February 2026

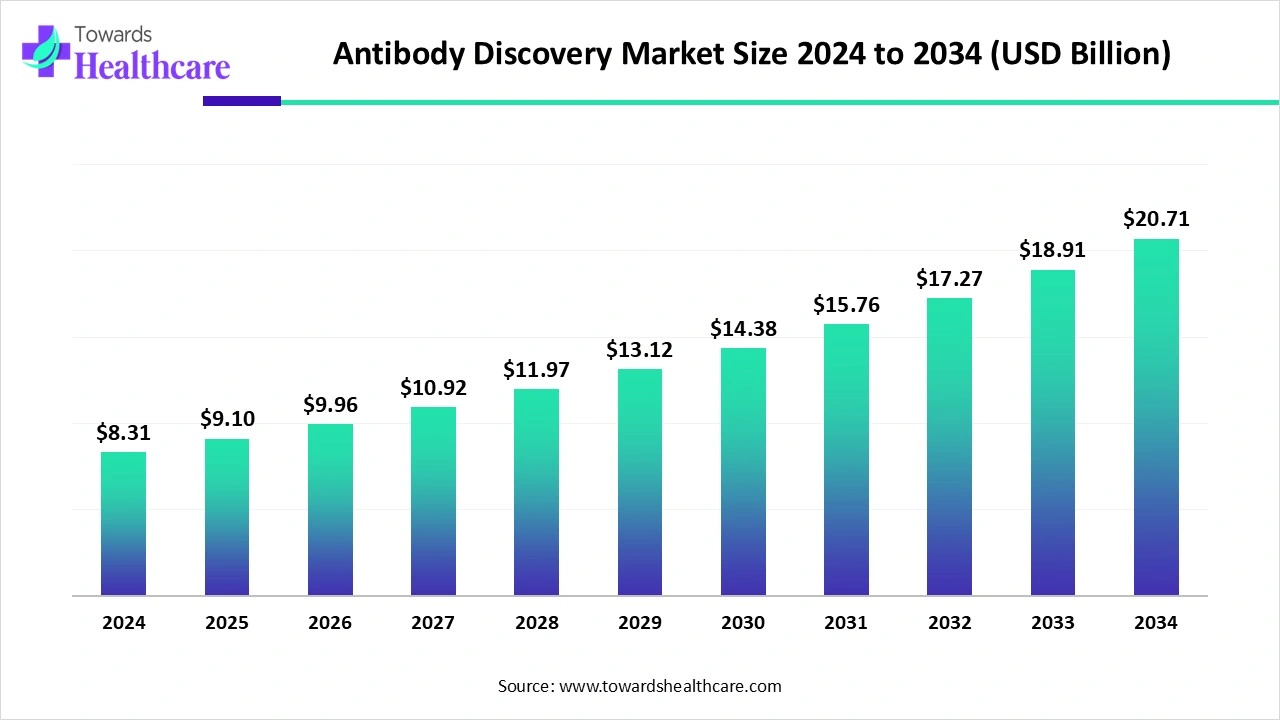

The global antibody discovery market size was reported at US$ 8.31 billion in 2024 and is expected to rise to US$ 9.1 billion in 2025. According to forecasts, it will grow at a CAGR of 9.54% to reach US$ 20.71 billion by 2034.

