January 2026

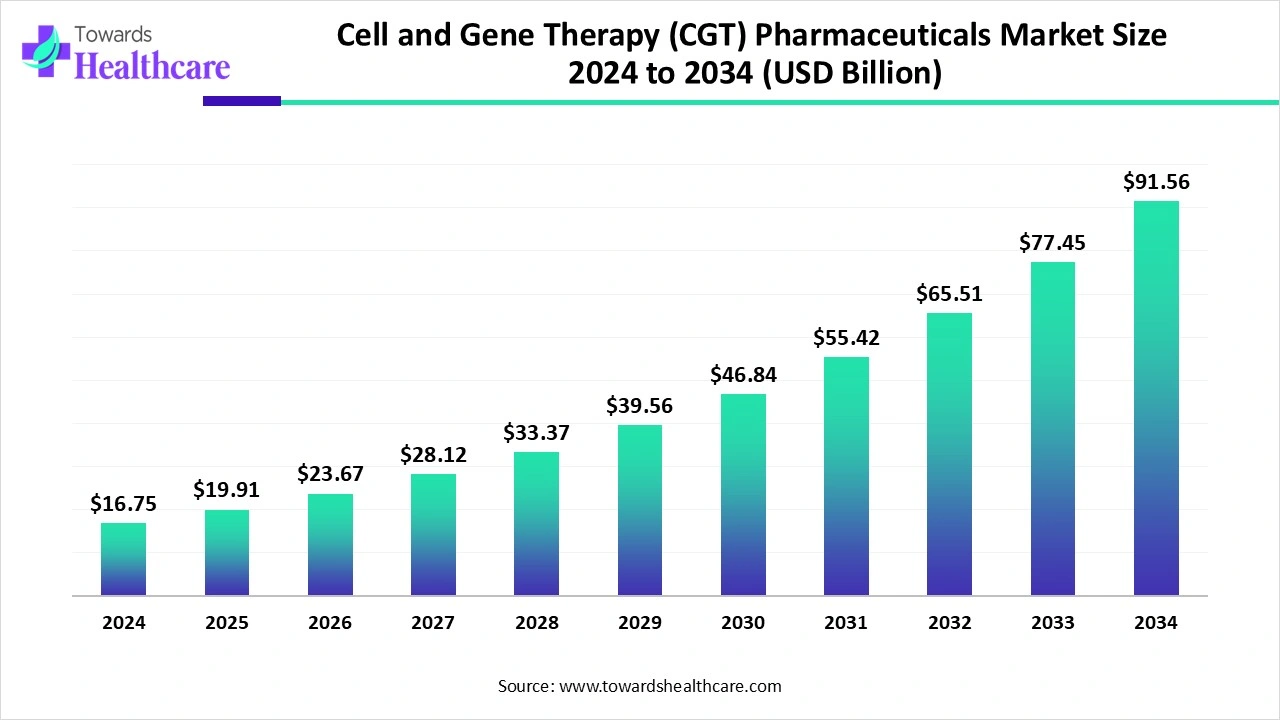

The global cell and gene therapy (CGT) pharmaceuticals market size recorded US$ 16.75 billion in 2024, set to grow to US$ 19.91 billion in 2025 and projected to hit nearly US$ 91.56 billion by 2034, with a CAGR of 18.93% throughout the forecast timeline.

