February 2026

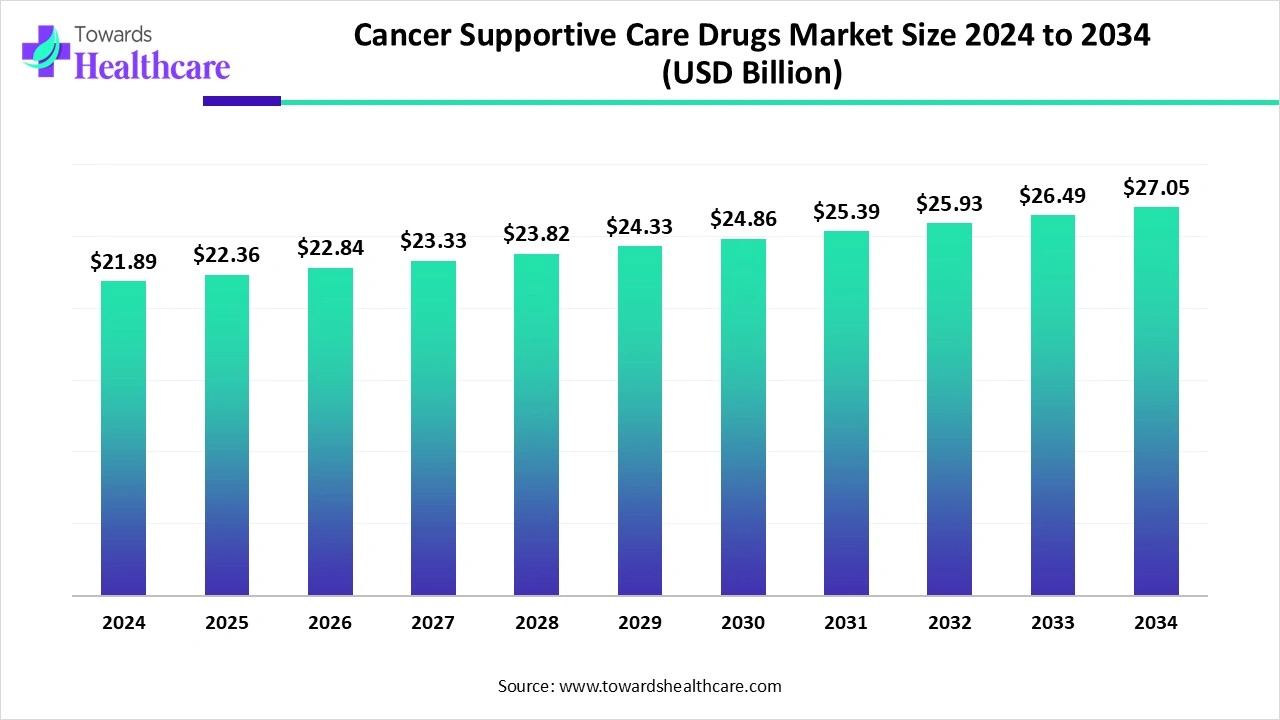

The global cancer supportive care drugs market size is calculated at US$ 21.89 billion in 2024, grew to US$ 22.36 billion in 2025, and is projected to reach around US$ 27.05 billion by 2034. The market is expanding at a CAGR of 2.14% between 2025 and 2034.

The increased incidence of cancer led to novel cancer treatments, improved access to cancer care, and expanded clinical benefits. The cancer supportive care drugs market is primarily driven by significant investments in key areas, such as early diagnosis and cancer screening. The introduction of these cancer medications resolved disparities in access to cancer care in low-and middle-income countries and across demographic groups. Robust research and development in the oncology sector focus on investigating cancer types, mechanisms, and targets. The rise of novel cancer medicines and their expected growth will reach up to billions in the upcoming period.

