February 2026

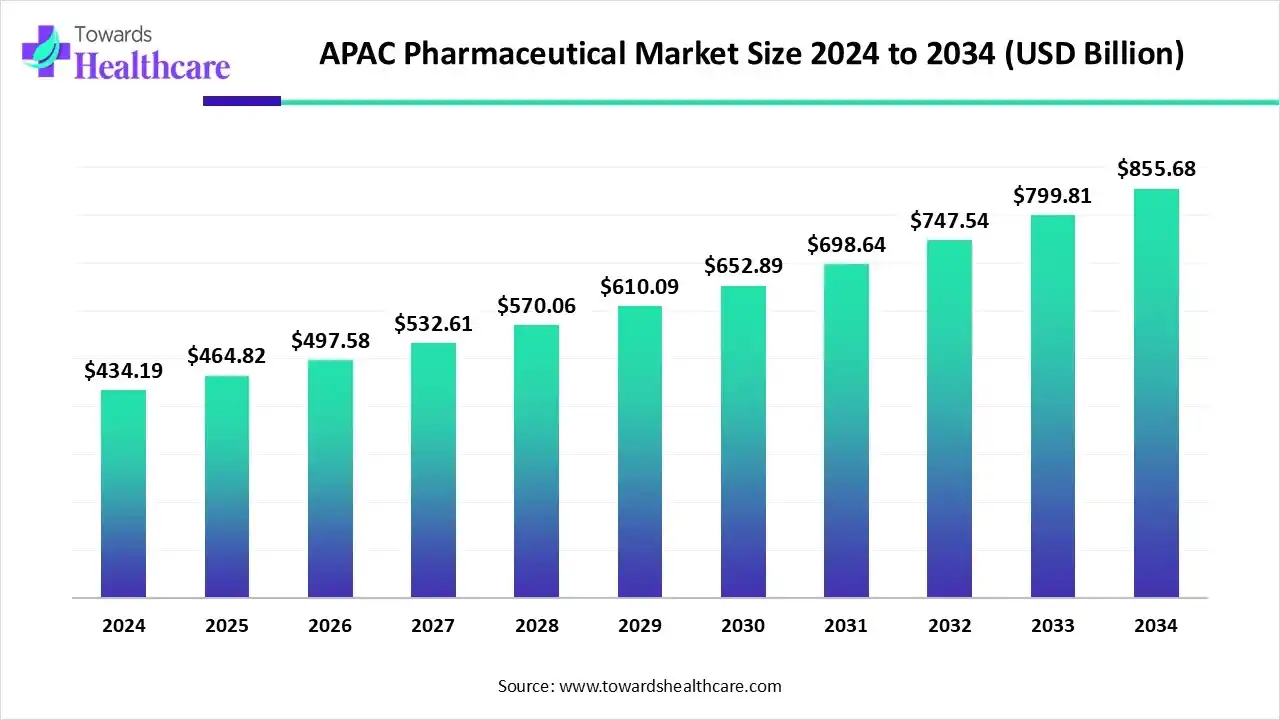

The APAC pharmaceutical market size is calculated at USD 434.19 billion in 2024, grew to USD 464.82 billion in 2025, and is projected to reach around USD 855.68 billion by 2034. The market is expanding at a CAGR of 7.02% between 2025 and 2034.

The APAC pharmaceutical market is primarily driven by growing research and development activities, as well as increasing demand for biologics. People are increasingly aware of maintaining good health and using high-quality products. The rising healthcare expenditure and favorable government support contribute to market growth. Artificial intelligence (AI) revolutionizes the pharmaceutical sector, enabling the development of personalized medicines. Digital transformation, such as robotics and 3D bioprinting, presents future opportunities for market growth.

| Table | Scope |

| Market Size in 2025 | USD 464.82 Billion |

| Projected Market Size in 2034 | USD 855.68 Billion |

| CAGR (2025 - 2034) | 7.02% |

| Market Segmentation | By Product Type, By Therapeutic Area, By Channel/Distribution, By Buyer/Payer Type, By Geography |

| Top Key Players | CSL Limited, Daiichi Sankyo, Cipla Limited, Astellas Pharma, Serum Institute of India, Bharat Biotech, Sinopharm/China National Pharmaceutical Group, WuXi Biologics, Pfizer, Inc., Roche/Genentech, Novartis AG, Sanofi, Johnson & Johnson, AstraZeneca |

The APAC pharmaceutical market is growing rapidly, due to expanding middle-class patient populations, government health programs, growing local manufacturing and R&D capacity, and increasing adoption of biologics and high-value therapies. It comprises prescription medicines (small molecules and biologics), generics and biosimilars, vaccines, OTC products, and advanced therapies across Asia-Pacific. The region includes major markets (China, Japan, India, South Korea, Australia) and fast-growing emerging markets (Southeast Asia, parts of South Asia). The APAC market is both a manufacturing hub and a large demand center with diverse payer and regulatory environments.

