February 2026

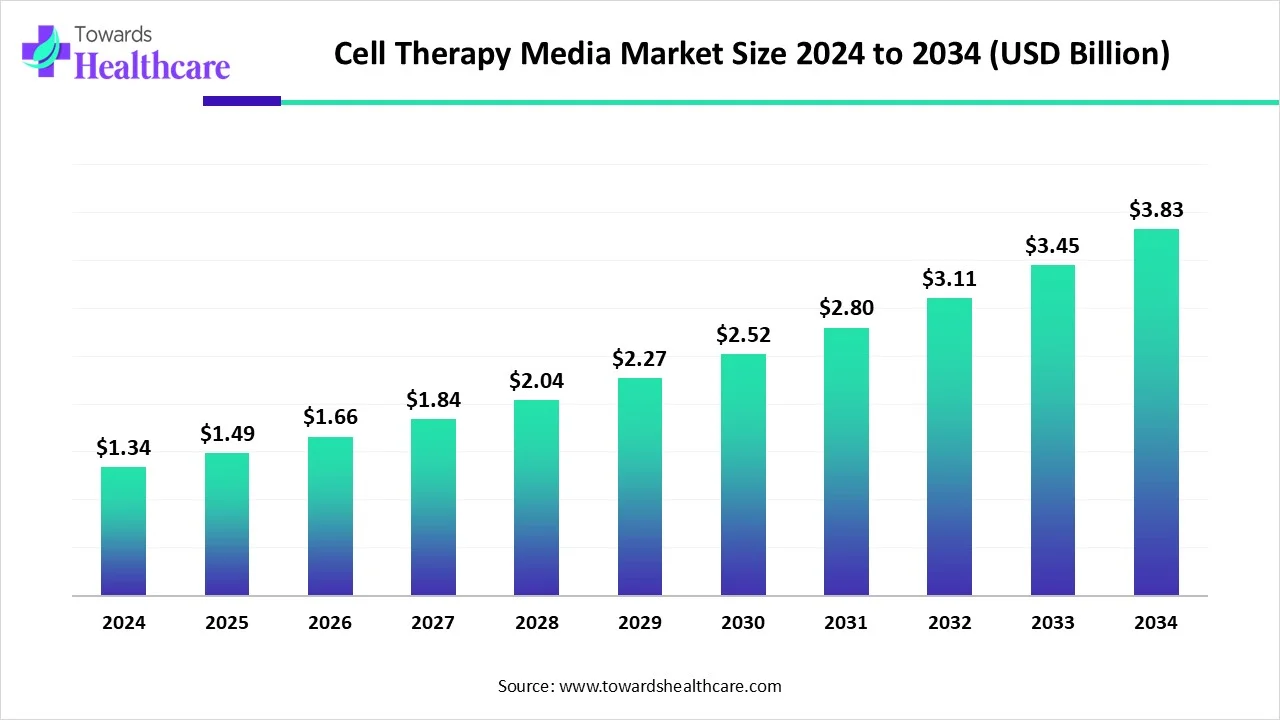

The global cell therapy media market size is calculated at USD 1.34 billion in 2024, grow to USD 1.49 billion in 2025, and is projected to reach around USD 3.83 billion by 2034.The market is expanding at a CAGR of 11.14% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 1.49 Billion |

| Projected Market Size in 2034 | USD 3.83 Billion |

| CAGR (2025 - 2034) | 11.14% |

| Leading Region | North America |

| Market Segmentation | By Product type, By type of cell therapy, By scale of operation, By end-user, By Regions |

| Top Key Players | Thermo Fisher Scientific, Merck KGaA, Lonza, Sartorius AG, Danaher Corporation, Becton, Dickinson, and Company, Bio-techne, STEMCELL Technologies |

Cell therapy media is a specially formulated solution that provides essential nutrients, growth factors, and environmental conditions required for the cultivation, expansion, and preservation of cells used in cell-based therapies, ensuring their viability, functionality, and therapeutic efficacy. The cell therapy media market is growing due to the increasing prevalence of chronic diseases, such as cancer and autoimmune disorders has heightened the demand for advanced cell-based treatments. Advancements in personalized medicines, where therapies are tailored to individual patient profiles, further drive the demand. Additionally, significant investments from both public and private sectors are accelerating research and development in cell therapies. The shift towards serum-free, chemically defined media enhances safety and consistency, aligning with stringent regulatory standards and supporting market expansion.

