February 2026

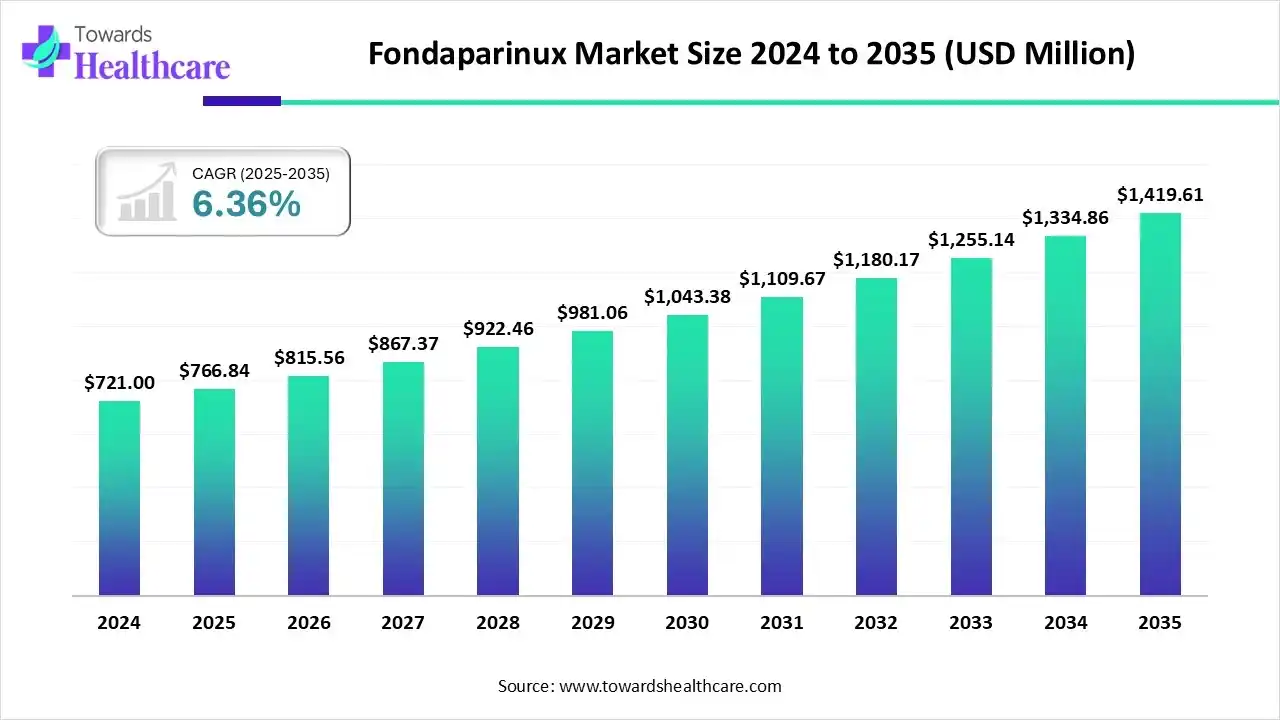

The global fondaparinux market size is calculated at USD 721 million in 2025, grew to USD 815.56 million in 2026, and is projected to reach around USD 1419.61 million by 2035. The market is expanding at a CAGR of 6.36% between 2026 and 2034.

The fondaparinux market is primarily driven by the rising prevalence of chronic disorders, such as cancer and cardiovascular disorders, and the growing research and development activities. Government initiatives and favorable reimbursement policies support the diagnosis and treatment of thromboembolic diseases. Artificial intelligence (AI) plays a transformative role in the fondaparinux research.