AI transforms the pharmaceutical sector by streamlining a wide range of processes, such as drug discovery, clinical trials, manufacturing, and supply chain optimization. It assists researchers in developing novel and more effective pharmaceuticals with reduced side effects. AI accelerates the research and manufacturing process, saving time and costs. AI-based predictive analytics detects potential errors in manufacturing. It ensures the timely delivery of pharmaceuticals to a large patient population.

Algorae Pharmaceuticals, Pharos iBio, and XtalPi Holdings are among the 700 companies in Asia that use AI for drug discovery and development. These companies develop AI tools to support the entire drug discovery process.

| Countries | Regulatory Agencies | New Product Launches (2024) | Clinical Trials |

| China | National Medical Products Administration (NMPA) | 228 | 46,019 |

| India | Central Drug Standard Control Organization (CDSCO) | 21 | 6,154 |

| Japan | Pharmaceuticals and Medical Devices Agency (PMDA) | 148 | 8,719 |

| South Korea | Ministry of Food and Drug Safety (MFDS) | 18 | 16,601 |

By product type, the branded innovative small molecules & biologics segment held a dominant presence in the market with a share of approximately 36% in 2024, due to the potential to treat a wide range of disorders. Patients are confident about the quality of branded drugs, as they are developed and marketed by trusted pharmaceutical companies. Companies benefit from intellectual property (IP) rights, which help combat the development of generic alternatives to brand-name drugs. This increases sales of brand-name drugs, enhancing the revenue of companies.

By product type, the specialty medicines & advanced therapies segment is expected to grow at the fastest CAGR in the market during the forecast period. Specialty medicines, such as cell and gene therapy products and RNA-based therapeutics, are in high demand. The increasing need for personalized medication, driven by rapidly changing demographics, leads to the development of specialty medicines. These drugs cure a disease from its root cause, reducing the chances of recurrence.

By therapeutic area, the infectious diseases segment held the largest revenue share of approximately 22% in the market in 2024, due to the rising incidence of infectious diseases, such as tuberculosis, flu, and SARS-CoV-2. Infectious diseases are a major public health concern among individuals in APAC countries and a leading cause of hospitalization. In mainland China, the influenza hospitalization rate is 73 per 100,000 individuals, while in Hong Kong, it is 35.7 per 100,000 individuals. Key players develop vaccines, antibiotics, anti-virals, and anti-fungals for treating these disorders.

By therapeutic area, the rare/orphan diseases segment is expected to grow with the highest CAGR in the market during the studied years. The increasing prevalence of rare diseases in APAC countries encourages companies to develop innovative therapeutics. APAC countries have varying degrees of maturity related to rare disease management. Government agencies focus on strengthening their regulatory frameworks for rare diseases, thereby enhancing access and affordability of medications.

By channel/distribution, the retail pharmacies segment contributed the biggest revenue share of approximately 46% in the market in 2024, due to the presence of favorable infrastructure and suitable capital investment. Retail pharmacies are easily accessible to patients and possess generic and OTC medications. Pharmacists can provide guidance about the drug delivery and route of administration. Retail pharmacies offer special discounts and same-day home delivery.

By channel/distribution, the e-commerce/direct-to-patient/online pharmacies segment is expected to expand rapidly in the market in the coming years. The burgeoning e-commerce sector and the rising adoption of smartphones boost the segment’s growth. Online pharmacies enable patients to order pharmaceuticals from different geographical locations. They offer specialized services, including free home delivery, special discounts, and virtual consultations.

By buyer/payer type, the out-of-pocket/private customers segment led the market with a share of approximately 40% in 2024, due to the increasing disposable incomes and the rising prevalence of chronic disorders. It is estimated that more than two-thirds of all healthcare payments are borne out-of-pocket in India, of which 70% are related to medicines. The expanding middle-class population and improving living standards also augment the segment’s growth. The availability of generic drugs imposes fewer economic strains on patients.

By buyer/payer type, the employers/corporates/benefit schemes segment is expected to witness the fastest growth in the market over the forecast period. Employers and corporates are concerned about their employees’ physical and mental health. They provide health insurance, reducing financial burdens on employees. This helps boost productivity and reduce absenteeism in the workplace. Employer-sponsored health insurance offers more benefits than individual insurance, including guaranteed coverage and tax benefits.

The major growth factors of the market include the presence of a favorable manufacturing infrastructure and increasing investments by government and private organizations. This encourages foreign companies to set up their manufacturing facilities in APAC countries. The rising number of startups and venture capital investments propels the market. Regulatory agencies take necessary measures to streamline the approval of pharmaceuticals. APAC countries like China, India, Japan, and South Korea are emerging as global hubs in the clinical trials field.

China dominated the market in 2024, due to increasing product innovations and new product launches. There are more than 10,000 major pharmaceutical enterprises in China, including Asia’s two largest companies by value. Chinese pharmaceutical companies accounted for the highest licensing deal flow in 2025, representing 42% of the total deal value. This is due to large pharma partnerships. In Q3 2024, China witnessed a total of 34 M&A deals, worth $4.4 billion.

