February 2026

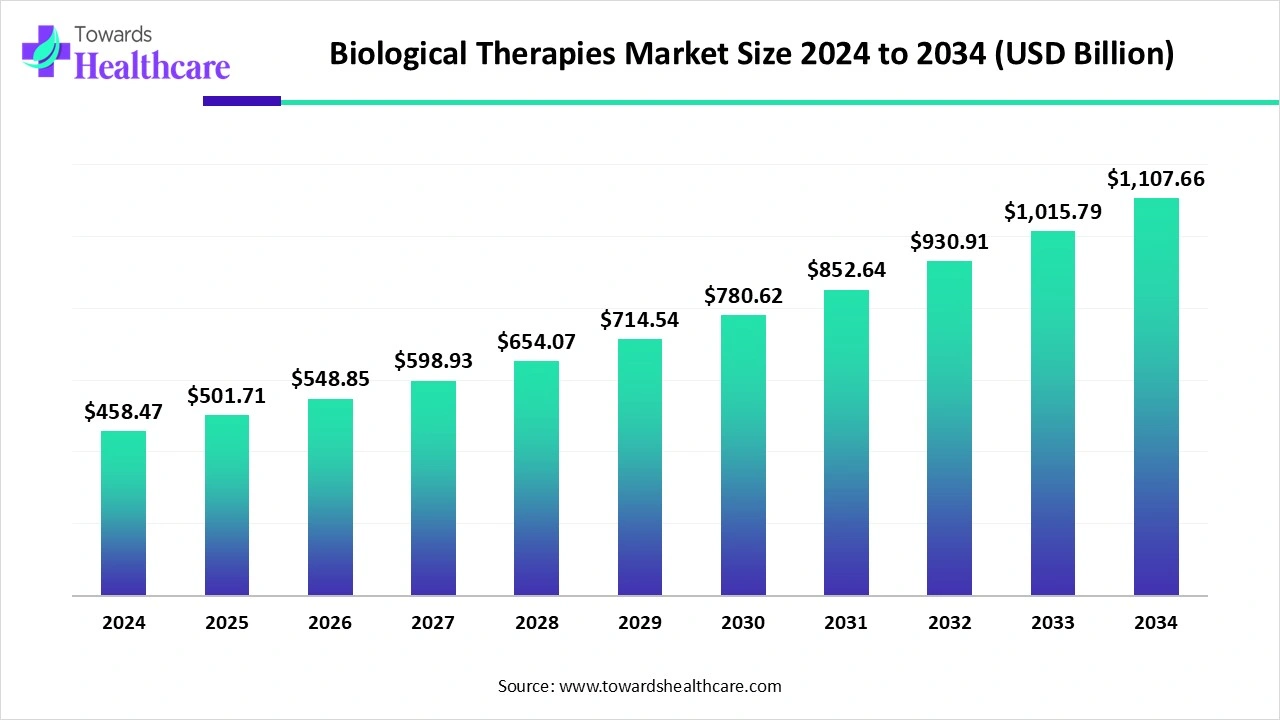

The global biological therapies market size is calculated at US$ 458.47 billion in 2024, grew to US$ 501.71 billion in 2025, and is projected to reach around US$ 1107.66 billion by 2034. The market is expanding at a CAGR of 9.35% between 2025 and 2034.

A multitude of variables are contributing to the substantial growth of the biological therapies market. The need for more specialised and effective treatment options is being driven by the increasing prevalence of chronic diseases, such as diabetes, cancer, and autoimmune disorders. Biotechnology and genetic research advancements are also enhancing the production of biologic medications and expanding patient access to them. Biologic treatment market prospects are expanding as companies focus on expanding their product lines and entering new markets.

| Table | Scope |

| Market Size in 2025 | USD 501.71 Billion |

| Projected Market Size in 2034 | USD 1107.66 Billion |

| CAGR (2025 - 2034) | 9.35% |

| Leading Region | North America |

| Market Segmentation | By Type, By End-Users, By Region |

| Top Key Players | F. Hoffmann-La Roche Ltd. (Switzerland), Mylan N.V. (U.S.), Teva Pharmaceutical Industries Ltd.(Israel), Sanofi (France), Pfizer Inc. (U.S.), GSK plc (U.K.), Novartis AG (Switzerland), Bayer AG (Germany), Lilly (U.S.), Merck & Co., Inc. (U.S.), Sun Pharmaceutical Industries Ltd. (India), Aurobindo Pharma (India), Lupin (India), Endo Pharmaceuticals plc (Ireland), Zydus Group (India), Bausch Health Companies Inc. (Canada) |

The use of materials derived from living things to treat illness is known as biological therapy. These compounds can be produced in a lab or they can be found naturally in the body. Treatment for many chronic and life-threatening illnesses, including diabetes, autoimmune disorders, and cancer, has changed as a result of biologic medications. When compared to traditional medications, these treatments can provide notable advantages in terms of convenience, safety, and efficacy.

