January 2026

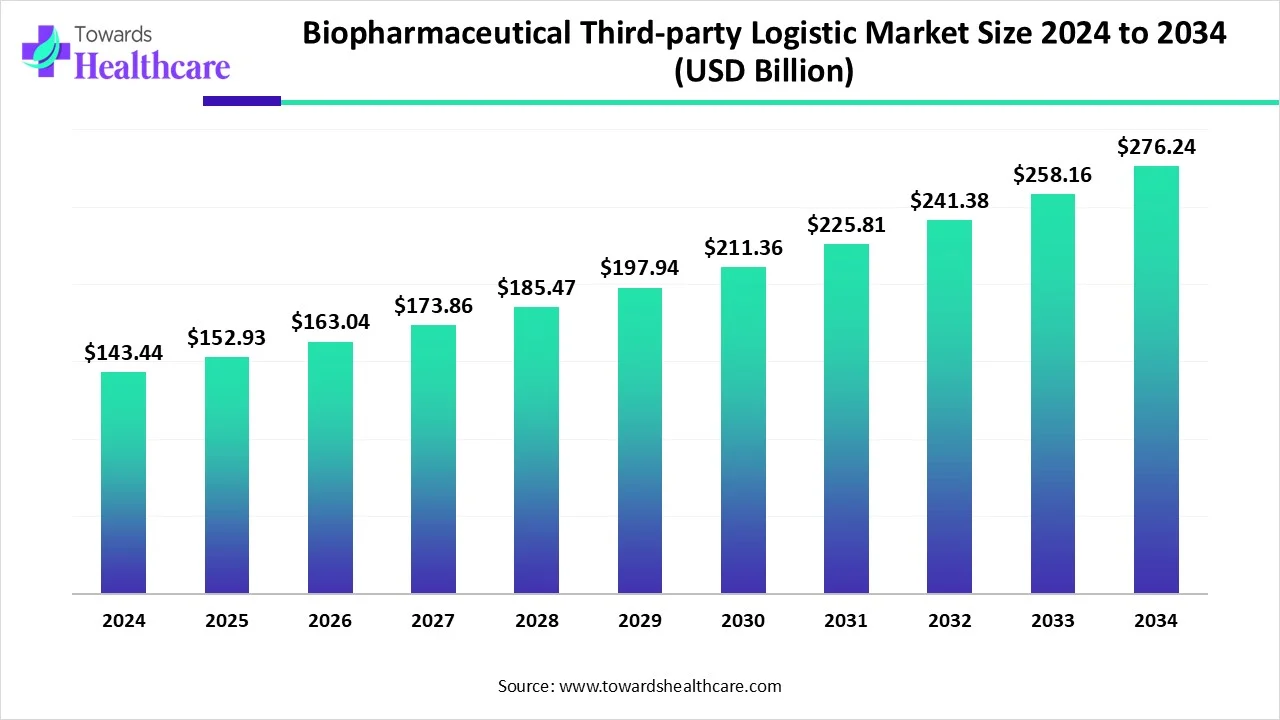

The global biopharmaceutical third-party logistics market size is calculated at USD 143.44 billion in 2024, grow to USD 152.93 billion in 2025, and is projected to reach around USD 276.24 billion by 2034.

| Metric | Details |

| Market Size in 2024 | USD 143.44 Billion |

| Projected Market Size in 2034 | USD 276.24 Billion |

| CAGR (2025 - 2034) | 6.62% |

| Leading Region | North America |

| Market Segmentation | Supply Chain, Service Type, By Region |

| Top Key Players |

Agility Logistics, AmerisourceBergen Corporation, DB Schenker, DHL International GmbH, FedEx Corporation, Kerry Logistics Network Limited, Kuehne + Nagel International AG, McKesson Corporation, SF Express Co. Ltd., United Parcel Service of America, Inc. |

Biopharmaceutical third-party logistics (3PL) refers to specialized outsourcing services that manage the storage, transportation, and distribution of biopharmaceutical products. These services ensure the proper handling of temperature-sensitive and regulated medicine. 3PL providers help companies streamline the supply chain while meeting strict industry standards.

The Biopharmaceutical third-party logistics market is growing rapidly due to the increasing demand for biologics, vaccines, and personalized medicines, which require strict temperature control and timely delivery. As global distribution becomes more complex, biopharma companies are outsourcing logistics to specialized 3PL providers to ensure regulatory compliance and reduce operational costs. Technological advancements such as real-time tracking and cold chain management are also driving growth. Additionally, rising healthcare needs, expanding pharmaceutical markets, and the need for efficient supply chain management further contribute to the strong growth of this sector.

