January 2026

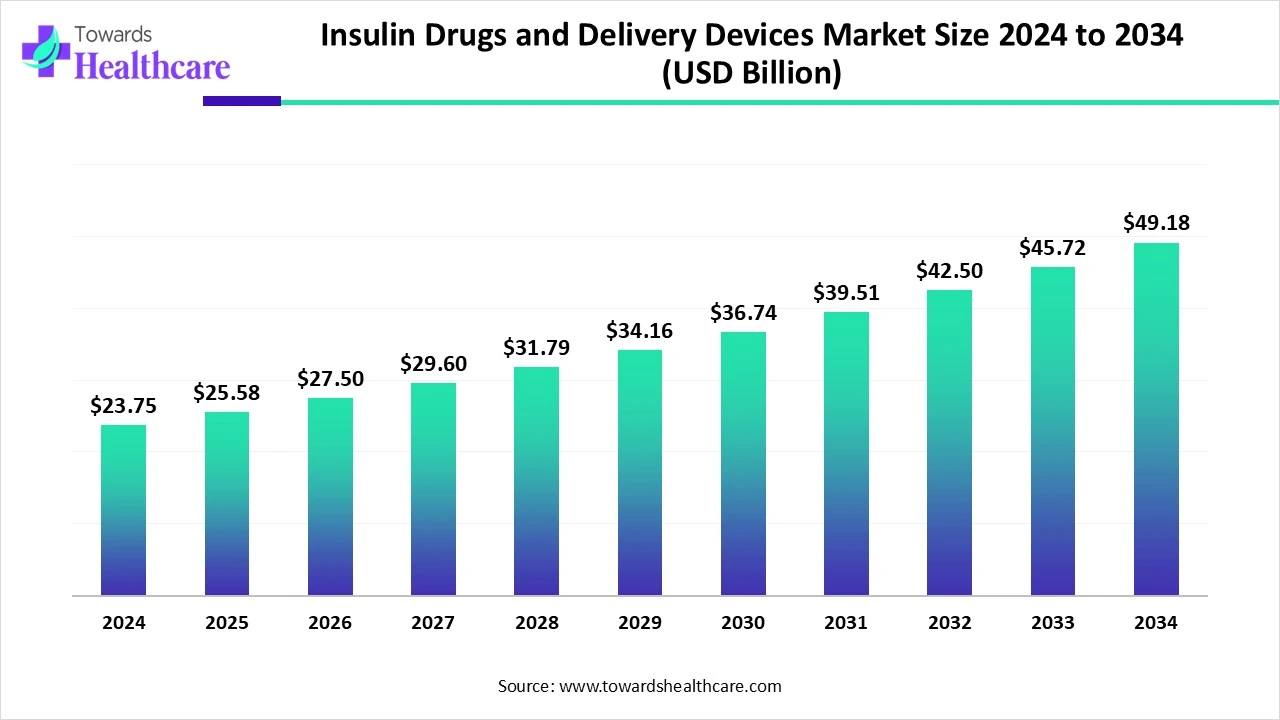

The global insulin drugs and delivery devices market size is calculated at USD 23.75 billion in 2024, grew to USD 25.58 billion in 2025, and is projected to reach around USD 49.18 billion by 2034. The market is expanding at a CAGR of 7.65% between 2025 and 2034.

The insulin drugs and delivery devices market is primarily driven by increasing diabetes cases and the burgeoning medical device sector. Government organizations launch initiatives to support early diagnosis of diabetes and provide funding for insulin treatment. Prominent players collaborate to develop novel insulin delivery devices using each other’s expertise. Artificial intelligence (AI) introduces automation in delivery devices, thereby monitoring usage and sending alerts. The future looks promising, with novel delivery devices.

| Table | Scope |

| Market Size in 2025 | USD 25.58 Billion |

| Projected Market Size in 2034 | USD 49.18 Billion |

| CAGR (2025 - 2034) | 7.65% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Source, By Application, By Distribution Channel, By Region |

| Top Key Players | Medtronic plc, Sequel MedTech, NuGen Medical Devices, Abbott Laboratories, Eli Lilly & Company, Sanofi, Novo Nordisk, Alkermes, Omnipod, Terumo, Senseonics Integrate Technologies, Code Biotherapeutics, MannKind Corporation, Biocon, Ypsomed, Insulet Corporation |

The insulin drugs and delivery devices market encompasses the development and distribution of insulin drugs and medical devices designed to administer them into the body. Insulin is usually administered through pens, pumps, jets, and syringes. It is prescribed to patients with type 1 and gestational diabetes, while it is also prescribed in some cases to patients with type 2 diabetes. Insulin is available as synthetic human insulin, insulin analogs, and biosimilars produced through recombinant technology.