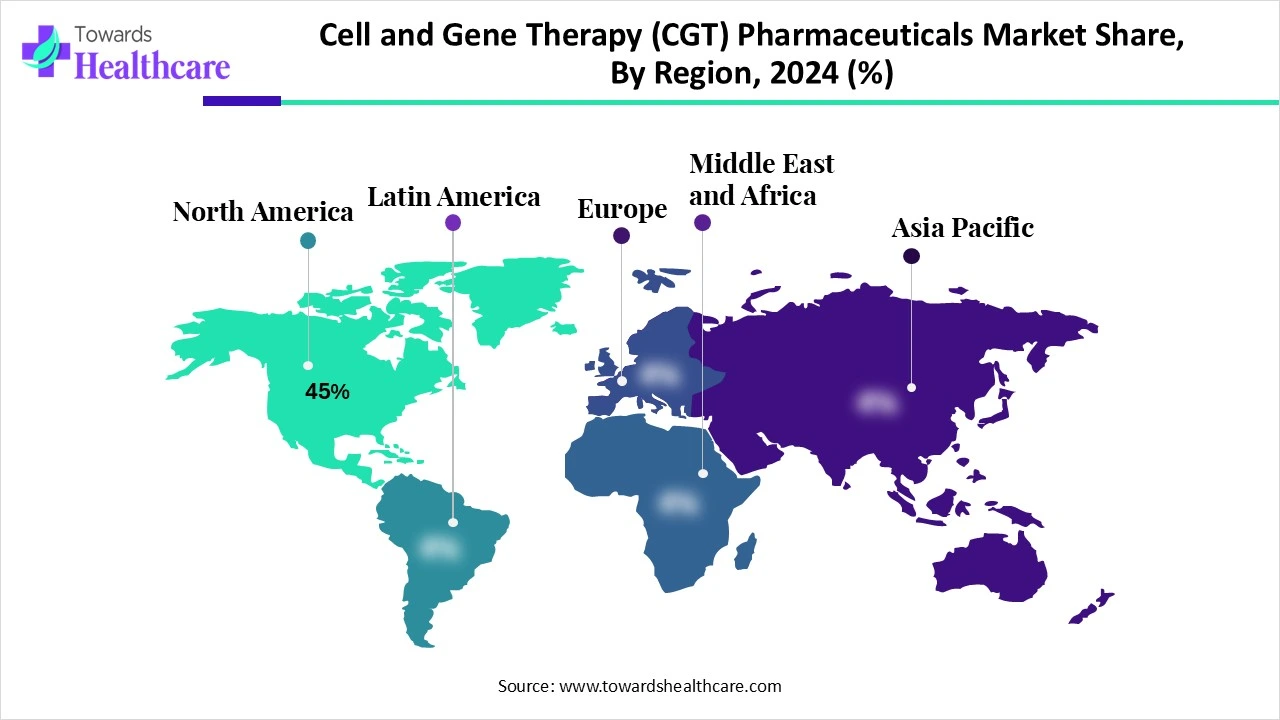

The cell and gene therapy (CGT) pharmaceuticals market is experiencing rapid growth, driven by advancements in biotechnology, increasing prevalence of chronic and genetic disorders, and rising demand for personalized medicine. North America remains the dominant region due to strong research infrastructure, favorable regulatory frameworks, high healthcare spending, and the presence of leading biopharmaceutical companies. Additionally, growing investments in clinical trials and innovative therapeutic approaches further strengthen the region’s leadership, positioning it at the forefront of global development and adoption in this market.

| Table | Scope |

| Market Size in 2025 | USD 19.91 Billion |

| Projected Market Size in 2034 | USD 91.56 Billion |

| CAGR (2025 - 2034) | 18.93% |

| Leading Region | North America Share 45% |

| Market Segmentation | By Therapy Type, By Modality / Vector & Delivery Platform, By Route of Administration, By Manufacturing & Supply Model, By End User / Customer, By Region |

| Top Key Players | Novartis, Gilead Sciences / Kite Pharma, Bristol Myers Squibb (BMS) / Juno Therapeutics, Roche / Spark Therapeutics, bluebird bio, Sarepta Therapeutics, REGENXBIO, uniQure, Orchard Therapeutics, Sangamo Therapeutics, CRISPR Therapeutics, Intellia Therapeutics, Editas Medicine, Beam Therapeutics, Allogene Therapeutics, Fate Therapeutics, Catalent (Cell & Gene Services), Lonza (Cell & Gene Solutions) , Thermo Fisher Scientific (including Patheon services), WuXi AppTec / WuXi Advanced Therapies |

Cell and gene therapy pharmaceuticals refer to advanced medical treatments that use living cells or genetic material to prevent, treat, or potentially cure diseases at their root cause. Cell therapy involves the administration of living cells, such as stem cells or immune cells, to repair or replace damaged tissues and restore normal function. Gene therapy focuses on modifying or replacing defective genes within a patient’s cells to correct underlying genetic disorders. These therapies hold transformative potential in treating cancers, rare genetic diseases, and chronic conditions by offering targeted, long-lasting, and sometimes curative solutions beyond conventional pharmaceuticals.