Rising investment in gene and cell therapies: Gene and cell therapies are gaining attention due to their therapeutic potential in treating cancer and rare diseases. Due to this, key players and government organizations are investing in developing gene and cell therapies to provide personalized medicine.

For instance,

By speeding up drug discovery and increasing the success rate of novel treatments, artificial intelligence (AI) is transforming biologics research and development. AI systems are excellent at sifting through enormous information and finding connections and patterns that human researchers might miss. This skill is crucial for drug research, since AI can evaluate protein structures, genetic data, and clinical trial outcomes to find interesting therapeutic targets, create new compounds, and forecast their possible safety and efficacy. AI also has the potential to greatly speed up the medication development process. Predicting preclinical study results, identifying the most prospective candidates for clinical trials, and optimising experimental design are all possible with machine learning algorithms.

Personalized medicine is Driving the Biological Therapies Market

In the field of advanced healthcare, biologics are crucial because they enable personalised care and precision medicine. Such advanced pharmaceuticals enable the incorporation of genetic and molecular information into advanced health systems and the customisation of drugs for specific patient profiles. Because biologics are so particular and can target certain biochemical pathways, they offer enormous potential for highly individualised and effective therapies.

High Cost of Biologics

Numerous biologic treatments range in price from $10,000 to $40,000, with some reaching $250,000 annually. A client would be required to pay $5,000 year, or 20% of the $25,000 cost of the therapy. Purchasing a biologic might cost more than $500,000 annually. A biologic's complexity, development process, mode of administration, competition, and market demand all contribute to its high cost.

What is the Future of the Biological Therapies Market?

With continuous research and development activities aimed at improving current medications and examining novel treatment modalities, biological therapies have a bright future. Precision medicine and customised treatments are becoming more feasible because to emerging technologies like genome editing and RNA-based therapies. Interest in microbiome-based treatments is also being fueled by our expanding knowledge of the human microbiome and its function in both health and illness.

By product, the monoclonal antibodies segment held the major share of the biological therapies market in 2024. Monoclonal antibodies (mAbs) are synthetic proteins that replicate the body's defences and are a significant advancement in contemporary medicine. They are now the accepted treatment for a number of illnesses in affluent nations because to their shown effectiveness in a variety of therapeutic domains, including cancer, immunological disorders, and infectious diseases.

By product, the vaccines segment is estimated to witness the highest growth during the upcoming period. In the great majority of the globe, vaccines have prevented the spread of infectious illnesses and slowed the onset of some of the deadliest diseases ever observed. They are the most effective public health intervention ever. The technique of developing vaccines has changed along with the intricate biological processes that underlie illness.

By route of administration, the intravenous segment led the market in 2024 and is estimated to grow at the highest rate during 2025-2034. In the case of biological medicines, it is the most often used administration method. Compared to other methods of administration, intravenous medication administration has a number of advantages. With the least amount of delay, intravenous (and intra-arterial) medication delivery offers the most comprehensive drug availability. Intravenous administration of compounds that are poorly absorbed by the gastrointestinal system may be beneficial. When given intramuscularly or subcutaneously, compounds that cause unbearable discomfort may not be problematic when provided intravenously.

By end-users, the hospitals segment was dominant in the market in 2024. As essential facilities for medical treatment and services, hospitals play a critical role in the provision of healthcare. Hospitals treat patients holistically, concentrating on treating a range of illnesses and meeting the fundamental requirements of those in need. They vigorously fight illness, actively engage in groundbreaking research, and encourage the development of cutting-edge medical technologies all of which greatly contribute to the ongoing improvement of global health.

By end-users, the specialty centers segment is anticipated to be the fastest-growing segment during the forecast period. A specialised clinic concentrates on a particular field of medicine. A specialised clinic's providers would have received specialised training in medical specialities. Although they can operate independently, specialised clinics are frequently connected to hospital groups or healthcare systems.