AI can transform the insulin drugs and delivery devices market, as it is an indispensable part of many insulin delivery devices that are available today. It automates the delivery of insulin, enhancing efficiency and precision. AI-based systems can analyze glucose levels in real-time and suggest insulin intake for patients. They provide real-time data to healthcare professionals, enabling them to continuously monitor a patient and make proactive clinical decisions. AI and machine learning (ML) algorithms analyze vast amounts of patient data and optimize insulin dosage based on a patient’s conditions. Moreover, AI is also used to derive recombinant insulin from various sources.

Rising Diabetes Cases

The major growth factor for the insulin drugs and delivery devices market is the rising prevalence of diabetes. Diabetes is a major public health concern globally, especially among the geriatric population. The International Diabetes Federation (IDF) reported that approximately 589 million people were affected by diabetes in 2024. It is projected that this figure will reach approximately 853 million by 2050, representing a 46% increase.The major causes of diabetes include urbanization, ageing, decreasing levels of physical activity, and increasing obesity prevalence.

High Cost

Innovative insulin delivery devices are very expensive, limiting the affordability of patients from low- and middle-income groups. The average cost of an insulin pump ranges from $6,000 to $8,000, while a single vial may cost around $300. Diabetes poses a significant economic burden on the nation.

Innovative Delivery Devices

The future of the insulin drugs and delivery devices market is promising, driven by continuous innovations in delivery systems. Integrating continuous glucose monitoring (CGM) with insulin pumps paved the way for artificial pancreas systems (APS) for automating insulin delivery. This marks the advent of bionic technology to revolutionize insulin delivery and monitor glucose levels. Insulin pumps are also transformed by incorporating CGM properties, predictive low glucose suspend (PLGS) capabilities, and smartphone connectivity. Some devices can detect glucose levels in patients, preventing the risks of hypoglycemia and hyperglycemia.

By product type, the drug type segment held a dominant presence in the market in 2024. This is due to the ability of insulin drugs to control glucose levels. Advancements in recombinant technology and the proteomics sector facilitate the development of insulin drugs. Ongoing efforts are made to derive novel methods to extract insulin. This leads to the development of insulin with enhanced properties, such as faster bioavailability and reduced systemic side effects. Amino acids of insulin are modified to develop a stable and long-lasting insulin.

By product type, the delivery device segment is expected to grow at the fastest CAGR in the market during the forecast period. Innovations in delivery devices and the growing demand for personalized insulin dosage boost the segment’s growth. The advent of wearable devices enables continuous glucose monitoring and responsive insulin delivery. Insulin devices possess precise insulin management capabilities, allowing patients to control dosing remotely. Scientists develop user-friendly devices to eliminate the need for trained professionals.

By source, the insulin analog segment held the largest revenue share of the market in 2024. Insulin analog is widely preferred due to their ability to have less pharmacologic variability, lower hypoglycemic risk, and greater impact on quality of life. It is the modified version of human insulin, enabling researchers to alter the pharmacokinetic and pharmacodynamic properties. Long-acting insulin analogs are suggested for patients with frequent severe hypoglycemia with human insulin.

By source, the human insulin segment is expected to grow with the highest CAGR in the market during the studied years. Human insulin is a short-acting insulin and is used in patients with type 1 or type 2 diabetes. It is either used alone or in combination with insulin analogs or diabetes medications, along with proper diet and exercise. Human insulin is prepared using recombinant DNA technology. Some common examples of human insulin are lispro, glulisine, and aspart.

By application, the type 2 diabetes segment contributed the biggest revenue share of the market in 2024. This is due to the rising prevalence of type 2 diabetes, the increasing geriatric population, and sedentary lifestyles. Type 2 diabetes accounts for the highest number of cases, accounting for 90-95% of all cases. Healthcare professionals prescribe insulin to type 2 diabetes patients who are unresponsive to medications. The types of insulin used for type 2 diabetes are long-acting, intermediate-acting, or mixed insulin.