AI is accelerating advancements in the market by optimizing media formulations through data-driven analysis, improving cell culture conditions, and predicting cell growth outcomes. It enables faster development of customized, high-quality media, reduces trial-and-error experimentation, and enhances manufacturing efficiency. Additionally, AI helps in monitoring production processes in real-time, ensuring consistency and scalability, which ultimately supports more effective and reliable cell-based therapies.

Advancement in Personalized Medicine

Personalized cell therapies, such as CAR-T and stem cell-based treatments, depend on precise culture conditions to ensure the safety, efficacy, and reproducibility of therapeutic cells. This demand has led to the development of customized high-performance media that support specific cell types and therapeutic goals. Additionally, personalized medicine emphasizes consistency and compliance with regulatory standards, further pushing innovation in media formulations.

For Instance,

High Cost of Cell Therapy Media Manufacturing

The high cost of cell therapy media manufacturing is a major waste in the market as it leads to inefficiencies and limits the broader application of cell-based therapies. Producing media requires expensive, high-quality ingredients, rigorous testing, and compliance with regulatory standards, all of which drive up costs. Additionally, short shelf lives and storage challenges often result in excess or expired media being discarded. These factors contribute to financial losses and restrict access to therapies, especially in lower-income regions, ultimately slowing down the growth and adoption of the advanced cell therapy media market.

Integration of Artificial Intelligence and Automation in Media Development

The integration of AI and automation in media development is a future opportunity because it enables faster, more precise optimization of cell culture formulations. AI can analyze complex data to identify ideal media components, reducing trial and error and development time. Automation improves manufacturing consistency and scalability while lowering costs. Together, these technologies enhanced efficiency, quality, and speed, making personalized and large-scale cell therapies more accessible and affordable, which will drive growth in the cell therapy media market.

In 2024, the media segment held the largest revenue share in the market due to its essential role in supporting cell growth, viability, and function during therapy development and manufacturing. Media is required in large volumes across all therapy stages of research, clinical trials, and commercialization, making it a recurring and high-demand component. The growing adoption of advanced and specialized media formulations further boosted market growth.

The reagent segment is expected to grow at the fastest rate in the cell therapy media market due to increasing demand for high-quality, specialized reagents that support cell isolation, expansion, and genetic modification. As advanced therapies like AR-T and stem cell treatments expand, the need for consistent, GMP-grade reagents rises. Additionally, innovations in reagent formulations that improve cell yield and functionality are driving the adoption to further boost the market expansion.

The dominance of the stem cell therapy segment in the market is driven by broad clinical potential and increasing research funding. Unlike other therapies, stem cells are used for both autologous and allogeneic applications, requiring diverse and tailored media solutions. Continued advancements in disease modeling and tissue engineering have fueled the need to optimize culture conditions, further boosting demand. This consistent and expanding usage has positioned stem cell therapy as the market leader.

The T cell therapy segment is expected to grow at a faster CAGR due to the rising adoption of treatments like CAR-T therapy for cancer. These therapies require precise media formulation for T-cell activation, expansion, and genetic modification. Increasing clinical success, regulatory approvals, and investment in immunotherapy research are accelerating demand. Additionally, advancements in gene editing and personalized oncology are expanding the scope of T-cell therapies, driving the rapid growth of the market.

In 2024, the clinical segment dominated the cell therapy media market due to the growing number of cell therapy clinical trials worldwide. Increased investment in translational research and rising regulatory approvals for investigational new therapies boosted media demand in clinical settings. This phase requires a large volume of high-quality, GMO-compliant media to ensure safety, consistency, and efficacy, making it the largest contributor to the market.

The rapid growth of the commercial segment is driven by the transition of many cell therapies from experimental stages to widespread clinical use. This shift requires a scalable production system and robust media solutions to meet market demand. Advances in automation, supply chain optimization, and global distribution capabilities have further gained reimbursement and entered mainstream healthcare; Manufacturers are scaling up operations, fueling the accelerated expansion of media demand the commercial applications.

The industry segment led the market in revenue as private companies increasingly prioritize cell therapy, development to address unmet medical needs. Unlike academic or hospital settings, industry players invest heavily in R&D automation and advanced bioprocessing technologies. Their ability to scale operations quickly, meet global regulatory standards, and commercialize therapies effectively creates sustained demand for specialized media. This strategic focus on innovation and market expansion has made it the largest contributor to the cell therapy media market.