AI has the potential to transform the biopharmaceutical third-party logistics (3PL) market by improving efficiency, accuracy, and responsiveness across the supply chain. It enables predictive analytics for demand forecasting, helping reduce waste and manage inventory more effectively. AI also enhances real-time tracking and temperature monitoring of sensitive products, ensuring quality and compliance with regulations. Moreover, AI-driven automation can streamline warehouse operations and optimize delivery routes, leading to faster and more reliable transportation. These advancements ultimately help biopharma companies deliver critical therapies more efficiently and safely.

Outsourcing Logistics

The Biopharmaceutical third-party logistics market enables companies to concentrate on their core functions, such as drug research and development. Managing biopharmaceutical supply chains requires specialized knowledge, particularly in handling temperature-sensitive products and ensuring regulatory compliance. 3PL providers bring this expertise along with advanced technology, real-time tracking, and global distribution networks. By outsourcing, companies can reduce operational costs, improve efficiency, and scale their logistics capabilities faster. This approach ensures the safe and timely delivery of products, supporting rising global demand and enhancing competitiveness in the rapidly evolving biopharma industry.

High Cost of Temperature-Controlled Logistics

Services require specialized packaging, advanced monitoring systems, and climate-controlled transportation, all of which add significant expenses. For many small to mid-sized biopharma companies, these high costs can limit access to reliable logistics solutions, restricting their ability to expand globally. Additionally, the financial risk associated with temperature excursions and potential product loss further discourages the full adoption of these services, slowing market growth.

Increasing Globalization and Commercial Activities

Increasing globalization and commercial activities create a significant opportunity in the biopharmaceutical third-party logistics market by driving demand for an efficient, secure, and compliant international supply chain. As biopharma companies expand into new and emerging markets, they require specialized logistics partners to manage the complexities of cross-border transportation, customs regulations, and temperature-sensitive product handling. The global expansion increases the need for reliable 3PL providers with the infrastructure and expertise to ensure timely delivery and product integrity. Additionally, rising international trade and collaboration in the healthcare sector further boost demand for advanced logistics solutions, fueling growth in the 3PL market.

By supply chain, the non-cold logistics segment held a dominant presence in the biopharmaceutical third-party logistics market in 2024 due to a larger volume of drugs and products that do not require temperature-controlled environments. Many biological products, especially in their early stages or non-sensitive forms, can be safely transported and stored under standard conditions, making non-cold logistics more cost-effective and easier to manage. Additionally, the infrastructure and resources needed for non-cold logistics are more widely available, allowing 3PL providers to handle larger volumes efficiently and at lower costs, contributing to the segment’s strong market share.

By supply chain, the cold chain logistics segment is anticipated to grow at the fastest rate in the market during the studied years, due to rising demand for temperature-sensitive products such as biologics, vaccines, cell and gene therapies, and other specialty drugs. These products require strict temperature control to maintain their safety and effectiveness throughout the supply chain. With the growing global focus on personalized medicine and the increase in biologics production, biopharma companies are increasingly turning to advanced cold chain solutions, driving rapid growth in the biopharmaceutical third-party logistics market to meet regulatory and quality standards.

By service type, the warehousing and storage segment was dominant in the market in 2024. The dominance is attributed to the increasing demand for specialized storage solutions that comply with stringent regulatory standards such as Good Manufacturing Practices (GMP and Good Distribution Practices (GDP). Advancements in warehouse automation, real-time inventory tracking, and temperature-controlled storage systems have further enhanced the efficiency and reliability of this market. Additionally, the integration of value-added services like packaging, customs management, and procurement support has made warehousing and storage a comprehensive solution for biopharmaceutical companies, driving their biopharmaceutical third-party logistics market leadership.

By service type, the transportation segment is expected to grow at the fastest rate in the coming years. The increasing clinical trials, international product launches, and the demand for faster delivery timelines drive the market growth. With healthcare systems focusing on quick patient access to critical therapies, there’s a growing reliance on efficient transportation services. The rise in direct-to-patient models and home healthcare further accelerates this need. Additionally, stricter delivery timelines for high-value biologics and the expansion of distribution to invest in advanced and responsive transportation solutions, make it a rapidly growth area within the biopharmaceutical third-party logistics market.

North America dominated the global biopharmaceutical third-party logistics market in 2024, driven by its advanced healthcare infrastructure, strong demand for pharmaceuticals, and well-established logistics networks. The region benefits from significant investment in cold chain logistics, with companies like UPS expanding abilities through strategic acquisitions such as Andlauer Healthcare Group. This enhances their capacity to handle temperature-sensitive products efficiently. Additionally, a strict regulatory framework, including the Drug Supply Chain Security Act (DSCSA), encourages the use of compliant and advanced logistics solutions. These factors collectively position North America as the dominant player in the biopharmaceutical 3PL market.