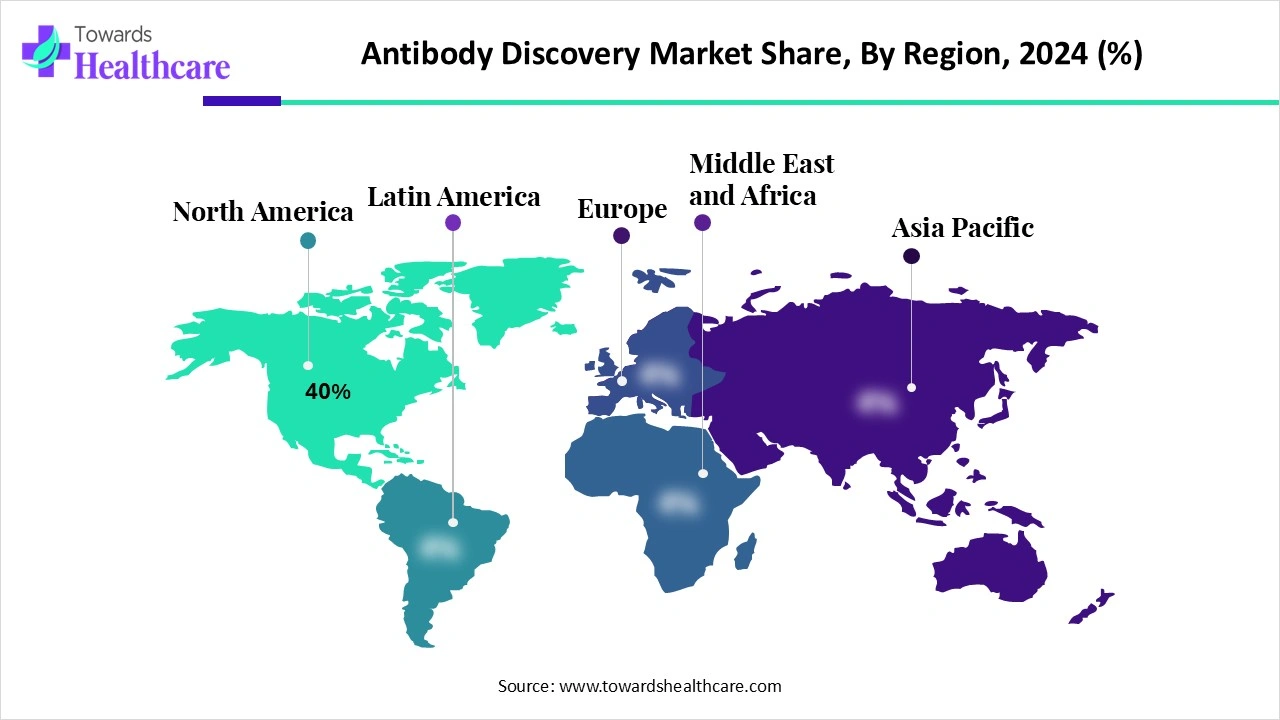

The antibody discovery market is witnessing rapid growth, driven by rising demand for targeted therapies in oncology, autoimmune, and infectious diseases. Technological advancements, including high-throughput screening, phage display, and next-generation sequencing, are accelerating the identification and optimization of novel antibodies. North America dominates the market due to the presence of leading pharmaceutical and biotechnology companies, robust R&D infrastructure, favorable regulatory frameworks, and strong government support. Increasing investments, academic-industry collaborations, and the focus on personalized medicine further strengthen market expansion globally.

| Table | Scope |

| Market Size in 2025 | USD 9.1 Billion |

| Projected Market Size in 2034 | USD 20.71 Billion |

| CAGR (2025 - 2034) | 9.54% |

| Leading Region | North America by 40% |

| Market Segmentation | By Technology, By Type of Antibody, By Application, By Service Type, By End User, By Region |

| Top Key Players | AbCellera Biologics, Genmab, Regeneron Pharmaceuticals, WuXi Biologics, Adimab, Ligand Pharmaceuticals, Lonza, AstraZeneca (MedImmune), Amgen, Pfizer, Eli Lilly, Roche/Genentech, Thermo Fisher Scientific, Twist Bioscience, MorphoSys, Seagen (Pfizer subsidiary), Charles River Laboratories, Harbour BioMed, MacroGenics, Incyte |

Antibody discovery is the process of identifying and developing antibodies that can specifically bind to target antigens for therapeutic, diagnostic, or research purposes. It involves screening large libraries of antibodies using techniques such as phage display, hybridoma technology, or next-generation sequencing to isolate candidates with high specificity and affinity. The process includes optimizing antibody structure, stability, and efficacy while minimizing immunogenicity. Antibody discovery is critical in developing treatments for cancer, autoimmune diseases, infectious diseases, and other conditions. Advances in computational biology, high-throughput screening, and bioengineering have significantly accelerated the speed and precision of antibody identification and development.

