. Increased smartphone penetration, wearable adoption, and demand for personalized health insights enable individuals to monitor and manage their health independently. Additionally, growing interest in preventive care, remote diagnostics, and virtual wellness programs is driving widespread consumer engagement, making this segment a key growth area in the U.S. digital health market.

The B2B segment led the market in 2024 as healthcare organizations sought integrated solutions for population health management, remote monitoring, and clinical workflow optimization. Large-scale contracts with technology providers allowed providers and payers to implement advanced platforms at scale, ensuring regulatory compliance and interoperability. This demand for enterprise-grade solutions, combined with recurring service agreements and technical support offerings, resulted in higher revenue generation, making B2B the dominant business model in the market.

The B2C segment is projected to grow fastest as consumers increasingly prefer direct access to health services, including virtual consultations, fitness tracking, and lifestyle management apps. Increasing smartphone and wearable penetration, along with rising interest in preventive care and mental wellness, is driving adoption. Companies offering personalized health insights, subscription-based digital therapies, and remote diagnostics are attracting more users, making the B2C model a rapidly expanding segment in the U.S. digital health market during the forecast period.

The U.S. digital health market is expanding as healthcare providers and consumers embrace connected health solutions, including virtual care platforms, digital therapeutics, and AI-enabled clinical tools. Growing demand for efficient care delivery, real-time health monitoring, and improved patient outcomes is driving adoption. Additionally, partnerships between tech companies and healthcare organizations, rising investments in health IT infrastructure, and increasing focus on preventive and value-based care are creating new opportunities, fueling rapid market growth across the country.

The West U.S. contributes to the growth of the digital health market by promoting large-scale pilot programs and early adoption of cutting-edge health technologies. Strong state-level support for digital healthcare initiatives, high smartphone and internet penetration, and a tech-savvy population encourage the use of mobile health apps, virtual care, and remote monitoring solutions. Additionally, partnerships between academic institutions, hospitals, and tech innovators drive research and commercialization of novel digital therapeutics, positioning the region as a key driver of national market expansion.

The South U.S. is projected to grow at the fastest CAGR as healthcare providers and consumers increasingly adopt mobile health apps, virtual care, and wearable devices. Rapid urbanization, a growing middle-class population, and rising health awareness are boosting demand for accessible and convenient healthcare solutions. Furthermore, partnerships between regional hospitals, tech startups, and insurers to implement scalable digital health programs are accelerating adoption, positioning the Southern U.S. as a high-growth market within the national digital health landscape.

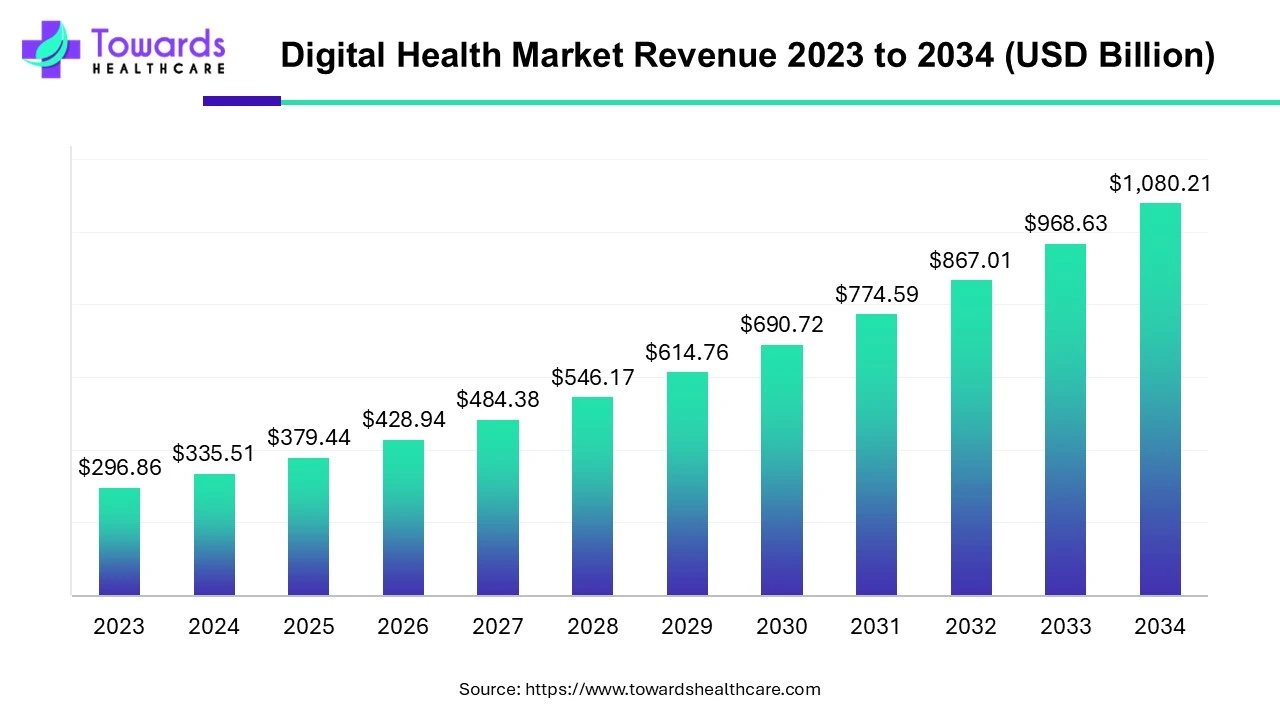

The global digital health market is valued at around USD 335.5 billion in 2024 and is projected to reach USD 1,080.2 billion by 2034. This growth, at a compound annual rate of 13.1% over the decade, is being driven by the rising popularity of mobile health apps and the increasing use of AI, IoT, and big data in healthcare.

Clinical trial-In the U.S., clinical trials are increasingly using digital health technologies (DHTs) like wearables, mobile apps, and electronic sensors to collect patient data, supporting decentralized and hybrid trial models. The FDA encourages DHT use to enhance data accuracy and patient engagement. Initiatives such as the Clinical Trials Transformation Initiative (CTTI) provide guidance, resources, and programs like the Digital Health Trials initiative to promote innovation and practical implementation of digital technologies in clinical research.

Regulatory Approvals- In the U.S., digital health products are regulated by the FDA, which classifies them based on risk and determines the appropriate approval pathway, such as 510(k) clearance, De Novo classification, or Premarket Approval (PMA). High-risk devices addressing serious conditions can benefit from the FDA’s Breakthrough Device Program, which accelerates review and market access for innovative and effective treatments.

Patient Support and Services- In the U.S., patient support in digital health includes mobile apps, wearables, and telehealth platforms that enable remote monitoring and personalized care. These tools collect real-time data, promote proactive health management, and enhance patient engagement. Core elements include communication platforms, health IT systems, and personalized medicine solutions, all designed to guide and support patients throughout their healthcare journey, improving outcomes and overall care experience.

In August 2024, in New York, Pfizer Inc. launched PfizerForAll, a digital platform aimed at simplifying healthcare access and wellness management for Americans. Aamir Malik, Pfizer’s EVP and Chief U.S. Commercial Officer, stated that the platform helps reduce information overload and healthcare decision challenges, streamlining access and improving health outcomes, particularly during the busy fall season.

By Technology

By Application

By End User

By Business Model

By Region

February 2026

February 2026

January 2026

January 2026