January 2026

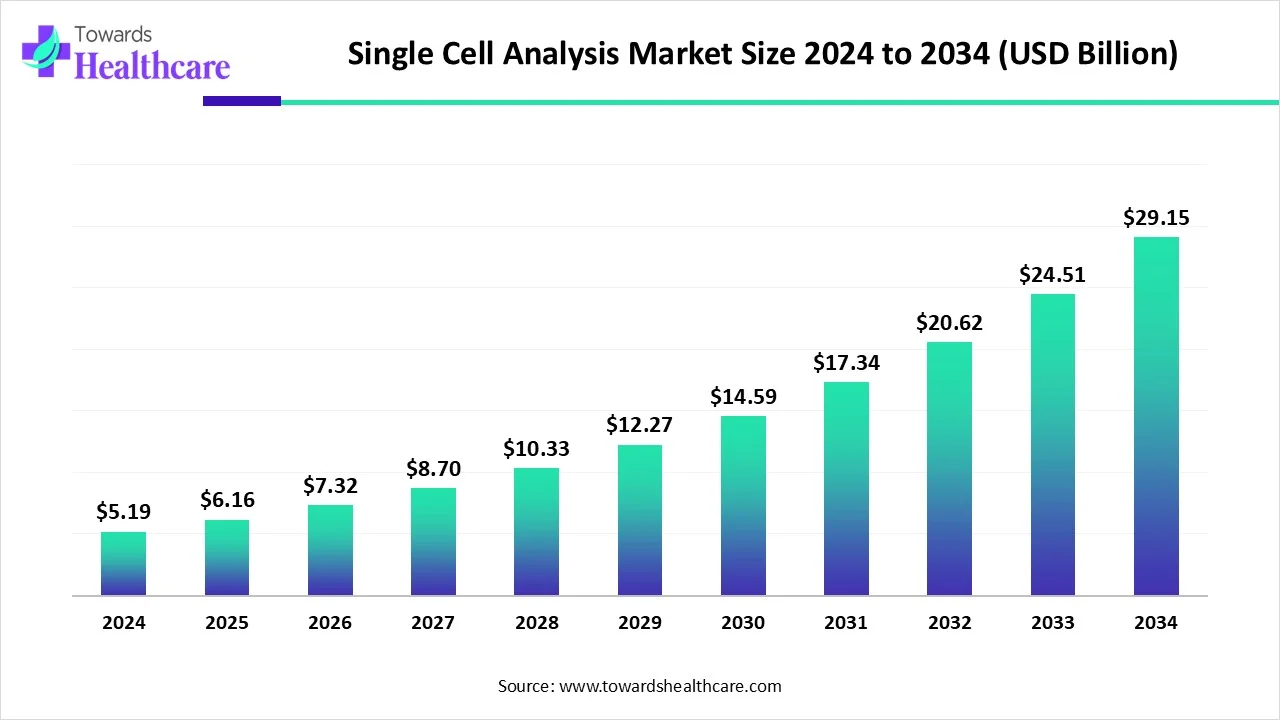

The global single cell analysis market size is calculated at USD 5.19 in 2024, grew to USD 6.16 billion in 2025, and is projected to reach around USD 29.15 billion by 2034. The market is expanding at a CAGR of 18.74% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 6.16 Billion |

