February 2026

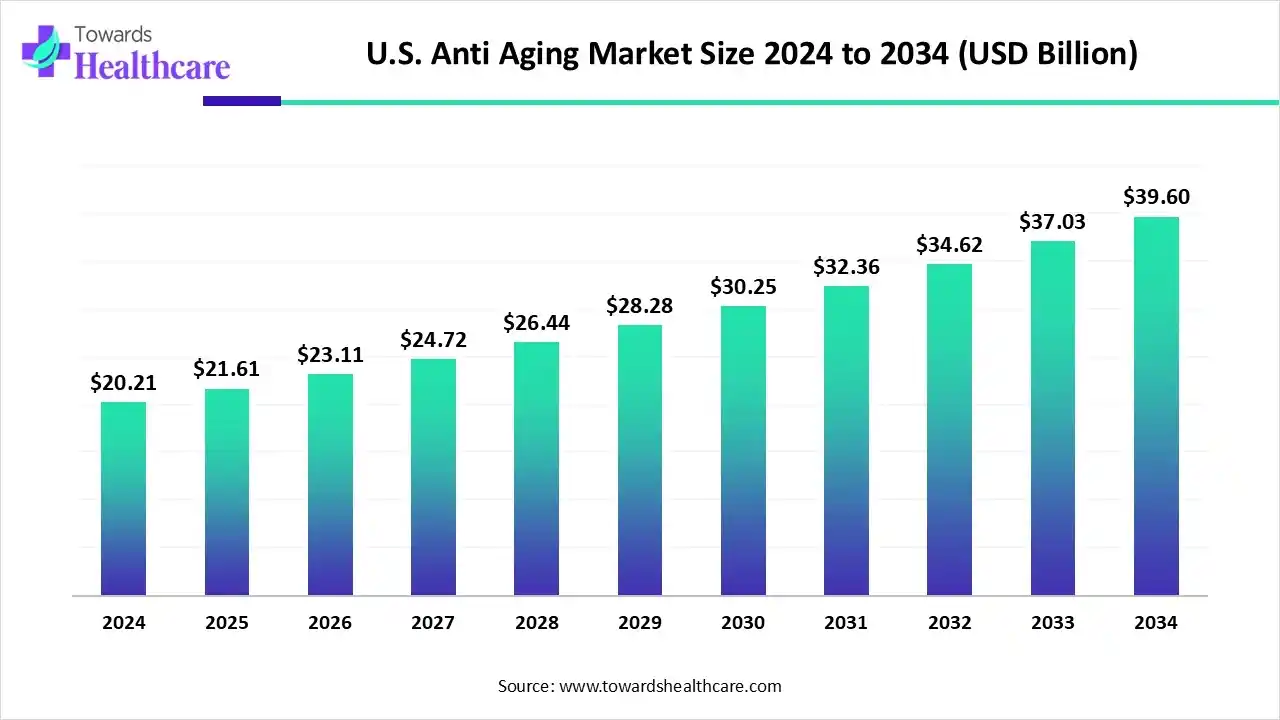

The U.S. anti-aging market size is calculated at US$ 20.21 billion in 2024, grew to US$ 21.61 billion in 2025, and is projected to reach around US$ 39.6 billion by 2034. The market is expanding at a CAGR of 6.95% between 2025 and 2034.

The growing aging population and awareness are increasing the use of anti-aging products. This, in turn, is driving their innovations to provide long-term action with fewer or no side effects. At the same time, AI is also being used to enhance drug discovery and development. Moreover, the growing investments and collaboration are enhancing their development and innovations. The companies are further contributing by launching new anti-aging products, and all these advancements are promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 21.61 Billion |

| Projected Market Size in 2034 | USD 39.6 Billion |

| CAGR (2025 - 2034) | 6.95% |

| Market Segmentation | By Product/Treatment Type, By Channel/Distribution, By Age/Demographic, By Technology/Science Platform, By End User/Buyer Type |

| Top Key Players | Allergan Aesthetics, Galderma, Merz Aesthetics, Revance Therapeutics, InMode, Cynosure, Cutera, Sciton/Lumenis/Alma Lasers, Nestlé Health Science/NBTY/major nutraceutical suppliers, Colgate-Palmolive, The Ordinary/Deciem, Dr. Fredric Brand/physician-led cosmeceutical brands, Large DTC/e-commerce players, Large dermatology clinic groups/medical aesthetics DSOs, Specialty ingredient suppliers |

The U.S. anti-aging market is driven by growing consumer skincare awareness, increasing innovations in beauty and medicines, and increasing elderly populations. The U.S. anti-aging covers consumer and clinical products, devices, and services aimed at preventing, slowing, or reversing visible and biological signs of aging.

