January 2026

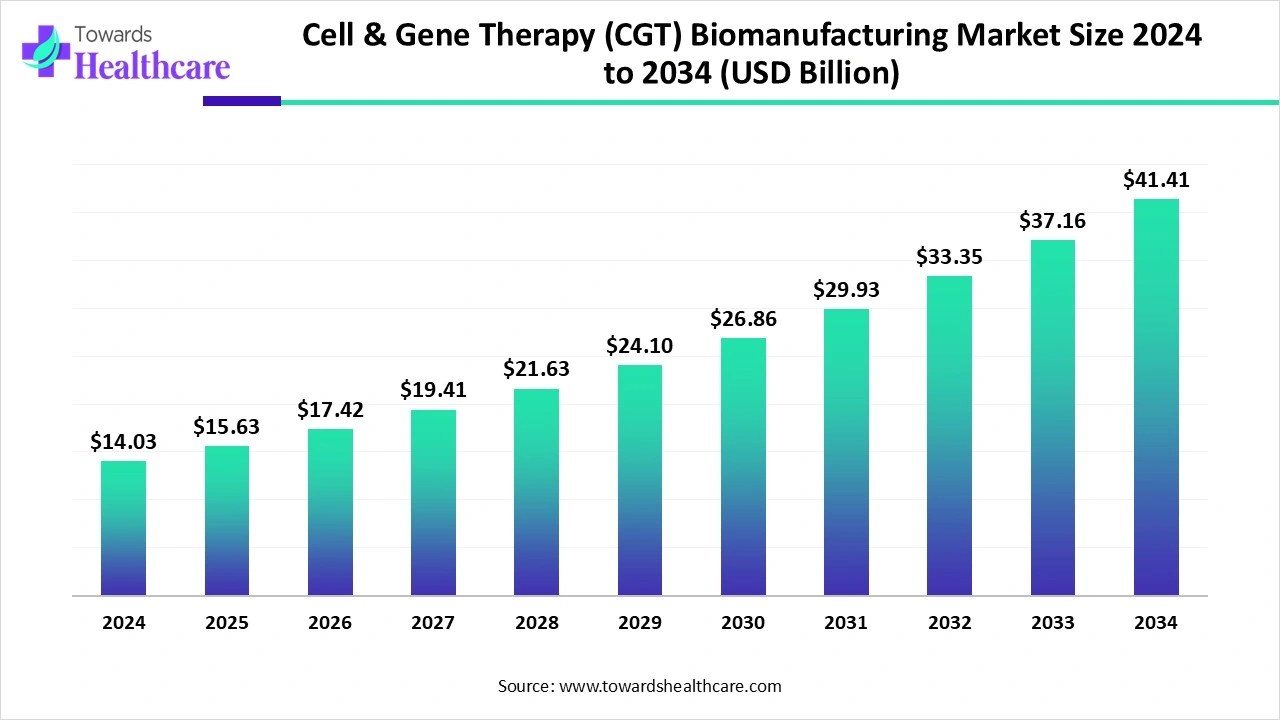

The global cell & gene therapy (CGT) biomanufacturing market size reached US$ 14.03 billion in 2024 and is anticipate to increase to US$ 15.63 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 41.41 billion, growing at a CAGR of 11.43%.

The cell & gene therapy (CGT) biomanufacturing market is witnessing rapid growth, driven by the rising demand for advanced therapies for genetic disorders, cancers, and rare diseases. Technological advancements in automated cell processing, viral vector production, and CAR-T manufacturing are enhancing efficiency and scalability. North America dominates the market due to its advanced healthcare infrastructure, presence of leading biopharma companies and CDMOs, strong R&D ecosystem, and favorable regulatory environment. Increasing outsourcing, clinical trial activity, and strategic collaborations further support market expansion globally.

| Table | Scope |

| Market Size in 2025 | USD 14.03 Billion |

| Projected Market Size in 2034 | USD 41.41 Billion |

| CAGR (2025 - 2034) | 11.43% |

| Leading Region | North America |

| Market Segmentation | By Therapy Type, By Vector / Delivery Type, By Mode of Manufacturing, By Manufacturing Workflow, By Region |

| Top Key Players | Lonza, Thermo Fisher Scientific, Catalent Inc., Fujifilm Diosynth Biotechnologies, WuXi Advanced Therapies / WuXi AppTec, Samsung Biologics, AGC Biologics, Minaris Regenerative Medicine, Oxford Biomedica, Charles River Laboratories, Recipharm / Vibalogics, Merck KGaA (MilliporeSigma), Takara Bio Inc., Miltenyi Biotec, Roche |