METiS Technologies is an international pioneer in AI-driven nanodelivery technology declared that it has successfully finished its 400 million RMB in a Series D funding round. The declaration was made at an important center for Beijing's life sciences industry is Zhongguancun (Daxing) Cell and Gene Therapy Industrial Park. Beijing Medical and Health Industry Investment Fund is co-leading the financing. Industrial Investment Fund Axing the Daxing Industrial Investment Fund and the Beijing Medical and Health Industry Investment Fund co-led the Series D round. The new funding will be utilized to expedite METiS's primary strategic goals, which include hiring top talent, developing an internal pipeline, expanding international alliances, and automating upgrades to its proprietary platform.

In August 2025, in order to create in vivo CAR-T treatments, Gilead's Kite acquired Interius BioTherapeutics for US$350 million. A GILEAD Company, Kite delivering therapeutic DNA to patients' cells with a single infusion. This purchase attempts to streamline and reduce expenses for Interiüs treatment with CAR-T. Separately, Cabaletta Bio and Cellares have teamed up to automate the production of their respective CAR-T cell therapies, with the goal of facilitating greater accessibility to these cutting-edge treatments.

AI integration can significantly enhance the market by accelerating research, development, and commercialization processes. In drug discovery, AI algorithms can analyze massive datasets to identify novel therapeutic targets and optimize gene-editing techniques with higher precision. During clinical trials, AI can streamline patient recruitment, predict treatment responses, and monitor safety outcomes in real time, reducing costs and timelines. In manufacturing, AI-driven automation ensures consistency, scalability, and quality control of complex cell-based products. Moreover, AI supports personalized medicine by analyzing genomic and patient data to tailor therapies for maximum efficacy. It also improves regulatory compliance through predictive analytics and documentation automation. By enabling faster innovation, cost efficiency, and precision, AI integration addresses key challenges such as high development costs, long approval cycles, and scalability issues, thereby driving broader accessibility and adoption of cell and gene therapies in the global pharmaceuticals market.

Expanding Clinical Pipeline

The expanding clinical pipeline plays a crucial role in driving the growth of the cell and gene therapy (CGT) pharmaceuticals market by continuously bringing innovative therapies closer to commercialization. A growing number of clinical trials worldwide reflect strong industry and academic interest in developing treatments for cancer, rare genetic diseases, and chronic conditions. As more therapies progress from early-stage trials to late-stage and gain regulatory approvals, patient access to advanced, often curative, treatment options increases. This growing pipeline not only boosts investor confidence but also accelerates partnerships between biotech firms and pharmaceutical companies, fueling long-term growth and innovation in the sector.

For instance,

Complex Manufacturing Processes & Limited Infrastructure

The key players operating in the market are facing issues due to limited infrastructure and complex manufacturing processes, which are estimated to restrict the growth of the cell and gene therapy (CGT) pharmaceuticals market. Production requires highly specialized facilities, a skilled workforce, and stringent quality control, making scalability difficult. Inadequate clinical centers, supply chains, and logistics for handling living cells and genetic materials hinder adoption.

Supportive Regulatory Initiatives

Supportive regulatory initiatives play a critical role in accelerating the growth of the cell and gene therapy (CGT) pharmaceuticals market by streamlining development, encouraging innovation, and improving patient access. Regulatory agencies such as the U.S. FDA and the EMA provide frameworks like accelerated approval pathways, breakthrough therapy designations, and conditional marketing authorizations that significantly shorten time-to-market and reduce uncertainty for developers. These mechanisms not only inspire investor confidence but also foster strategic partnerships, increased funding, and heightened global collaboration, ultimately enabling more life-changing therapies to reach patients sooner.

For instance,

The cell therapies segment dominates the cell and gene therapy (CGT) pharmaceuticals market due to its wide-ranging therapeutic applications, particularly in oncology, regenerative medicine, and immune-related disorders. Its proven efficacy in treatments such as CAR-T therapies for blood cancers and stem cell therapies for tissue repair has positioned it as a leading approach. Strong investment in research and development, along with a robust clinical pipeline, supports continuous innovation and expansion of indications. Additionally, favorable regulatory frameworks, growing adoption in developed regions like North America, and increasing awareness among healthcare providers and patients further solidify the segment’s market leadership, driving sustained growth and commercial success.