It spans topical skincare (creams, serums, moisturizers with retinoids, peptides, vitamin C, AHAs, niacinamide), cosmeceuticals, ingestible nutraceuticals (collagen, omega-3s, anti-oxidant supplements), prescription dermatology (topical Rx, tretinoin, peptide therapies), medical aesthetic injectables (neuromodulators and dermal fillers), energy-based aesthetic devices (lasers, RF, HIFU), and clinical regenerative approaches (PRP, micro-needling with growth factors, early cell/peptide therapies). The market is a hybrid of retail (mass & prestige), medical-aesthetic channels, and professional/clinic revenue streams.

The use of AI is increasing to discover drug candidates to develop effective anti-aging products. It is also being used to develop drugs that show targeted action depending on the pathways or to target multiple age-related biological pathways at once. At the same time, along with the use of machine learning, it is being used to analyze the datasets, optimize the formulation, target specific proteins, and develop models.

For instance,

Growing innovations: To deal with the growing demand for anti-aging solutions, there is a growth in their research and development. This, in turn, is enhancing the development of novel products and therapies. These developments are further supported by the investments from various sources.

For instance,

| Company | Products | Action |

| SkinCeuticals | Advanced RGN-6 | Reverse six signs of aging and skin tone damage, including wrinkles, redness, firmness, and stubborn discoloration |

| L’Oréal | Lancôme's Absolue Longevity Soft Cream | Promotes cellular energy and extends the skin's youth |

| Leading Edge Health | GenuinePurity Liposomal NMN | Anti-aging solution promoting drug absorption, boosting cellular health, and longevity. |

By product/treatment type, the topical skincare segment led the market with approximately 48% share in 2024, due to its wide range of availability. At the same time, they were easy to use and affordable. Moreover, the growing demand for non-invasive alternatives has increased their use.

By product/treatment type, the injectables segment is expected to show the highest growth during the upcoming years. Due to a growing shift in the aesthetic or beauty standards, they are being used as they are effective and provide long-term action. Additionally, the growing geriatric population is also increasing its use.

By channel/distribution type, the retail segment held the dominating share of approximately 54% in the market in 2024, as it provides a wide range of products. This, in turn, helps the consumers to browse multiple options along with their ingredients and applications. Therefore, this increased accessibility enhanced the market growth.

By channel/distribution type, the medical aesthetics clinics/dermatology practices segment is expected to show the fastest growth rate during the predicted time. The presence of experts is increasing the trust among the clients, which is increasing their reliance. Additionally, minimally invasive options are also attracting the clients.

By age/demographic type, the women 35–64 segment dominated the market with approximately 60% share in 2024, driven by their visible aging signs. This, in turn, increased the use of a number of anti-aging solutions that maintain their appearance. Moreover, the growth in aesthetic awareness also increased their use.

By age/demographic type, the younger prevention (25–34) segment is expected to show the highest growth during the upcoming years. With the growing skin damage due to environmental factors, the demand for antiaging products is increasing. Moreover, the growing use of online platforms is also increasing the beauty standards, which is promoting their use

By technology/science platform type, the actives & formulation chemistry segment held the largest share of approximately 50% in the market in 2024, due to their targeted action, which helped in minimizing the aging signs. Their enhanced efficacy and stability also increased their use. Additionally, the presence of products like serums, masks, etc, also attracted the consumers.

By technology/science platform type, the biotech-derived injectables & biostimulators segment is expected to show the fastest growth rate during the predicted time. They show a longer duration of action, increasing their acceptance rate. Moreover, their safety and non-invasive technique are also attracting the population.

By end user/buyer type, the individual consumers (retail purchases) segment led the global market with approximately 54% share in 2024, driven by growing beauty awareness. The availability of a wide range of products also increased their purchase, enhancing their at-home use. Their affordability has also increased their adoption rate.

By end user/buyer type, the dermatology & medical aesthetic clinics segment is expected to show the highest growth during the upcoming years. The growing demand for minimally invasive treatments and for faster results is increasing, which is enhancing the use of their clinics. The presence of experts and advanced technologies is also enhancing client satisfaction.