Southeast Asia is expected to grow at the fastest CAGR in the APAC pharmaceutical market during the forecast period. Countries like Myanmar, Vietnam, the Philippines, Thailand, and Malaysia are at the forefront of revolutionizing the pharmaceutical sector, with the increasing number of companies and the rapidly expanding manufacturing sector. There are around 288 and 445 pharmaceutical companies in Vietnam and Malaysia, respectively. Government bodies provide incentives to attract investment and support R&D.

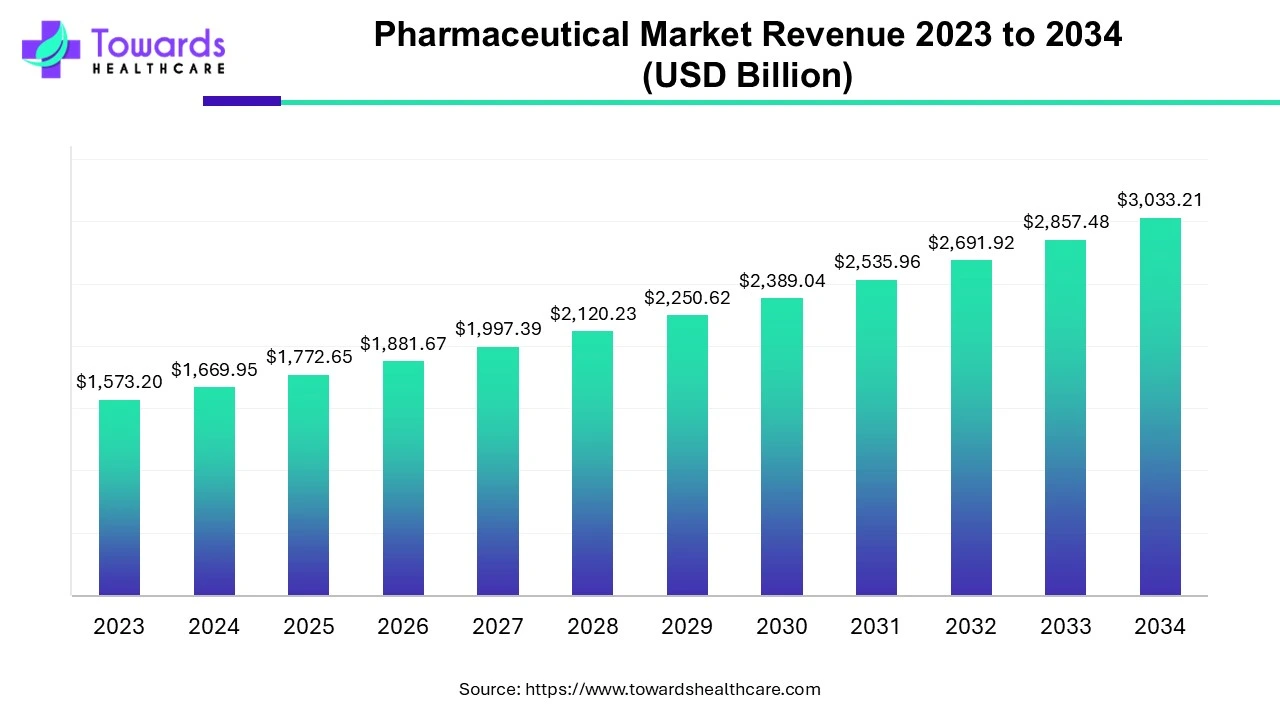

The global pharmaceutical market was valued at approximately US$ 1,573.20 billion in 2023 and is expected to reach US$ 3,033.21 billion by 2034, growing at a CAGR of 6.15% between 2024 and 2034.

Ongoing research activities refer to the development of novel drug delivery methods and personalized medicines based on patients’ conditions.

Key Players: Sun Pharmaceutical Industry, Shanghai Pharmaceuticals, and Takeda Pharmaceuticals

Clinical trials & regulatory approvals are interconnected processes that involve the assessment of the safety and efficacy of pharmaceuticals and subsequent approval by regulatory agencies.

Key Players: Genrix Biopharmaceutical Co., Ltd., Innovent Biologics Co., Ltd., Eli Lilly and Company

Pharmaceutical distribution is the process of moving drugs from manufacturers to healthcare providers like hospitals and community pharmacies, ensuring their availability to patients.

Key Players: DCH Auriga, Pacific Bridge Medical, DKSH, and AxxessBio

According to our analysis, the pharmaceutical sector in the APAC region is burgeoning with the increasing availability of generic drugs and technological advancements. Government-backed incentives facilitate the development of innovative pharmaceuticals and expand the local manufacturing infrastructure, reducing reliance on exports. Venture capital investment infrastructure is reshaping the industry, enabling companies to reconfigure their R&D capabilities and bolster their innovation bases.

By Product Type

By Therapeutic Area

By Channel/Distribution

By Buyer/Payer Type

By Geography

February 2026

February 2026

February 2026

February 2026