| Table | Scope |

| Market Size in 2025 | USD 22.36 Billion |

| Projected Market Size in 2034 | USD 27.05 Billion |

| CAGR (2025 - 2034) | 2.14% |

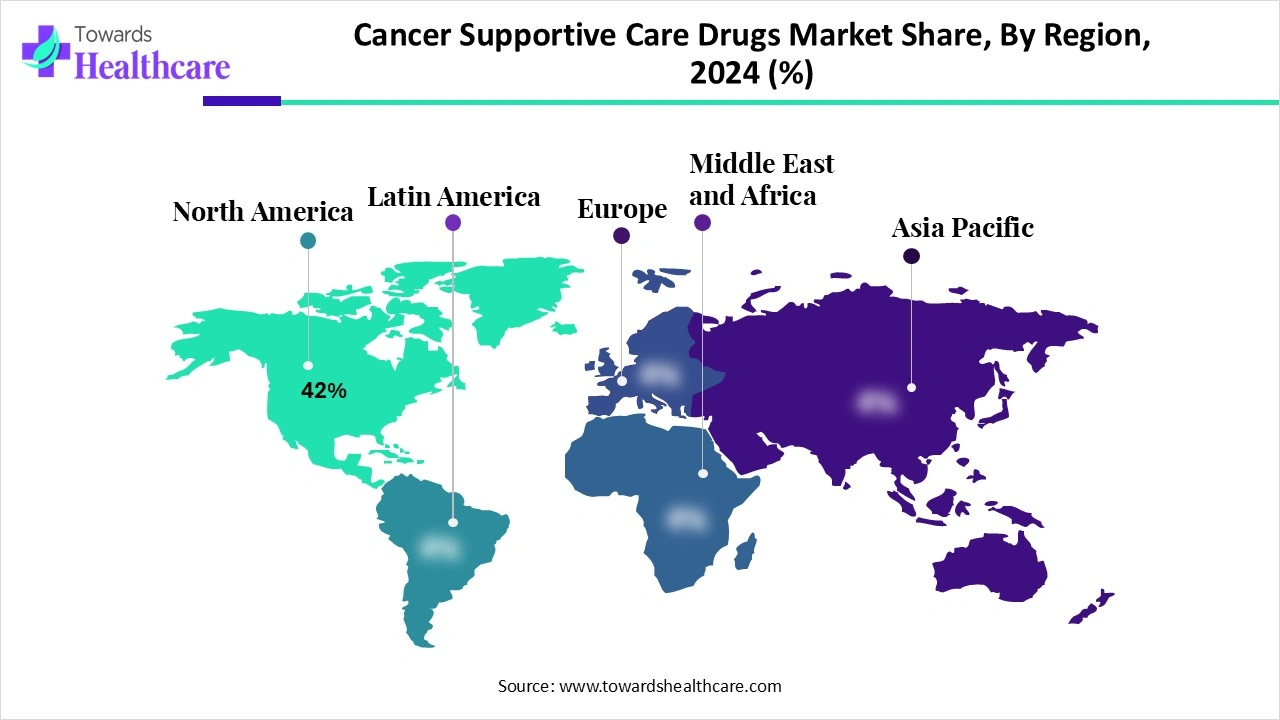

| Leading Region | North America by 42% |

| Market Segmentation | By Drug Class, By Cancer Type, By Distribution Channel, By End User, By Region |

| Top Key Players | Amgen, Roche/Genentech, Novartis, Pfizer, Johnson & Johnson, Merck & Co., Eli Lilly, Teva Pharmaceuticals, Mylan (Viatris), Bristol-Myers Squibb, AstraZeneca, Takeda Pharmaceutical, Helsinn Healthcare, Kyowa Kirin, Dr. Reddy’s Laboratories, Fresenius Kabi, Cipla, Sun Pharma, Hikma Pharmaceuticals, Apotex |

Cancer supportive care drugs refer to pharmaceutical products used to alleviate side effects and improve the quality of life of cancer patients undergoing treatments such as chemotherapy, radiotherapy, immunotherapy, and targeted therapy. These drugs do not treat the cancer itself but manage complications like anemia, neutropenia, nausea, pain, infections, and bone health deterioration. The market is driven by the rising global cancer prevalence, extended survival rates, demand for palliative care, and continuous development of biologics and biosimilars. Supportive care is increasingly integrated into oncology treatment protocols to enhance patient adherence and outcomes.

Artificial intelligence and related technologies play a crucial role in providing more efficient and effective cancer care to patients undergoing essential treatments. AI helps in the translation of data into easy-to-understand forms. It is possible to develop AI models that act as trained immunologists. AI helps in early cancer detection, scanning, and the detection of patterns that are not visible to the human eye. AI tools are used to design and develop drugs that are effective against specific cancer types.

What are the Major Drifts in the Cancer Supportive Care Drugs Market?