For Instance,

The non-industry segment is expected to grow at the fastest CAGR due to the rising involvement of academic institutions, research organizations, and hospitals in early-stage cell therapy research and clinical trials. Increased government funding, academic-industry collaborations, and the establishment of specialized cell therapy centers are fueling this growth. These entities often focus on innovation and proof-of-concept studies, driving demand for customized media solutions, which contributes to the rapid expansion during the forecast period.

North America dominated the market in 2024 due to its well-established biopharmaceutical industry, strong research infrastructure, and high investment in cell-based therapies. The region hosts numerous clinical trials, leading biotech firms, and advanced manufacturing facilities. Favorable regulatory frameworks, increased adoption of personalized medicine, and strong funding from both the public and private sectors further supported market growth. These factors combined to position North America as the leading region in cell therapy media demand and innovation.

The U.S. market is experiencing significant growth due to several key factors. Firstly, the increasing adoption of regenerative medicine and the rising number of clinical trials on cell therapies, driven by positive therapeutic outcomes, are major contributors. Additionally, the introduction of technological advancements in the market is propelling growth. This robust growth underscores the expanding demand for cell therapy media in the United States.

The country's strong research infrastructure and increasing investment in regenerative medicine are fostering growth. Additionally, the rising prevalence of chronic diseases is driving demand for innovative therapies. The adoption of serum-free media, which was the largest revenue-generating product in 2024, further supports this expansion. Collectively, these elements are propelling the growth of Canada's market.

Asia Pacific is anticipated to grow at the highest CAGR in the market during the forecast period due to several key factors. These include substantial government investments in regenerative medicine, a surge in clinical trials, particularly in China and India, and the expansion of biomanufacturing infrastructure. Additionally, the region's large patient population and increasing demand for personalized therapies are driving the need for scalable, high-quality media solutions. Collectively, these elements are propelling Asia Pacific's rapid growth in the market.

China's market is expanding rapidly due to the Chinese government has implemented supportive regulatory policies, including pilot programs that permit foreign investment in the cell and gene therapy sectors within selected free trade zones. This has attracted significant interest from global pharmaceutical companies, such as AstraZeneca, which acquired Gracell Biotechnologies to enhance its cell therapy capabilities. Additionally, China's robust research infrastructure and increasing demand for personalized medicine are driving the growth of the market.

India's market is growing due to rising research activity in regenerative medicine and the increasing adoption of advanced therapies in both public and private healthcare institutions. The establishment of specialized cell therapy centers and collaborations between academic institutions and biotech companies are also fueling market growth. Additionally, the availability of skilled professionals and supportive regulatory developments is encouraging more clinical trials and manufacturing activities, driving consistent demand for cell culture media across the country.

For Instance,

Europe is accelerating the market through a combination of strategic investments, regulatory support, and collaborative initiatives. Countries like Germany, the UK, and France are leading in research and development, bolstered by government funding and partnerships between academia and biotech firms. The European Medicines Agency (EMA) provides a supportive regulatory environment, facilitating the approval of innovative therapies. Additionally, the expansion of manufacturing capabilities and the establishment of specialized facilities are enhancing Europe's capacity to meet the growing demand for cell therapy media.

The UK's market is expanding due to its robust research infrastructure, supportive regulatory environment, and strong collaboration between academia and industry. Initiatives like the Cell and Gene Therapy Catapult have fostered innovation and streamlined the translation of research into clinical applications. Additionally, the UK's focus on personalized medicine and the establishment of specialized manufacturing facilities are enhancing production capabilities, driving increased demand for cell therapy media.

Germany's market is expanding due to its strong biopharmaceutical sector, substantial government funding, and advanced research infrastructure. The country has over 30 biotech companies actively developing cell and gene therapies, supported by significant investments in research and development. Additionally, Germany's focus on innovative technologies like CRISPR and gene editing tools, along with its commitment to addressing genetic disorders, is propelling the demand for specialized cell culture media. These factors collectively contribute to the robust growth of the market.

In January 2025, Astraveus SAS announced a breakthrough in CAR-T cell production using its fully automated Lakhesys Benchtop Cell Factory. This innovative microfluidic system streamlines the entire manufacturing process, boosting efficiency and cell quality while significantly cutting costs. By integrating analytics and enabling scalable production from early research to commercial levels, the system reduces lab space needs and minimizes cell stress, offering a more cost-effective and high-throughput solution for cell therapy manufacturing. (Source - Astraveus)

By Product type

By type of cell therapy

By end-user

By Region

February 2026

January 2026

January 2026

January 2026