| Table | Scope |

| Market Size in 2025 | USD 721 Million |

| Projected Market Size in 2035 | USD 1419.61 Million |

| CAGR (2026 - 2035) | 6.36% |

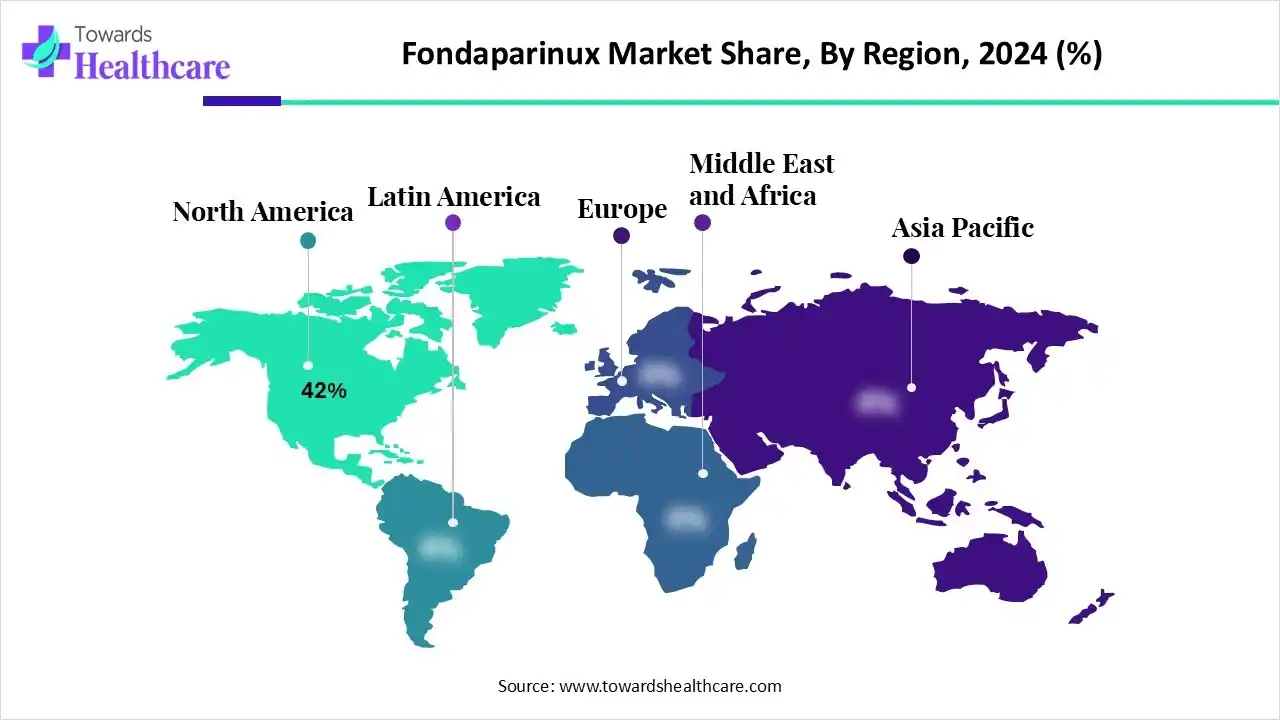

| Leading Region | North America by 42% |

| Market Segmentation | By Type, By Application, By Form, By End-User Industry, By Region |

| Top Key Players | GlaxoSmithKline plc, Abbott Laboratories, Inc., Dr. Reddy’s Laboratories, Lee’s Pharmaceutical Ltd., Shanghai Min-Biotech Co., Ltd., Jiangsu Hengrui Medicine, Viatris, Aurobindo Pharma, Pfizer, Teva Pharmaceutical Industries, Boehringer Ingelheim, Zydus Lifesciences, Lupin Pharmaceuticals, Sun Pharmaceuticals, Ltd., Hikma Pharmaceuticals |

The fondaparinux market is experiencing robust growth, driven by the increasing incidence of thromboembolic diseases, growing volumes of surgical procedures, and the rising demand for reliable anticoagulants. It covers the development, manufacturing, and commercialization of fondaparinux sodium, a synthetic pentasaccharide anticoagulant (factor Xa inhibitor) used for the prevention and treatment of venous thromboembolism and related indications, along with its APIs, finished dosage forms (injectables), generic/biosimilar versions, and the contract manufacturing and distribution services that support clinical and commercial supply.

AI assists researchers in optimizing research protocols and managing clinical trials of fondaparinux. AI and machine learning (ML) algorithms can analyze vast amounts of data and predict pharmacokinetic and pharmacodynamic properties of fondaparinux. They can also help analyze complex clinical trial data, saving time for researchers. AI and ML can also predict the response of fondaparinux in a patient, including side effects. This enables healthcare professionals to make proactive clinical decisions.

Which Type Segment Dominated the Fondaparinux Market?

The generic fondaparinux segment held a dominant presence in the market in 2024 with a revenue of 60%, due to the growing demand for cost-effective medications and the increasing healthcare expenditure. Generic drugs enhance patient convenience and treatment accessibility. Companies develop generic alternatives to branded drugs after their patent expiration that have therapeutic equivalence. The availability of generic drugs also fosters competition among pharma companies, leading to reduced prices for generic and branded drugs.

Branded Fondaparinux

The branded fondaparinux segment is expected to grow at the fastest CAGR in the market during the forecast period, because branded fondaparinux is more trustworthy than generic drugs. Branded drugs undergo extensive research and clinical trial stages to determine their safety and efficacy profile. Unlike generic medicines, branded fondaparinux is approved by regulatory agencies.

Others

The others segment is expected to grow in the coming years, due to the availability of fixed-dose combination products. Several studies have proved the significance of fondaparinux with other anticoagulants. Combination products provide synergistic therapeutic effects on patients by attacking multiple targets simultaneously, thereby enhancing efficacy.