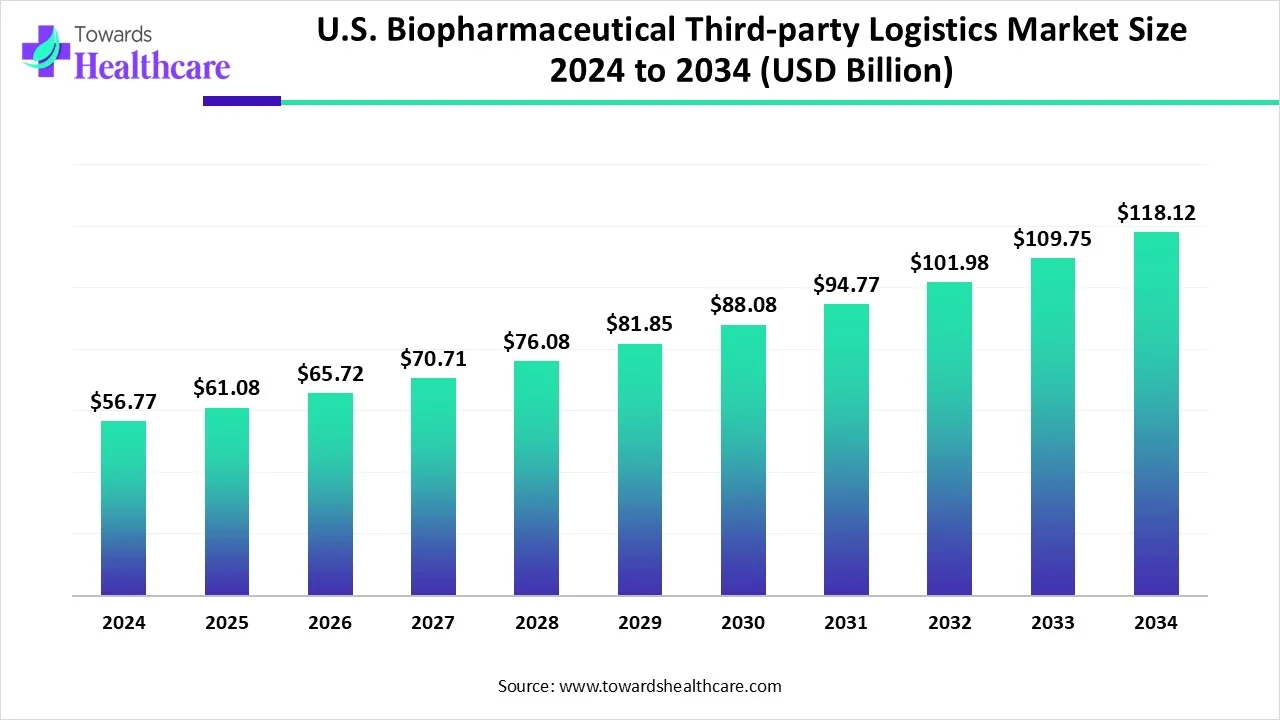

The U.S. biopharmaceutical third-party logistics (3PL) market is seeing steady growth. In 2024, it was valued at $56.77 billion and increased to $61.08 billion in 2025. Looking ahead, the market is expected to nearly double, reaching approximately $118.12 billion by 2034. This growth is driven by a compound annual growth rate (CAGR) of 7.6% from 2025 to 2034.

The U.S. market is experiencing strong growth due to the increasing demand for advanced logistics solutions that can handle a growing range of temperature-sensitive biopharmaceutical products, including cell and gene therapies. As the complexity of the supply chain rises, more biopharma companies are outsourcing logistics to specialized 3Pl providers to ensure regulatory compliance and maintain product integrity. Additionally, the need for efficient cold chain infrastructure and real-time monitoring has grown, driven by strict U.S. regulations. The shift allows companies to focus on core activities like research and development while relying on expert logistics partners for distribution.

The Canadian market is expanding due to the growing need for efficient handling of temperature-sensitive products such as biologics, vaccines, and personalized therapies. As the demand for advanced healthcare solutions increases, biopharma companies are outsourcing logistics operations to specialized 3PL providers to ensure product safety and regulatory compliance. Canada’s strong regulatory framework, along with the increasing complexity of biopharmaceutical supply chains, has further encouraged the adoption of expert logistics services. These factors, combined with technological advancement and investment in cold chain infrastructure, are fueling the rapid growth of the market.

In August 2023, FedEx Express teamed up with Gyeongsangbuk-do to support SMEs entering sectors like biopharma and semiconductors. In November, Innomar Strategies opened a 92,000 sq-ft GMP-compliant logistics center in Canada to offer storage, quality assurance, and importation services.