| Projected Market Size in 2034 | USD 29.15 Billion |

| CAGR (2025 - 2034) | 18.74% |

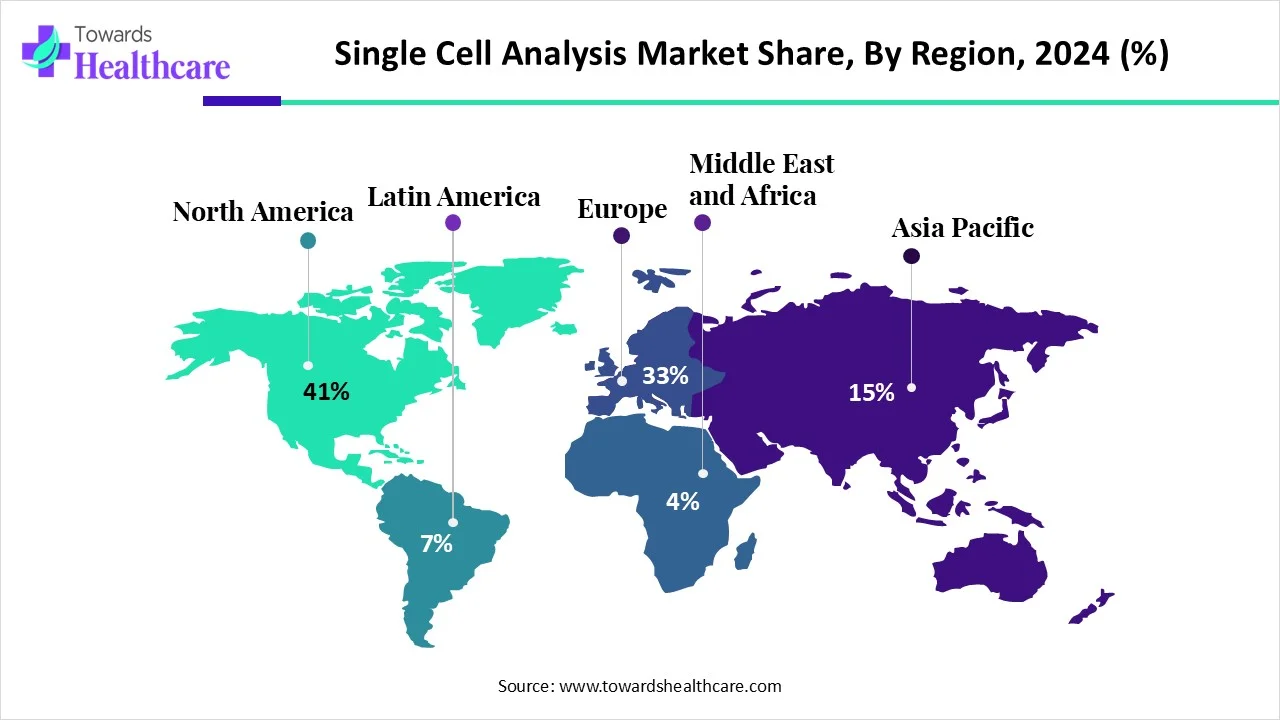

| Leading Region | North America share by 41% |

| Market Segmentation | By Product, By Application, By Workflow, By End-use, By Region |

| Top Key Players | 10x Genomics, BD, Bio-Rad Laboratories, Illumina, Qiagen, Thermo Fisher Scientific, Mission Bio, Inc., RareCyte, Inc., TAKARA BIO INC., Ancilia Biosciences, CYTENA GmbH, BGI, PacBio, Merck KGaA, Novogene Co, Oxford Nanopore Technologies, Roche, Acuitas Therapeutics |

Single-cell analysis is an influential technique that permits researchers to scrutinize a single cell in a culture, exposing variations in phenotypic and physiological circumstances. The single cell analysis market is fueled by the rising incidences of cancer and chronic diseases, which provide more accurate diagnoses and targeted therapies. Also, boosting fascination in stem cell research and regenerative medicine is a contributing factor to the market growth. Emerging advances in single-cell analysis products, including sequencing and microfluidics, have a significant role in the market.

AI algorithms are playing a vital role in the market, which is impacted by escalating data processing, boosting interpretation, and allowing personalized medicine. Moreover, AI-aided tools give automation in complex analyses, extracting significant patterns, and increasing reproducibility. This results in rapid discovery and broad insights into cellular biology and disease mechanisms. AI is also being utilized to examine dimensional transcriptomic data, which permits data about the genes' location and their expression patterns, providing for a robust understanding of tissue architecture and cellular interactivity.

Growing Instances of Cancer and Other Chronic Diseases

Across the globe, increasing cancer instances and autoimmune disorders are driving the single-cell analysis market growth, indicating perceptions of cellular mechanisms of these conditions, resulting in more accurate diagnosis and treatment. In cancer cases, single-cell analysis allows researchers to study in detail of individual cells within a tumor, unveiling their specific genetic, epigenetic, and transcriptomic profiles.

Rising Expenses of Instruments and Reagents

Presently, various emerging advanced technologies in instruments like flow cytometers, microfluidic devices, and high-content screening systems are associated with high costs. Along with this, the expenses of reagents and consumables, and skilled personnel, are escalating the expenditure on processes. Hence, rising costs are a major hurdle to the growth of the market.

Development in Technological Advances and Cancer Research

In the single cell analysis market, accelerating opportunities are rising developments in cancer research for recognizing cancer growth, detecting drug targets, and anticipating treatment results. Along with this, growing technological advancements such as single-cell sequencing permit for complete examination of cellular heterogeneity and transcriptional inconsistency, covering the path for novel discoveries and applications.

By product, the consumables segment held the largest share in 2024. The consumables are a vital segment in the single cell analysis market, which includes reagents, assay kits, beads, and microplates. These consumables are widely used in numerous processes like cell processing, isolation, and analysis. The reagents comprising chemicals and solutions are used in cell labelling, lysis, and DNA/RNA amplification. In immunoassays and cell-based assays, assay kits are highly utilized.

By product, the instruments segment is predicted to grow at the fastest CAGR during the projected timeframe. The single cell analysis market includes various instruments for the study of each cell. From these instruments, flow cytometers are employed in single-cell analysis in solution, which permits faster multidimensional research. As well as, the utilization of microscopes having high-content screening (HCS) systems is harnessed for visualizing and analyzing single cells, oftentimes in merged with other techniques.

By application, the cancer segment dominated the market in 2024. In cancer, single-cell analysis is used in the identification of various subpopulations of cells within a tumor, involving those having specific gene mutations, epigenetic alterations, and gene expression patterns. Also, in rising cancer cases, by studying each cell, researchers can detect and distinguish cancer stem cells (CSCs), which leads to tumor generation, growth, and metastasis.