Advancements in Antibody Formats: The Development of bispecific antibodies and antibody-drug conjugates offers targeted therapeutic options, improving treatment efficacy.

The integration of artificial intelligence (AI) is transforming the market by significantly accelerating and optimizing the identification and development of novel antibodies. AI algorithms can analyze vast datasets from high-throughput screening, genomic sequencing, and structural biology to predict antibody-antigen interactions with higher accuracy and speed, reducing the need for time-consuming laboratory experiments. Machine learning models help in designing antibodies with improved specificity, stability, and reduced immunogenicity, while also optimizing binding affinity and efficacy. AI-driven platforms can identify potential therapeutic candidates earlier in the drug development process, thereby lowering R&D costs and shortening timelines.

Expansion of the Biologics and Therapeutic Antibodies

The expansion of the biologics and therapeutic antibody market is a major driver for the growth of the antibody discovery market, as it creates increasing demand for novel, effective, and targeted therapies. With biologics becoming central to treating cancer, autoimmune disorders, and infectious diseases, pharmaceutical companies are actively seeking new antibodies with higher specificity, improved efficacy, and reduced immunogenicity. The rise of monoclonal antibodies, bispecific antibodies, and antibody-drug conjugates has intensified the need for advanced discovery platforms and technologies. This trend encourages investments in high-throughput screening, computational modeling, and engineering approaches to accelerate antibody identification. Additionally, growing regulatory approvals for therapeutic antibodies incentivize research and development, expanding the antibody discovery pipeline and fueling market growth globally.

Long Development Timelines & Regulatory Challenges

The key players operating in the market are facing issues due to regulatory challenges and long development timelines, which are estimated to restrict the growth of the market. Antibody discovery and validation can take several years, delaying commercialization and returns on investment. Stringent regulatory requirements for approval of therapeutic antibodies can slow down development and market entry.

Supportive Regulatory Framework

Supportive regulatory frameworks play a crucial role in driving the growth of the antibody discovery market by providing clear guidelines and streamlined pathways for the development and approval of novel antibody-based therapeutics. Regulatory agencies, such as the U.S. FDA and the EMA in Europe, offer accelerated review programs, orphan drug designations, and fast-track approvals for promising biologics, enabling companies to bring therapies to market more quickly. These frameworks reduce uncertainty and financial risk for pharmaceutical and biotechnology companies, encouraging increased investment in antibody research and development. Additionally, standardized safety and efficacy requirements ensure product quality and patient safety, boosting confidence among healthcare providers and investors. The availability of such supportive regulatory mechanisms accelerates innovation, facilitates commercialization, and expands the global antibody discovery pipeline.

The phage display segment is the dominant technology in the market due to its high efficiency, versatility, and proven track record in identifying specific and high-affinity antibodies. This technology enables the rapid screening of vast antibody libraries against target antigens, allowing researchers to isolate candidates with optimal binding properties. Phage display supports the development of monoclonal antibodies, bispecific antibodies, and antibody-drug conjugates, making it highly applicable across therapeutic areas such as oncology, autoimmune diseases, and infectious diseases. Additionally, its cost-effectiveness, scalability, and compatibility with advanced computational and high-throughput screening techniques further strengthen its dominance in the market.

The AI/ML & computational antibody design segment is estimated to be the fastest-growing in the antibody discovery market due to its ability to accelerate the identification and optimization of novel antibodies. Machine learning algorithms and computational models can predict antibody-antigen interactions, binding affinity, and stability with high accuracy, reducing the need for time-consuming laboratory experiments. This approach lowers R&D costs, shortens development timelines, and enables the design of highly specific and effective antibodies. Increasing adoption by pharmaceutical and biotechnology companies along with integration with high-throughput screening technologies, is driving rapid growth in this segment.