Cancer treatment has become a critical area of clinical research where several approaches have been developed based on tumor type and stage. The latest advances in immunotherapy, genetics, and genetic science have transformed cancer diagnosis and treatment. The emerging technologies, including oncolytic virotherapy, gene delivery, suicide gene therapy, and CRISPR/Cas9, offer promising therapeutic solutions. Moreover, the recent techniques such as nanocarrier delivery systems, gene therapy, CAR T-cell therapy, vaccines, epigenetics, etc., help in the assessment of therapeutic potential in cancer treatment.

What are the Potential Challenges in the Cancer Supportive Care Drugs Market?

Patients experience out-of-pocket expenditures during ovarian cancer management. Patients also deal with financial toxicity while undergoing various cancer treatments. Targeted therapies may introduce increased treatment morbidity and reduced quality of life. Research and advances in targeted therapies could reduce the clinical and financial burden.

What is the Future of the Cancer Supportive Care Drugs Market?

There are numerous strategies to address the burden of targeted therapies on patients, research, the economy, and clinical aspects. It is now possible to provide personalized treatments based on disease biology and molecular profile. Healthcare systems are adopting tailored therapies to respond to adverse effects. Patients are empowered with shared decision-making related to their preferences and willingness to pay. There is a development of country-specific economic evaluation guidelines for budget allocations. The ongoing research revolves around pharmacokinetics and pharmacodynamics.

The granulocyte colony-stimulating factors segment dominated the market in 2024, owing to the primary role of G-CSFs in supportive cancer care in managing neutropenia caused by chemotherapy. The continued expansion of biosimilar availability is evolving the immunology and oncology research fields. The G-CSFs help to mitigate infection risk, enable optimal chemotherapy, and are used in optimal chemoradiotherapy.

The anti-emetics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the key role of anti-emetics associated with multi-drug combinations, management of nausea, and individualized care. It helps in the prevention and management of nausea and vomiting. The preference to administer prophylactic antiemetics before chemotherapy regimens supports preventive cancer care.

The lung cancer segment dominated the market in 2024, owing to the potential of supportive cancer care in managing symptoms, resolving treatment side effects, and improving the overall quality of patients’ lives. This approach helps to better manage the side effects of cancer treatments. Lung cancer treatments also benefit from these new approaches in terms of pain management, bone health, weight loss, and reduced anxiety and depression.

The hematologic cancers segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the high effectiveness of modern therapies like CAR T-cell therapy and hematopoietic stem cell transplantation in the management of treatment side effects. The various cancer types, like hematologic cancers, are treated with precision supportive care and management of specific complications. It is now possible to prevent infections with prophylactic antibiotics, antivirals, antifungals, and immunosuppressed patients.

The hospital pharmacies segment dominated the market in 2024, owing to the excellence of these platforms in the management of medications, adverse events, and pharmacogenomics. They help in enhanced patient education, patient support, and patient counselling. They provide cost-effective alternatives and help in quality improvement and cost management.

The specialty clinics & cancer centers segment is anticipated to grow at a notable rate in the market during the upcoming period due to the assistance of these platforms in enhancing treatment tolerance and effectiveness. They help in providing personalized care for individual patient needs. They offer an integrative treatment approach and introduce genomic testing and tailored therapies.

The hospitals segment dominated the market in 2024, owing to the importance of hospitals in enhancing the quality of life and improving treatment outcomes. They help in the management of finances and logistics. They provide decentralized care and help in remote monitoring.

The specialty oncology clinics segment is predicted to grow at a rapid rate in the market during the studied period due to the clinical support in providing integrated care models, reducing hospitalization, and offering patient-centered care. The strategic partnerships, global market shifts, and expansion of decentralized care contribute to the evolution of specialty oncology clinics. They provide holistic and digital support to reduce the financial and psychosocial burden of cancer.

North America dominated the market share by 42% in 2024, owing to high cancer incidence, access to supportive care, and the adoption of biosimilars. The Association of Cancer Care Centers (ACCC) focused on reimbursement policies, patient protection, and empowerment of healthcare providers. The policies of the ACCC aim to address issues related to drug and medical supply shortages, patient navigation, financial toxicity, etc. Moreover, these policies also address issues related to treatment access, reimbursement, and affordability. The American Association for Cancer Research (AACR) makes efforts in precision medicine, immunotherapy, hematologic malignancies, cancer disparities, and cancer prevention.