The gene editing & gene modulation segment is estimated to be the fastest-growing in the cell and gene therapy (CGT) pharmaceuticals market due to rapid advancements in technologies like CRISPR, TALENs, and base editing, which allow precise modification of genetic material. These therapies offer the potential to treat a wide range of genetic disorders, rare diseases, and some cancers, attracting significant research and investment.

The viral vectors segment dominates the cell and gene therapy (CGT) pharmaceuticals market due to its critical role in delivering genetic material efficiently and safely into patient cells. Viral vectors, such as adeno-associated viruses (AAV), lentiviruses, and retroviruses, are widely used in gene therapy and CAR-T applications because of their high transduction efficiency and stable gene expression. Strong research focus, established manufacturing protocols, and extensive clinical validation contribute to their dominance. Additionally, supportive regulatory frameworks, increasing adoption in oncology and rare disease therapies, and continued technological advancements in vector design and production reinforce the viral vector segment’s leadership in the market.

The non-viral delivery segment is estimated to be the fastest-growing in the market due to its potential to overcome limitations associated with viral vectors, such as immunogenicity, insertional mutagenesis, and complex manufacturing. Techniques like lipid nanoparticles, electroporation, and polymer-based delivery enable safer, scalable, and more versatile gene and cell therapy applications. Rapid advancements in nanotechnology, coupled with increasing research investments and expanding clinical trials, are driving adoption.

The intravenous/systemic infusion segment dominates the cell and gene therapy (CGT) pharmaceuticals market due to its wide applicability, ease of administration, and ability to deliver therapies directly into the bloodstream for rapid distribution to target tissues. This method is commonly used for CAR-T cell therapies, stem cell treatments, and viral vector-based gene therapies. Strong clinical validation, established protocols, and preference among healthcare providers for minimally invasive delivery further reinforce its dominance, driving adoption and supporting the growth of the overall cell and gene therapy market.

The intrathecal/intracerebral/CNS direct delivery segment is anticipated to be the fastest-growing in the market due to its ability to target central nervous system disorders more effectively, bypassing the blood-brain barrier. This approach enables precise delivery of gene and cell therapies for conditions like spinal muscular atrophy, Parkinson’s disease, and other neurological disorders. Rapid advancements in delivery technologies, increasing clinical trials focused on CNS diseases, and growing demand for innovative treatments contribute to the segment’s accelerated adoption and market growth globally.

The in-house manufacturing by sponsors segment dominates the cell and gene therapy (CGT) pharmaceuticals market due to the critical need for quality control, consistency, and compliance with stringent regulatory standards. Sponsors, including leading biopharmaceutical companies, prefer maintaining direct oversight of production to ensure the integrity of complex cell and gene therapy products. In-house facilities allow for customization of processes, rapid troubleshooting, and scalability aligned with clinical and commercial demands. Additionally, high investment capacity, strong technical expertise, and established infrastructure in developed regions like North America reinforce this segment’s dominance, enabling faster product development, reliable supply, and enhanced market competitiveness.

The outsourced & CDMO manufacturing segment is estimated to be the fastest-growing in the market due to increasing demand for scalable, cost-effective production solutions. Many small and mid-sized biotech companies lack the infrastructure, expertise, or capital to manufacture complex cell and gene therapy products in-house, creating strong reliance on CDMOs. These organizations provide specialized capabilities, regulatory compliance support, and flexible production capacity, making the CDMO model a rapidly expanding market segment.

The hospitals & specialized infusion centers segment dominates the cell and gene therapy (CGT) pharmaceuticals market due to its ability to provide the specialized infrastructure, trained personnel, and clinical expertise required for complex therapies. These facilities are equipped to handle advanced procedures like CAR-T cell infusion, viral vector administration, and stem cell therapies safely and effectively. Strong presence in developed regions, established patient referral networks, and integration with clinical trial programs further reinforce their leadership. Additionally, hospitals and infusion centers offer comprehensive patient monitoring and support services, ensuring high treatment success rates and driving adoption of cell and gene therapies.