How the Thromboprophylaxis Segment Dominated the Fondaparinux Market?

The thromboprophylaxis segment held the largest revenue share of 45% of the market in 2024, due to the rising prevalence of thrombosis and the increasing awareness of thrombosis prevention. Government organizations launch initiatives to raise awareness about the screening and early diagnosis of thromboembolic disorders. Fondaparinux is widely prescribed to patients undergoing major orthopedic surgery. According to the 2024 American Joint Replacement Registry (AJRR) Annual Report, 4.3 million hip and knee arthroplasties were performed in the U.S.

Acute Coronary Syndrome (ACS)/NSTEMI Adjunct Use

The acute coronary syndrome (ACS)/NSTEMI adjunct use segment is expected to grow with the highest CAGR in the market during the studied years, due to the increasing prevalence of cardiovascular diseases and the growing number of heart surgeries. It is estimated that more than 1.2 million people in the U.S. are hospitalized annually. Fondaparinux shows anticoagulant activity with a lower risk of bleeding compared to other anticoagulants.

Treatment of DVT/PE

The treatment of DVT/PE segment is expected to grow significantly in the upcoming years. Deep vein thrombosis (DVT) and pulmonary embolism (PE) are clotting disorders that develop in deep veins and lungs, respectively. Venous thromboembolism (VTE) refers to DVT, PE, or both. Up to 900,000 people in the U.S. are affected by VTE annually.

Why Did the Prefilled Syringes Segment Dominate the Fondaparinux Market?

The prefilled syringes segment contributed the biggest revenue share of 55% of the market in 2024, due to the growing demand for self-delivery of medications and accurate dosing. Prefilled syringes offer numerous advantages, such as convenience, affordability, accuracy, sterility, and safety. They save a lot of time for healthcare professionals, eliminating the need for measuring doses. They reduce manual error in the precise dosing of fondaparinux.

Vials

The vials segment is expected to expand rapidly in the market in the coming years, due to the need to deliver tailored doses based on patients’ conditions. Vials are available in different sizes, from small vials for single doses to large vials of multiple doses. They are designed to maintain the drug’s safety and effectiveness through features like sterile closures and precise construction.

Prefilled Pens/Auto-Injectors & Specialty Delivery

The prefilled pens/auto-injectors & specialty delivery segment is expected to show lucrative growth, due to advances in drug delivery systems. Auto-injectors eliminate the need for patients to visit a healthcare organization for drug delivery. They reduce the physical burden of injection and decrease the chances of injection site adverse effects.

Which End-User Industry Segment Led the Fondaparinux Market?

The hospitals & inpatient care segment led the market in 2024, with a revenue of 65% due to favorable infrastructure and suitable capital investments. Patients prefer visiting hospitals as they possess skilled professionals from multiple departments and favorable reimbursement policies. Healthcare professionals can perform complex surgeries and can continuously monitor a patient. Moreover, hospitals are part of clinical trials, benefiting patients before market approval.

Ambulatory Surgical Centers/Day Care Clinics

The ambulatory surgical centers/day care clinics segment is expected to witness the fastest growth in the market over the forecast period. Ambulatory surgical centers (ASCs) possess specialized equipment and skilled professionals to provide personalized care. The demand for ASCs is increasing as patients do not need to stay overnight, thereby saving exorbitant costs.

Retail & Hospital Pharmacies

The retail & hospital pharmacies segment is expected to grow in the foreseeable future. Retail & hospital pharmacies are necessary for the outpatient dispensing of medications. They offer numerous advantages, such as special discounts and 24/7 services. Hospitals and ASCs also purchase fondaparinux from retail & hospital pharmacies.

North America dominated the global market with a 42% share in 2024. The availability of state-of-the-art research and development activities, a robust healthcare infrastructure, and the rising prevalence of chronic disorders are the major growth factors of the market in North America. People are more aware of early diagnosis and personalized treatment of several conditions, including thromboembolic disorders. The increasing number of surgeries also fosters market growth.

According to a recent study on 33,366 Americans, approximately 11.3% reported having surgery in the previous year, while 61.8% had private health insurance and 25% had public health insurance. The total Medicare spending in 2023 was $1,029.8 billion, an increase of 8.1%, whereas the Medicaid spending grew 7.9% to $871.7 billion in 2023. Companies like Viatris and Mylan N.V. manufacture and market fondaparinux in the U.S.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. Countries like China and India have a strong presence of pharmaceutical and biotech companies that manufacture and sell fondaparinux. They have a suitable manufacturing infrastructure, enabling foreign companies to set up their facilities. Government organizations launch initiatives to encourage the indigenous manufacturing of pharmaceuticals. This is supported by government incentives and the increasing number of startups.