By application, the immunology segment is seen to grow at the fastest CAGR during the forecast period. In immunology, single-cell analysis plays a major role in the analysis of specific features of individual immune cells, providing insights into the immune system’s complexity and variety. Also, it assists in the detection of possible targets for immunotherapy, like particular immune cell populations that are involved in tumor suppression or disease-causing processes, impacting the growth of the single cell analysis market.

By workflow, the data analysis segment led the market in 2024. This segment acts as a driver in the expansion of the market, which provides data on gene expression, protein levels, and metabolic activity, which demands advanced computational tools and algorithms. Although, similar need for advancements in bioinformatics and computational approaches to manage huge and complex datasets.

By workflow, the downstream analysis segment is estimated to witness the fastest growth in the upcoming years. The downstream analysis noted the methods and tools utilized in the interpretation and isolation of significances from data prompted by single-cell sequencing and other technologies. It is a major step that generates huge amounts of highly resolved data, demanding advanced bioinformatics solutions for examination and interpretation, which is driving the growth of the single-cell analysis market.

By end-use, the academic & research laboratories segment held the largest share in 2024 and is expected to grow significantly in the projected period. In academic and research laboratories, fundamental research is conducted along with the exploration of the prospective of single-cell analysis across many sectors. The segment is driven by rising activities in research institutions to gain knowledge regarding cellular biology and develop new targeted drugs.

North America led the market share by 41% in 2024. North America in the single cell analysis market is fueled by robust pharmaceutical and biotechnology R&D. Besides this, growing developments in healthcare infrastructure, including boosting awareness about healthcare and spending, are propelling the growth of the market. This accelerating advancement in healthcare infrastructure, machine learning tools are assisting expansion of the market.

The U.S. is experiencing significant growth due to various dominant factors like a robust existence of leading players of the market, focused on pharmaceutical and biotechnology R&D, and furthermore, developments in the healthcare framework. Also, the growth is impelled by rising technological advances and revolutions in single-cell analysis.

For instance,

The market is widely impacted by the rapidly rising field, with research targeted at gaining knowledge about cellular heterogeneity and establishing novel diagnostic and therapeutic methods due to the increasing prevalence of cancer and else chronic diseases as well as boosting technological advancements such as NGS (Next Generation Sequencing), which supports a widespread analysis of cells simultaneously.

Asia Pacific is expected to be the fastest-growing region in the upcoming years. In the single cell analysis market, Asia Pacific is driven by boosting technological advancements like single-cell sequencing, transcriptomics, and other analysis techniques. Also, escalating investments in cell-based research and drug development are demanding for single-cell analysis tools.

For instance,

In China, accelerating single-cell RNA sequencing is a crucial driver in the market, as well as a rising need in multi-omics and dimensional transcriptomics, which are majorly influencing the market growth. Emerging single-cell analysis in biotechnology is assisting in the examination of different details of biology, with understanding disease mechanisms, establishing novel therapies, and generating cell atlases.

The market is highly influenced by the growing technological advancements in single-cell sequencing and Next-Generation sequencing, which enlighten cellular heterogeneity and analysis of a huge number of cells simultaneously, respectively. Further, the Japanese government and private sectors are widely encouraging investment in life science research, which needs single-cell analysis tools.

For instance,

Europe is anticipated to grow significantly during the forecast period. In Europe, developments in genomics, such as single-cell analysis, provide significant details into molecular mechanisms of diseases, and also highlight the genome of individual cells separately, along with permitting identification of differences in cells, are driving the growth of the market. As single-cell analysis improves the study of disease mechanisms, it supports in enhancement of personalized medicine.

In Germany, the market is facing substantial growth propelled by developments in personalized medicine, accelerated research and development investments, and, moreover, growing immunotherapy is contributing significantly to market growth.

In the UK, critically influential factors are raised investments in pharmaceutical and biotechnology research are aiding the growth of the single cell analysis market. Also, the growing focus on stem cell research and the purpose of single-cell sequencing to examine cellular functions.

Latin America is considered to be a significantly growing area, due to the growing demand for personalized medicines and the rising prevalence of chronic disorders. The increasing adoption of advanced technologies and the burgeoning synthetic biology and molecular biology sectors contribute to market growth. Government and private organizations organize seminars, conferences, and workshops to advance knowledge and train professionals with innovative techniques.

Companies like RareCyte, Parse Biosciences, and LevitasBio provide single-cell analysis technologies. The oriGen project was launched to sequence the genomes of 100,000 Mexicans, promoting precision medicine, strengthening prevention, and improving the quality of life of individuals.

The Brazilian National Institute of Cancer (INCA) and Wellcome Connecting Science (WCS) announced the first Single Cell LATAM Symposium: Connecting Communities and Advancing Research in August 2024. The symposium focused on bringing together local researchers interested in single-cell technologies.

By Product

By Application

By Workflow

By End-use

By Region

January 2026

January 2026

January 2026

January 2026