The oncology segment dominates the market due to the high prevalence of various cancers and the growing demand for targeted therapies. Monoclonal antibodies, bispecific antibodies, and antibody-drug conjugates are increasingly used to selectively target cancer cells, improving treatment efficacy while minimizing side effects. Advances in immuno-oncology and personalized medicine further fuel the development of novel antibodies for tumor-specific antigens. Additionally, strong R&D investments, government initiatives, and supportive regulatory frameworks in cancer therapeutics reinforce the dominance of the oncology segment in antibody discovery.

The neurology segment is anticipated to be the fastest-growing segment in the antibody discovery market due to the rising prevalence of neurological disorders, including Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis. Growing demand for targeted therapies that can cross the blood-brain barrier and modulate specific neural pathways is driving the development of novel antibodies. Advances in neurobiology, biomarker identification, and precision medicine enable the design of highly specific therapeutic antibodies. Additionally, increasing investments by pharmaceutical companies and supportive regulatory initiatives for neurological therapies are accelerating growth in this segment.

The monoclonal antibodies segment dominates the market due to their proven efficacy, specificity, and wide therapeutic applicability. mAbs are extensively used in oncology, autoimmune disorders, and infectious diseases, providing targeted treatment with minimal off-target effects. Advances in high-throughput screening, phage display, and antibody engineering have streamlined their discovery and optimization. Strong R&D investments, regulatory support, and increasing approvals of monoclonal antibody-based therapies further reinforce their dominance. Their versatility in diagnostics and therapeutics makes mAbs a central focus in antibody discovery.

The bispecific antibodies segment is estimated to be the fastest-growing segment in the antibody discovery market due to its ability to bind two different antigens or epitopes simultaneously, offering enhanced therapeutic potential over traditional monoclonal antibodies. These antibodies are particularly valuable in oncology and immunotherapy, as they can redirect immune cells to specifically target cancer cells. Advances in antibody engineering, along with increasing clinical trials and approvals, are accelerating their adoption. Rising investment from pharmaceutical companies and their promise to address complex diseases further drives the rapid growth of this segment.

The in-house discovery segment dominates the market because it allows pharmaceutical and biotechnology companies to maintain full control over research, intellectual property, and product pipelines. By conducting discovery internally, organizations can customize approaches to specific therapeutic areas, ensure better integration of R&D with clinical strategies, and accelerate innovation. In-house capabilities also reduce reliance on external partners, safeguard proprietary technologies, and support long-term competitiveness. Significant investments in advanced platforms and skilled researchers further strengthen the dominance of the in-house discovery segment.

The outsourced services segment is anticipated to be the fastest-growing in the antibody discovery market due to the increasing reliance of pharmaceutical and biotechnology companies on contract research organizations (CROs) and specialized service providers. Outsourcing enables access to advanced technologies, expertise, and global infrastructure without the high costs of maintaining in-house facilities. It also accelerates discovery timelines and supports scalability for complex projects. Rising collaborations, cost-efficiency benefits, and the growing demand for specialized antibody engineering and screening services are driving the rapid expansion of this segment.

The pharmaceutical & biotechnology companies segment dominates the market due to their extensive R&D investments, advanced infrastructure, and strong focus on developing innovative biologics. These companies are at the forefront of discovering, engineering, and commercializing therapeutic antibodies across oncology, neurology, and autoimmune diseases. Their ability to leverage cutting-edge technologies, such as AI-driven platforms and high-throughput screening, accelerates the drug discovery process. Additionally, strategic collaborations with CROs, academic institutes, and healthcare providers further enhance their capabilities. Strong financial resources and global market reach reinforce their leadership in driving antibody discovery and development.

The contract research organizations (CROs) segment is the fastest-growing in the antibody discovery market due to the increasing trend of outsourcing R&D activities by pharmaceutical and biotechnology companies. CROs offer specialized expertise, advanced technologies, and cost-efficient solutions that accelerate antibody discovery and development timelines. They provide end-to-end services, including target validation, antibody engineering, preclinical studies, and regulatory support, making them valuable partners in reducing operational burden. Rising demand for flexibility, scalability, and global reach further drives reliance on CROs. Additionally, the growth of complex antibody formats, such as bispecifics and antibody-drug conjugates, is boosting the demand for CRO-led discovery services.