Key players, such as Shanghai Min-Biotech Co., Ltd., Jiangsu Hengrui Medicine, and Sihuan Pharmaceutical Holdings Group, are the major contributors to the market in China. China is the second-largest exporter of fondaparinux in the world, accounting for 6 shipments from February 2024 to January 2025. The rising geriatric population further propels market growth. China’s population aged 60 years and above reached nearly 297 million in 2023.

Europe is expected to grow at a considerable CAGR in the upcoming period. The burgeoning healthcare sector and the increasing healthcare expenditure contribute to market growth. The European Medicines Agency (EMA) authorizes the regulation of fondaparinux in European nations. Government bodies provide funding to conduct research activities related to fondaparinux. The increasing number of surgeries and favorable clinical trial infrastructure bolster market growth.

The clinical trial infrastructure is rapidly expanding in Germany. Out of 94 trials, 15 clinical trials related to fondaparinux were registered in Germany related to fondaparinux as of October 2025. This indicates the significance of the drug in the region. The increasing number of heart surgeries also contributes to market growth. The German Heart Surgery Report 2023 reported that 100,606 heart surgeries were performed in 2023.

The Fondaparinux market in South America is experiencing significant, steady expansion. Growth is powered by rising orthopedic surgical rates and a growing elderly population, which increases the incidence of venous thromboembolism (VTE). Affordable generic formulations are becoming increasingly available, boosting accessibility across the region. This trend supports its use in hospital and outpatient care.

In Argentina, the market is primarily driven by the increasing adoption of cost-effective generic fondaparinux. Its superior safety profile for patients with specific conditions, like heparin-induced thrombocytopenia, makes it a preferred prophylactic agent. Expanding healthcare infrastructure and protocols for DVT and PE treatment are further solidifying its growing market presence here.

The Middle East and Africa (MEA) region is exhibiting steady growth, although it has a smaller market share globally. Key drivers include a rising prevalence of cardiovascular diseases and obesity-related disorders, requiring more anticoagulation therapy. Increased health awareness and governmental efforts to improve access to modern medicines are the main factors expanding its market footprint.

The UAE market, which boasts the highest growth rate within the MEA region, is fueled by substantial public and private healthcare investments. High-quality surgical centers and a focus on advanced medical treatments for an expatriate and affluent local population ensure high adoption rates. The UAE's advanced hospital infrastructure prioritizes effective post-surgical thromboprophylaxis.

Researchers are evaluating novel applications of fondaparinux, such as in treating viral and inflammatory diseases. They also focus on developing fondaparinux with reduced side effects.

Key Players: Dr. Reddy’s Laboratories, Abbott Laboratories, Inc., Bayer AG

Clinical trials are conducted to evaluate the efficacy and safety of fondaparinux compared with other anticoagulants. Regulatory agencies like the FDA, EMA, and NMPA approve fondaparinux based on clinical trial data.

Key Players: GlaxoSmithKline

Patient support & services refer to providing financial assistance to patients and suggesting an appropriate dosage regimen.

Company Overview

Corporate Information, Headquarters, London, UK, Year Founded, 2000 (from a merger), Ownership Type, Public, LSE, NYSE

History and Background, GSK was formed by the merger of Glaxo Wellcome plc and SmithKline Beecham plc. It is a global pharmaceutical and biotechnology company focused on science to prevent and treat disease. The company's product Arixtra (Fondaparinux) was the original branded product.

Key Milestones / Timeline: Fondaparinux was first approved in the early 2000s. GSK received EU approval for a new therapeutic indication for Arixtra in acute symptomatic spontaneous superficial vein thrombosis, September 2010. GSK spun off its Consumer Healthcare division (Haleon) in 2022 to focus purely on biopharma.

Business Overview

Key Developments and Strategic Initiatives

Technological Capabilities / R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

Company Overview

Corporate Information, Headquarters, Canonsburg, Pennsylvania, USA, Year Founded, 2020 (formed via the merger of Mylan and Upjohn), Ownership Type, Public, NASDAQ

History and Background, Viatris was created to be a global healthcare company with broad access to medicines. Its fondaparinux market presence stems primarily from the Mylan legacy, which acquired key rights to Arixtra and its generic forms.

Key Milestones / Timeline: Mylan acquired the US rights to Arixtra from Aspen in 2014; Mylan acquired Aspen's thrombosis business in Europe in 2020; Viatris formed through the combination of Mylan and Pfizer's Upjohn division in November 2020.

Business Overview

Key Developments and Strategic Initiatives

Technological Capabilities / R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

By Type

By Application

By Form

By End-User Industry

By Region

February 2026

February 2026

February 2026

February 2026