Cell and gene therapy biomanufacturing refers to the large-scale production of therapeutic cells and genetic materials used to treat various diseases, including cancers, rare genetic disorders, and chronic conditions. It involves creating, modifying, and expanding living cells or viral vectors under strictly controlled, Good Manufacturing Practice (GMP) conditions to ensure safety, quality, and efficacy. Key processes include cell isolation, genetic modification, expansion, purification, formulation, and cryopreservation. Advanced technologies such as automated bioreactors, closed systems, and viral vector platforms are used to increase efficiency and scalability. Biomanufacturing supports both clinical trials and commercial supply of personalized and off-the-shelf therapies.

In April 2025, Immune Bio Inc., a clinical-stage biotechnology company, teamed up with the Cell and Gene Therapy Catapult (CGT) to target immunology and inflammation through the innate immune system. Catapult) to develop commercially viable, large-scale production for its cell therapy platforms. Cell and gene therapy industry advancement is the focus of CGT Catapult, an independent technology and innovation organization. It was founded by Innovate UK, with whom it collaborates.

In July 2025, BioTech Social Inc. (BS') and Charles River Laboratories International, Inc. announced that they are investigating a possible client-centric partnership to make the BioTech Funding Portal, an investment crowdfunding platform for life science companies, accessible to participants in the Charles River Incubator (CIP) and Accelerator (CAP) Program.

The industry is shifting from manual to highly specialized automated systems tailored for small-batch and personalized manufacturing needs. These include real-time, inline/online analytics and machine learning based data management to ensure consistent quality and streamlined process control.

AI integration significantly enhances the cell and gene therapy (CGT) biomanufacturing market by improving efficiency, precision, and scalability across the production process. AI-powered systems enable real-time monitoring of cell cultures, predictive modelling of growth patterns, and early detection of contamination or process deviations, ensuring higher product quality and yield. In quality control, AI automates image analysis, biomarker detection, and potency testing, reducing human error and accelerating timelines. It also supports process optimization, supply chain management, and personalized therapy design, allowing manufacturers to scale production while maintaining compliance with GMP standards. Overall, AI drives cost efficiency, reliability, and faster commercialization of CGT products.

Regulatory Support

Regulatory support plays a pivotal role in advancing the cell and gene therapy (CGT) biomanufacturing market by establishing frameworks that ensure safety, efficacy, and scalability. Regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have implemented expedited approval pathways, such as Breakthrough Therapy Designation and Accelerated Approval, to fast-track promising CGT products. These initiatives encourage investment, facilitate timely market entry, and promote innovation. For instance, in 2024, the FDA approved Casgevy, the first CRISPR-based gene therapy for sickle cell disease and beta-thalassemia, under its expedited programs, highlighting the agency's commitment to supporting advanced therapies.

Regulatory Challenges & Complex Manufacturing Processes

The key players operating in the market are facing issues due to complex manufacturing processes and regulatory challenges. Upstream and downstream processing for CAR-T, gene therapies, and viral vectors is technically challenging, requiring precision and specialized expertise. Strict regulatory requirements for approval, quality, and safety can delay commercialization and increase compliance costs. Shortage of GMP-certified facilities and an experienced workforce constrain scalability.

Expanding Clinical Applications

Expanding clinical applications significantly drive the growth of the cell and gene therapy (CGT) biomanufacturing market by broadening the scope of treatable conditions and increasing demand for scalable production. As CGT progresses beyond oncology into areas like neurology, cardiology, and rare genetic disorders, the need for efficient manufacturing solutions intensifies. This expansion necessitates advancements in upstream and downstream processing, quality control, and cryopreservation to meet the diverse requirements of various therapies. Consequently, manufacturers are investing in flexible, high-throughput systems to accommodate the growing variety of CGT products, thereby accelerating market growth.