Asia-Pacific is anticipated to grow at the highest CAGR in the biopharmaceutical third-party logistics market during the forecast period, due to an increase in pharmaceutical production, rising healthcare demand, and rapid expansion of cold chain infrastructure. Countries like China, India, and South Korea are investing heavily in healthcare and biopharma manufacturing, attracting global partnerships and boosting export volumes. Additionally, growing clinical research activities and rising demand for biologics and vaccines are driving the need for advanced logistics services. The region's improving regulatory standards and cost-effective logistics solutions further contribute to its strong market growth potential.

The China market is growing due to increasing demand for temperature-sensitive products, such as biologics, vaccines, and personalized medicines, which has created a strong need for advanced cold chain logistics solutions. To support this demand, China is heavily investing in the development of specialized cold storage and transportation infrastructure, equipped with modern temperature control and monitoring systems. Additionally, the complex regulatory landscape within the country has led biopharmaceutical companies to quality assurance and efficient handling of sensitive products, further fueling market growth.

The country’s robust pharmaceutical industry, being the largest provider of generic medicines globally, drives the demand for efficient logistics services. Government initiatives like the Production Linked Incentives (PLI) Scheme are encouraging domestic production and reducing reliance on imports. Additionally, infrastructure development, such as Multi-Modal Logistics Parks (MMLPs), is improving freight logistics and enhancing storage facilities, including cold storage for temperature-sensitive products. Regulatory support for biotechnology parks and research further boosts the sector.

In August 2023, SPARX Logistics expanded by opening new offices in Mumbai and Ahmedabad, enhancing its global presence with over 60 offices in 25 countries. This expansion is expected to drive market growth by strengthening the company's logistics network.

Europe is expected to see significant growth in the biopharmaceutical third-party logistics market during the forecast period, due to increasing demand for biopharmaceutical products like biologics and vaccines. The aging populations and rising prevalence of chronic diseases fuel the need for specialized logistics services. Technological advancement in cold chain management and real-time tracking improves efficiency, while strict regulatory standards drive reliance on compliant 3PL providers. Additionally, the trend of pharmaceutical companies outsourcing logistics functions and expanding biopharmaceutical manufacturing in Europe further boosts the market's growth potential.

The UK market is growing due to increased innovation in healthcare delivery and the need for efficient supply chain management. With a rise in clinical supply trials and research activities, there’s a greater demand for precise logistics solutions to support these initiatives. Additionally, Brexit has led to a need for more streamlined and localized supply chain solutions within the UK to ensure regulatory compliance and avoid delays, further boosting the need for specialized 3PL services in the biopharmaceutical sector.

The rising demand for biologics, biosimilars, and treatment for chronic diseases has driven the need for specialized logistics services. Germany’s advancements in cold chain logistics, supported by significant investment in infrastructure, ensure proper temperature control during transportation. Additionally, the adoption of digital technologies like IoT and blockchain improves regulatory compliance and enhances operational efficiency. Strategic acquisitions by major logistics providers further strengthen Germany’s position as a hub for pharmaceutical logistics in Europe.

Latin America is considered to be a significantly growing area, due to the growing demand for biopharmaceuticals and growing research and development activities. The increasing number of biopharma startups potentiates the need for CDMOs/CMOs for research and manufacturing of biopharmaceuticals. The growing need for specialized logistics solutions for temperature-sensitive medications also propels the market. The rising prevalence of chronic disorders increases the demand for biopharmaceuticals. Government organizations support the development of biopharmaceuticals through initiatives and funding.

As of April 2025, there are 39 biopharmaceutical outsourcing startups in Mexico. The Mexican government offers favorable regulatory support for biosimilars manufacturing and distribution. The Regulatory Certainty Strategy aims to provide an operational framework that supports and strengthens the production and development of biosimilar medicines. (Source: BMI Fitch Solutions)

In October 2024, GEMMABio announced a collaboration with Oswaldo Cruz Foundation to improve global access to rare disease gene therapies and provide affordable gene therapies to Brazilian patients. This is accomplished through the country’s publicly funded healthcare system, the Sistema Único de Saúde. (Source: Fierce Biotech)

In January 2024, Yaky Yanay, President and CEO of Pluri, expressed that the launch of the CDMO division is expected to boost cash flow and revenue by utilizing its established manufacturing facility and technology. The goal of PluriCDMO™ is to provide clients with access to state-of-the-art facilities and, more importantly, the expertise in cell therapy development accumulated over the past two decades. As a high-end boutique CDMO, PluriCDMO™ aims to help partners accelerate their development processes while effectively managing risks.

By Supply Chain

By Service Type

By Region

January 2026

October 2025

December 2025

November 2025