The CDMOs & contract labs segment is anticipated to be the fastest-growing in the market due to increasing outsourcing of research, development, and manufacturing by biotech and pharmaceutical companies. Many developers lack the specialized infrastructure, technical expertise, or capital required for complex cell and gene therapies, making CDMOs a preferred solution. These organizations offer scalable production, regulatory compliance support, and advanced analytical and quality control services.

North America dominates the cell and gene therapy (CGT) pharmaceuticals market share 45% due to its robust research infrastructure, strong presence of leading biopharmaceutical companies, and substantial investment in biotechnology and advanced therapeutics. Favorable regulatory frameworks, including accelerated approval pathways and orphan drug designations, encourage the rapid development and commercialization of innovative therapies. High healthcare spending, advanced clinical trial networks, and access to skilled scientific talent further strengthen the region’s leadership. Additionally, growing awareness and adoption of personalized medicine, coupled with strong collaborations between academia, industry, and government, ensure continuous innovation, extensive clinical pipelines, and widespread patient access, solidifying North America’s dominance in the market.

The U.S. is the largest contributor, driven by extensive R&D infrastructure, leading biotech and pharmaceutical companies, high healthcare expenditure, and supportive regulatory frameworks like the FDA’s breakthrough therapy and orphan drug designations. Strong clinical trial networks and early adoption of innovative therapies further strengthen its market leadership.

Canada’s market growth is supported by government initiatives promoting biotechnology, increasing clinical trials, and rising awareness of advanced therapies. Collaboration between research institutions and pharmaceutical companies enhances innovation and adoption.

The Asia-Pacific region is the fastest-growing in the cell and gene therapy (CGT) pharmaceuticals market due to increasing healthcare investments, rising prevalence of chronic and genetic diseases, and expanding patient populations. Rapid development of biotechnology infrastructure, a growing number of clinical trials, and government support through favorable policies and funding initiatives further drive growth. Additionally, lower manufacturing costs, increasing adoption of advanced therapies, and strategic collaborations between local and global pharmaceutical companies enhance market expansion.

China is the largest contributor in the region, driven by strong government support, expanding biotechnology infrastructure, and increasing investments from both domestic and global pharmaceutical companies. Rapidly growing clinical trials and a large patient population accelerate market adoption.

Japan benefits from advanced healthcare infrastructure, regulatory support for regenerative medicine, and early adoption of innovative therapies. Government initiatives and a strong R&D ecosystem support the development of cell and gene therapies.

India’s market growth is fueled by a rising prevalence of genetic disorders, increasing healthcare investments, and cost advantages in manufacturing and clinical trials. Growing awareness and partnerships with global biotech firms enhance innovation.

Steps:

Key Organizations/Companies:

Novartis, Gilead/Kite Pharma, CRISPR Therapeutics, Sangamon Therapeutics – Gene therapy development, Cellectis,

Academic & research institutions: Harvard Medical School, Stanford University, University of Pennsylvania

Steps:

Key Organizations/Companies:

Novartis, Bluebird Bio, Sarepta Therapeutics, etc., FDA (USA) – Regulatory oversight, EMA (Europe) – Approval and regulation, PMDA (Japan) – Regulatory review, Contract research organizations (CROs): IQVIA, Parexel, Charles River Labs

Steps:

Key Organizations/Companies:

Lonza, WuXi AppTec, Samsung Biologics, Catalent – Contract manufacturing

Steps:

Key Organizations/Companies: Novartis Patient Support Programs, Gilead’s KiteCare, Bluebird Bio Patient Services, Hospitals & specialized infusion centers (e.g., Mayo Clinic, MD Anderson Cancer Center)

In August 2025, the U.S. Food and Drug Administration announced the clinical hold on the pivotal phase 2 clinical trial conducted by Rocket Pharmaceuticals. In order to treat Danon Disease, RP-A501, an experimental adeno-associated virus serotype 9 (AAV9) vector-based gene therapy, is being evaluated (NCT06092034).

By Therapy Type

By Modality / Vector & Delivery Platform

By Route of Administration

By Manufacturing & Supply Model

By End User / Customer

By Region

January 2026

January 2026

January 2026

January 2026