The U.S. Food and Drug Administration (FDA) approved many drugs in 2024 based on clinical trials in which the Memorial Sloan Kettering Cancer Center (MSK) played a vital role. These approvals by the U.S. FDA encompass existing drugs, engineered cell therapies, more effective drug combinations, and novel classes of targeted therapies. The Memorial Sloan Kettering Cancer Center (MSK) contributed to new surgical techniques, innovative cancer vaccines, novel tools to diagnose and detect cancer, and drugs to boost the effectiveness of radiation therapy.

In January 2025, Astellas received approval from Health Canada for VYLOY® (zolbetuximab) in combination with chemotherapy for advanced gastric and gastroesophageal Junction Cancer.

The government of Canada takes initiatives for the clinical trial enrollment of children with cancer in Canada. The recently launched national Canadian government program is specifically supporting supportive cancer care drugs from specialty oncology clinics.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to rising cancer prevalence, expanding access, and growing generics. The Asian Pacific countries vary in healthcare and cancer care expenditure based on their higher income levels. The countries with higher income levels can better support cancer care delivery and public healthcare with more funding and resources. The Asia Pacific region makes efforts towards palliative care for adolescents and young adults with cancer. It also supports patient-centred care and oncology research. The extensive research in Asia keeps an eye on the potential of virotherapy and CAR-T cell therapy for solid tumors. The Department of Health (DOH) and the World Health Organization (WHO) launched the national integrated cancer control program (NICCP) strategic framework for the period 2024-2028.

In July 2025, the Ministry of External Affairs (MEA) launched a specialized training program in cancer care for Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) countries at the Tata Memorial Centre (TMC), Mumbai.

The Ministry of Health and Family Welfare took initiatives towards a cancer-free India by staying committed to prevention, treatment, and innovation. India potentially stays ahead as a leader in cancer care.

China has set its policies for cancer research, healthcare, and cancer prevention. The rising incidence of cancer in China has made this disease a leading threat to population health in China. Robust reforms in drug evaluation, approval mechanisms, and novel drug development in China foster its massive growth.

The R&D process for cancer supportive care drugs includes discovery, preclinical research, clinical trials, and expedited regulatory review.

Key Players: Novartis, AstraZeneca, Eli Lilly, Johnson & Johnson, GlaxoSmithKline, AbbVie, Pfizer, Teva Pharmaceuticals, Bristol Myers Squibb Company, etc.

The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) contribute to regulatory approvals for supportive cancer care drugs and expanded indications. Clinical trials are prioritizing symptom management, quality of life, and at-home care models.

Key Players: Johnson & Johnson, Amgen Inc., Merck & Co., Inc., Novartis AG, Pfizer Inc., Bristol Myers Squibb, etc.

The government programs, pharmaceutical patient assistance programs, non-profit organizations, hospital resources, global initiatives, and research contribute to patient support programs and related services. These services include financial assistance, patient navigation, psycho-social, and holistic support.

Key Players: Amgen Inc., Novartis, Roche, Merck, Pfizer, Johnson & Johnson, etc.

| Medicine Name | Core Benefits | Net Sales (USD millions, 2024) |

| Entresto | Oral medicine for heart failure and hypertension | 7,822 |

| Cosentyx | Injectable treatment for inflammatory and immune conditions | 6,141 |

| Kesimpta | Injectable treatment for relapsing multiple sclerosis | 3,224 |

| Kisqali | Oral treatment for a type of breast cancer | 3,033 |

| Promacta / Revolade | Oral treatment for certain blood disorders | 2,216 |

| Tafinlar + Mekinist | Oral combination targeted therapy for a certain type of cancer | 2,058 |

| Jakavi | Oral treatment for certain rare blood disorders | 1,936 |

| Tasigna | Oral treatment for a type of chronic myeloid leukemia | 1,671 |

| Xolair* | Injectable medicine for certain respiratory and immunological conditions (severe asthma) | 1,643 |

| Ilaris | Injectable medicine for certain rare autoinflammatory disorders | 1,509 |

In April 2024, Courtney Bugler, President and CEO of ZERO Prostate Cancer of Novartis, said that people suffering from advanced cancers need advanced solutions through innovations that are important for patients and facilities. These inventions help them ensure promising healthcare delivery through treatments that are critical for patients.

By Drug Class

By Cancer Type

By Distribution Channel

By End User

By Region

February 2026

February 2026

January 2026

January 2026