The cell therapy segment dominates the cell & gene therapy (CGT) biomanufacturing market due to its widespread clinical applications and proven therapeutic potential. Treatments like CAR-T therapies and stem cell-based interventions have demonstrated significant success in oncology, immunology, and regenerative medicine, driving demand. Advanced manufacturing technologies, such as automated cell expansion and GMP-compliant processing, support large-scale production. Additionally, increasing investments in cell therapy research, growing clinical trial activity, and regulatory incentives for innovative therapies further reinforce the dominance of the cell therapy segment within the overall market.

The gene therapy segment is estimated to be the fastest-growing segment in the cell & gene therapy (CGT) biomanufacturing market due to rising demand for treatments targeting rare genetic disorders, cancers, and inherited diseases. Advances in viral and non-viral vector technologies, CRISPR-based gene editing, and personalized medicine are accelerating development and commercialization. Supportive regulatory frameworks, such as orphan drug designations and breakthrough therapy approvals, along with increasing investments in R&D and clinical trials, are enabling rapid expansion. Growing awareness of curative potential further drives adoption and market growth in gene therapies.

The viral vectors segment dominated the market in 2024. Under the viral vectors segment, the AVV sub-segment was dominant in 2024. The viral vector segment dominates the cell and gene therapy (CGT) biomanufacturing market due to its proven efficiency in delivering therapeutic genes, extensive use in CAR-T and gene therapies, and strong clinical validation. Established production protocols, high demand for curative treatments, and widespread adoption by leading biopharma companies further reinforce its dominance.

The AAV vectors sub-segment held a dominant share under the viral vectors segment. AAV vectors are favored for their safety, low immunogenicity, and ability to deliver genes to target cells effectively. They are extensively applied in treating rare genetic disorders, ocular diseases, and neurological conditions. Strong clinical validation, established manufacturing protocols, and high demand for curative gene therapies contribute to the segment’s dominance. Leading biopharma companies and CDMOs continue to invest in scalable AAV production technologies to meet growing global demand.

The non-viral delivery segment is anticipated to be the fastest-growing in the cell & gene therapy (CGT) biomanufacturing market due to its safety, scalability, and cost-effectiveness compared with viral vectors. Non-viral platforms, such as plasmid DNA, lipid nanoparticles, and electroporation-based delivery systems, reduce immunogenicity and simplify regulatory approval. Rising demand for personalized therapies, RNA-based treatments, and CRISPR gene editing applications is accelerating adoption. Additionally, ongoing technological innovations, increasing R&D investment, and the need for high-throughput, reproducible manufacturing are driving rapid growth in the non-viral segment globally.

The contract manufacturing (CDMO) segment dominates the cell & gene therapy (CGT) biomanufacturing market due to the growing complexity and cost of producing advanced therapies. Biopharma companies increasingly rely on CDMOs for GMP-compliant manufacturing, process development, scalability, and regulatory expertise, allowing them to focus on R&D and clinical trials. The CDMO model also enables faster commercialization, access to advanced technologies like automated bioreactors and viral vector production, and flexibility in capacity management, making it the preferred choice for companies developing CAR-T, stem cell, and gene therapies.

The in-house segment is estimated to be the fastest-growing in the cell & gene therapy (CGT) biomanufacturing market due to increasing demand for control over quality, intellectual property, and production timelines. Biopharma companies are investing in their own GMP-compliant facilities to ensure consistent supply for clinical trials and commercial products, reduce reliance on external CDMOs, and protect proprietary technologies. Additionally, technological advancements such as automated cell processing, closed-system bioreactors, and scalable gene therapy platforms make in-house production more feasible, cost-effective, and efficient, driving rapid growth in this segment globally.

The upstream processing segment dominates the cell & gene therapy (CGT) biomanufacturing market because it is critical for producing high-quality cells and viral vectors. This stage involves cell isolation, expansion, transfection, and vector production, which determine the potency, purity, and yield of therapies. High demand for CAR-T, stem cell, and gene therapies requires robust upstream processes. Additionally, advancements in bioreactor technology, automated cell culture systems, and optimized growth media enhance scalability and efficiency, making upstream processing the foundational and dominant segment in CGT manufacturing.