By application, the type 1 diabetes segment is expected to expand rapidly in the market in the coming years. Insulin is the only source of managing glucose levels in patients with type 1 diabetes, as the pancreas is unable to produce insulin. Although type 1 diabetes accounts for 5-10% of all cases, it is the most severe type of diabetes. Type 1 diabetes is mainly caused by genetic conditions or some viruses. Patients require a continuous supply of insulin, necessitating them to receive insulin through pens, syringes, or pumps.

By distribution channel, the retail pharmacies segment led the market in 2024. The segmental growth is attributed to the increasing number of retail pharmacies and favorable infrastructure. This increases the accessibility of insulin drugs and devices to patients. Suitable capital investment enables retail pharmacies to adopt advanced devices and drugs. Retail pharmacies offer a wide range of services, such as free home delivery, 24/7 services, and special discounts. They possess skilled professionals to guide patients about the dosage and time of insulin administration.

By distribution channel, the online pharmacies segment is expected to witness the fastest growth in the market over the forecast period. Online pharmacies allow patients to order insulin drugs and delivery devices in the comfort of their home. This also enables them to order from a wide range of options. Online pharmacies offer free home delivery, special discounts, and virtual consultations.

North America dominated the global insulin drugs and delivery devices market in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable regulatory support are the major growth factors for the market in North America. Government organizations launch initiatives and provide funding for controlling diabetes. They also provide funding for diabetes research and developing innovative delivery devices.

Key players, such as Abbott Laboratories, Eli Lilly & Company, and MannKind Corporation, are major manufacturers and suppliers of insulin drugs and delivery devices in the U.S. It is estimated that more than 38.4 million Americans rely on insulin for the management of diabetes. The U.S. government’s Healthy People 2030 aims to reduce diabetes cases, complications, and deaths.

The federal government’s next step toward the first phase of national universal pharmacare is the introduction of Bill C-64 into Parliament, and the intention to provide universal, single-payer coverage for various diabetes medications. Statisque Canada reported that the prevalence of diabetes is around 1% in Canadians aged 20 to 39 years, and about 1 in 5 seniors aged 60 to 79 years.

Asia-Pacific is expected to grow at the fastest CAGR in the insulin drugs and delivery devices market during the forecast period. The rising prevalence of diabetes, the growing geriatric population, and the increasing adoption of advanced technologies drive the market. The burgeoning pharmaceutical and biotech sectors and increasing venture capital investments contribute to market growth. Government and private institutions conduct seminars, workshops, and conferences to share updates about the latest developments in diabetes.

IDF reported that the prevalence of diabetes is 11.9% in China, affecting over 147 million people. China has a suitable manufacturing infrastructure, encouraging foreign players to set up their manufacturing facilities. In December 2024, Sanofi announced an investment of around 1 billion euros ($1.1 billion) to build a new insulin production base in Beijing.

More than 89 million people, or 10.5% of the population, in India have diabetes. The diabetes sector has 41 companies in India, including 19 funded companies. These 19 companies have collectively raised $78.1 million in venture capital and private equity. India’s Ministry of Health and Family Welfare (MoHFW) collaborated with the WHO and WDF to provide timely access to care for people with diabetes and hypertension by 2025.

R&D activities refer to developing insulin formulations with improved pharmacokinetic properties. They also involve developing novel delivery systems to automate insulin delivery.

Key Players: Sanofi, Eli Lilly and Company, and Novo Nordisk.

Regulatory agencies mandate companies to conduct clinical trials for novel insulin drugs and delivery devices to assess their safety and efficacy.

Key Players: Wockhardt, Biodel, MannKind Corporation, and Sanofi.

Manufacturers sell insulin drugs and delivery devices to distributors or wholesalers through a regulated supply chain and a favorable logistics infrastructure.

Key Players: Biocon, Durbin, and IDA Foundation.

Patient support & services refer to educating patients about diabetes diagnosis and treatment, including insulin dosage. Healthcare professionals also respond to complications associated with insulin drugs.

Dr. Marc Breton, Associate Director for Research at the UVA Center for Diabetes Technology, commented that after working with Tandem for more than 10 years, the expansion of collaboration marks a new beginning to serve patients with diabetes. Together, both will expand their research efforts into automated insulin delivery with the goal of once more substantially enhancing care and quality of life for patients globally.

By Product Type

By Source

By Application

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026