By distribution channel, the hospital pharmacy segment held the dominant share of the biological therapies market in 2024. When it comes to the acceptance and use of biological treatments, hospital pharmacists are essential. Pharmacists are in charge of assessing their cost-efficiency, safety, and effectiveness while informing patients and medical professionals of their advantages. Hospital pharmacy staff must create plans for a smooth transition as biological treatments gain popularity, making sure that proper prescription, dispensing, and monitoring procedures are followed.

By distribution channel, the online pharmacy segment is estimated to witness the fastest growth during the studied period. As digital health technologies, artificial intelligence, and telemedicine improve to assist prescription administration, remote patient care, and personalised drug delivery, internet pharmacies will play an increasingly important role in providing access to biological medicines in the future. Online platforms are crucial in helping people throughout the world obtain therapy and get beyond financial obstacles.

North America dominated the market in 2024. The high incidence of chronic illnesses, the existence of multiple top biopharmaceutical businesses, advantageous reimbursement practices, and large R&D expenditures are some of the causes of this. Growing investments in the development of targeted pharmaceuticals and the rising percentage of prescriptions for biologics are some of the reasons driving the market's expansion. The approval of many innovative biologic medications is also anticipated to fuel market expansion.

A number of regulatory bodies oversee the items that are regulated by the Centre for Biologics Evaluation and Research (CBER). Nearly half of prescription medication spending in the U.S. as of 2023 went towards biologics, and this percentage is still rising. There are 226 biologics on the market in the U.S. at the moment. These 226 biologics are now open for competition from biosimilars as 62 of them no longer have patent protection. Of the 62 biologics without patent protection, only 12 (19%) have a commercially available biosimilar.

Through significant funding partners like the Canadian Institutes for Health Research, the Government of Canada has made investments in research initiatives across the country. Over $2.5 billion has been invested by the Canadian government in 43 initiatives related to the biomanufacturing, vaccine, and medicines ecosystem, enhancing the country's capacity to respond to pandemics and foster innovation in life sciences.

Asia Pacific is estimated to host the fastest-growing biological therapies market during the forecast period. Rising incidence of chronic diseases, greater biopharma investments, legislative reforms that support local biologics innovation, and a thriving pharmaceutical sector in China and India are all contributing factors to the region's market growth.

Biological therapy research and development includes discovery and target identification, which identifies disease targets; preclinical research, which includes laboratory and animal studies for safety and efficacy; human clinical trials (phases 1, 2, and 3) for safety, efficacy, and dosage; regulatory review by organisations such as the FDA; and post-market monitoring for long-term safety.

Top Companies Include: Pfizer, Eli Lilly, Johnson & Johnson, and Merck, as well as specialized biotech firms such as Amgen, Gilead Sciences, Regeneron, and Moderna.

Before being approved by regulatory bodies such as the FDA or CDSCO, biological therapies must pass a stringent preclinical testing, clinical trial, and regulatory review process to prove their safety and effectiveness. In order to prove that the product, manufacturing method, and facilities satisfy strict quality standards for public use, this entails submitting an Investigational New Drug (IND) application, carrying out comprehensive human trials under regulatory supervision, and finally filing a Biologics Licence Application (BLA) or equivalent.

Top Companies Include: Pfizer, Eli Lilly, Johnson & Johnson, and Merck, as well as specialized biotech firms such as Amgen, Gilead Sciences, Regeneron, and Moderna.

In order to improve health outcomes and quality of life, patient support services are essential for biological therapies. They offer financial aid, assistance with insurance and administration, education on how to manage side effects, and support for medication adherence.

Top Companies Include: Fresenius Kabi, Grifols, and Pfizer, along with specialized support service providers like ProPharma Group and Syneos Health

In June 2025, recently, the Pondicherry Institute of Medical Sciences (PIMS) unveiled a new biological therapy for asthma sufferers as well as a state-of-the-art medical intensive care unit. Patients with severe eosinophilic asthma, particularly those who have long struggled with uncontrolled symptoms despite standard treatments, can have their lives significantly improved by the innovative modality with Benralizumab, according to Antonious Maria Selvam, Head of the Department of Respiratory Medicine at PIMS.

By Type

By Route of Administration

By End-Users

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026