The U.S. anti-aging market is expected to show significant growth due to the growth in the aging population. This, in turn, increased the use of various anti-aging products and therapies. At the same time, the growing awareness among the population is also increasing their demand for preventive care or cosmetics. Moreover, the healthcare investments are also enhancing their adoption rates as well as accelerating their innovations. Thus, this is promoting the market growth.

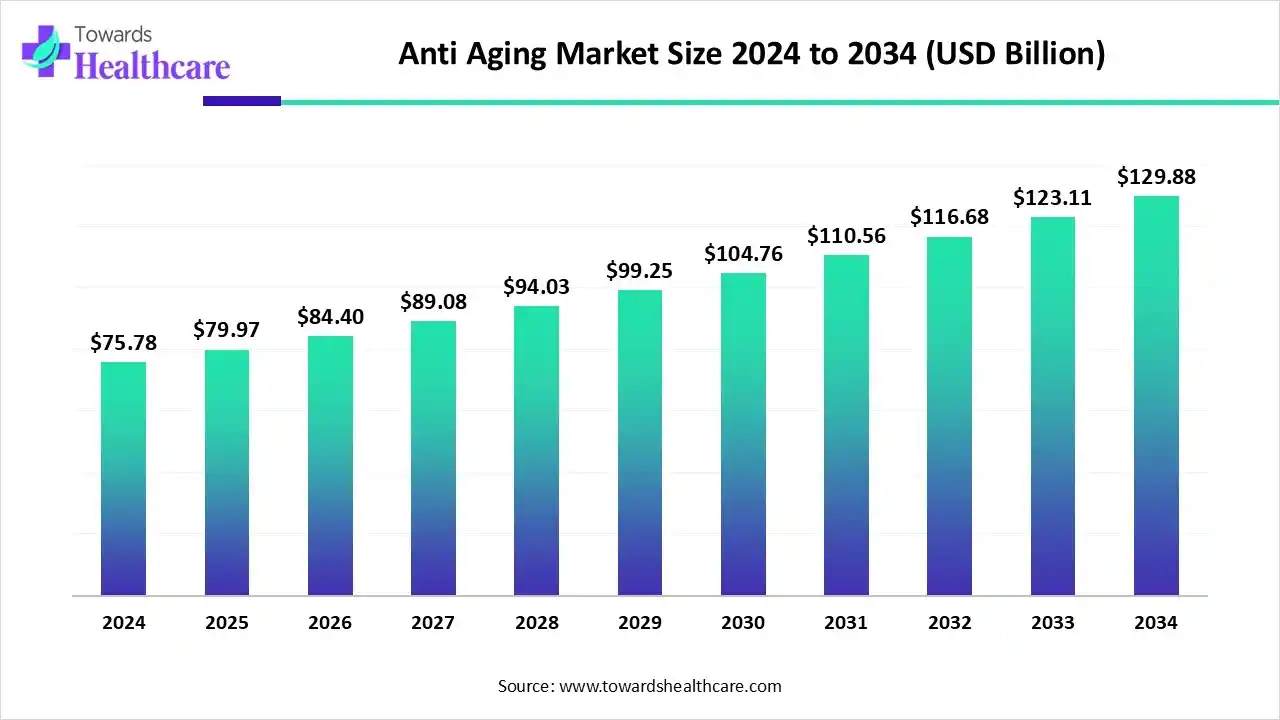

The global anti-aging market is valued at about US$ 75.78 billion in 2024 and is expected to grow to US$ 79.97 billion in 2025. By 2034, it’s projected to reach nearly US$ 129.88 billion, reflecting a steady annual growth rate of 5.54%.

The R&D of anti-aging focuses on the development of products, therapies, and technologies targeting molecular or cellular mechanisms to reverse the aging or delay it.

Key Players: L’Oréal Group, Johnson & Johnson, Unilever, The Estée Lauder Companies, Procter & Gamble.

Developing an effective formulation in the dosage form, such as serum, cream, or gel, is involved in the formulation and final dosage preparation of the anti-aging products.

Key Players: L’Oréal Group, Johnson & Johnson, Unilever, The Estée Lauder Companies, Procter & Gamble.

The patient support and services of anti-aging solutions involve lifestyle guidance on nutrition and exercise, personalized consultations, aftercare for treatments, continuous monitoring, and educational resources.

Key Players: L’Oréal Group, Johnson & Johnson, Unilever, The Estée Lauder Companies, Procter & Gamble, Shiseido Company Ltd.

By Product/Treatment Type

By Channel/Distribution

By Age/Demographic

By Technology/Science Platform

By End User/Buyer Type

February 2026

February 2026

February 2026

February 2026