The North America region dominates the market share by 40% due to its strong biotechnology and pharmaceutical industry presence, supported by significant R&D investments and advanced infrastructure. The region benefits from a well-established regulatory framework, encouraging faster approvals of novel antibody-based therapies. High prevalence of chronic and autoimmune diseases, coupled with rising demand for targeted biologics, further fuels market growth. Additionally, the presence of leading market players, strong academic research networks, and extensive collaborations drives continuous innovation, reinforcing North America’s leadership in antibody discovery.

The U.S. leads the antibody discovery market, driven by its robust biotechnology ecosystem, advanced R&D infrastructure, and substantial funding from both government and private investors. High prevalence of cancer, autoimmune disorders, and infectious diseases creates a strong demand for therapeutic antibodies. The U.S. FDA’s supportive regulatory pathways, such as fast-track and breakthrough therapy designations, further accelerate development. Additionally, the presence of global pharmaceutical leaders, extensive clinical trial activities, and strong academic-industry collaborations solidifies the U.S. as the central hub for antibody discovery innovations.

Canada is emerging as a key player in the antibody discovery market, supported by a strong academic research base and government initiatives promoting biotechnology innovation. Increasing investments in healthcare research, particularly in biologics and immunotherapies, are driving growth. Collaborations between Canadian universities, research institutes, and global pharmaceutical companies enhance discovery capabilities. Favorable policies supporting clinical trials and biosimilar development also contribute to market expansion. Rising demand for targeted therapies in oncology and neurology further strengthens Canada’s position as an important market for antibody discovery.

The Asia-Pacific region is the fastest-growing in the market due to rapid advancements in biotechnology, increasing government support for R&D, and rising healthcare investments. Countries like China, India, and Japan are witnessing strong demand for biologics and targeted therapies, driven by the growing burden of cancer, autoimmune, and infectious diseases. Expanding clinical trial activities, cost-efficient manufacturing, and the rise of domestic biotech firms further accelerate market growth. Additionally, international collaborations and technology transfer agreements are strengthening regional capabilities, positioning Asia-Pacific as a key hub for antibody discovery innovation and development.

Steps: Target identification, antibody generation (via phage display, hybridoma, or computational design), lead optimization, and preclinical validation.

Organizations: Pharmaceutical and biotechnology companies (e.g., Roche, Amgen, Regeneron), academic research institutes (e.g., Harvard Medical School, University of Cambridge), and contract research organizations (CROs) specializing in antibody engineering.

Steps: Phase I (safety), Phase II (efficacy), Phase III (large-scale validation), and regulatory review.

Organizations: Pharmaceutical companies, CROs (e.g., WuXi Biologics, Charles River Laboratories), regulatory bodies like the U.S. FDA, EMA (Europe), and PMDA (Japan) that provide guidelines and approvals.

Steps: Manufacturing and distribution of approved antibodies, patient education, therapy administration, and post-market surveillance.

Organizations: Hospitals and clinics, specialty pharmacies, patient advocacy groups, and healthcare providers ensuring therapy access and monitoring. Companies like Pfizer, Novartis, and Johnson & Johnson also provide patient-assistance programs and post-treatment support services.

In 2025, Jingsong Wang, MD, PhD, CEO of Nona Biosciences, stated that in the first half of 2025, Nona Biosciences, a healthcare company, launched Hu-mAtrlx, an AI-assisted drug discovery engine that integrates with their Harbour Mice platform, aiming to accelerate antibody discovery in therapeutic areas like neurodegenerative and metabolic diseases. The company also deepened global partnerships with entities like Invetx, UAB, Atossa Therapeutics, and Visterra.

By Technology

By Type of Antibody

By Application

By Service Type

By End User

By Region

February 2026

February 2026

February 2026

February 2026