The fill-finish, & cryopreservation segment is estimated to be the fastest-growing in the cell & gene therapy (CGT) biomanufacturing market because it streamlines the final stages of therapy production, ensuring sterility, consistency, and regulatory compliance. Automated systems for filling vials, finishing packaging, and performing quality control tests reduce human error, contamination risk, and turnaround time. Increasing production volumes, the complexity of personalized therapies like CAR-T and gene therapies, and the need for scalable, GMP-compliant operations drive adoption. Investments in robotics, AI, and high-throughput QC technologies further accelerate growth in this segment.

North America dominates the cell and gene therapy (CGT) biomanufacturing market due to its well-established healthcare infrastructure, advanced research ecosystem, and early adoption of innovative therapies. The region benefits from significant government funding, favourable regulatory frameworks, and strong intellectual property protection, which encourage investment in R&D and manufacturing. The presence of leading pharmaceutical and biotech companies, coupled with extensive clinical trial networks, accelerates the development and commercialization of cell and gene therapies. Additionally, the growing prevalence of chronic and genetic disorders in the U.S. and Canada drives demand for advanced therapies, reinforcing North America’s position as the global market leader.

The U.S. dominates the cell and gene therapy biomanufacturing market due to its advanced infrastructure, skilled workforce, and robust R&D ecosystem. Regulatory support from the FDA, including expedited approval pathways, accelerates therapy commercialization. High clinical trial activity, combined with significant investments by pharmaceutical companies like Biogen in AI and automated manufacturing, strengthens production capabilities and innovation in gene and cell therapies.

Canada is emerging in CGT biomanufacturing through strategic government investments, academic-industry collaborations, and regulatory support. Institutions like the University of Alberta and BioCanRx advance CAR-T and other therapies, while companies like OmniaBio establish modern manufacturing facilities. Health Canada’s frameworks ensure safety and market access, fostering a growing ecosystem that supports scalable, efficient, and innovative cell and gene therapy production.

The Asia-Pacific region is the fastest-growing cell & gene therapy (CGT) biomanufacturing market in cell and gene therapy (CGT) biomanufacturing market due to rapidly expanding healthcare infrastructure, increasing investment in biopharmaceutical research, and supportive government initiatives. Countries like China, Japan, and South Korea are aggressively developing manufacturing capabilities, fostering public-private partnerships, and facilitating clinical trials. Rising prevalence of genetic and chronic disorders, along with growing patient awareness, fuels demand for advanced therapies. Additionally, cost advantages in manufacturing and skilled workforce availability attract global biopharma companies to establish facilities in the region, accelerating technology transfer, capacity expansion, and market penetration, positioning Asia-Pacific as a key growth hub.

China is rapidly emerging in cell and gene therapy biomanufacturing, driven by government-backed initiatives, substantial investment in biopharma infrastructure, and favorable regulatory reforms. Leading companies are expanding manufacturing capacity, while academic-industry collaborations accelerate research and clinical trials. Rising prevalence of chronic and genetic disorders further fuels demand, positioning China as a major growth hub in the Asia-Pacific CGT market.

India’s CGT biomanufacturing market is growing due to increasing government support, investment in biotech parks, and cost-effective manufacturing capabilities. Expanding clinical trials, partnerships with global biopharma companies, and a large, skilled workforce enhance research and production capacity. Rising patient awareness and demand for advanced therapies further drive adoption, making India a rapidly developing player in Asia-Pacific CGT biomanufacturing.

Japan leads in CGT biomanufacturing in Asia-Pacific through strong regulatory frameworks, advanced technological infrastructure, and high R&D investment. Government incentives and streamlined approval pathways support the commercialization of innovative therapies. Partnerships between academia and industry boost CAR-T and gene therapy development. With a growing elderly population and rising prevalence of chronic diseases, Japan remains a key market for cell and gene therapy production.

This stage involves discovery, preclinical research, and process development for cell and gene therapies. Activities include identifying therapeutic targets, developing viral and non-viral vectors, and optimizing cell culture and gene-editing processes.

Organizations/Companies involved: Novartis – CAR-T therapy development (Kymriah), Gilead Sciences / Kite Pharma – Cell therapy R&D, Bluebird Bio – Gene therapy vector development, University of California, San Francisco (UCSF) – Academic research in CGT, and Harvard Stem Cell Institute – Stem cell and gene therapy research, among others.

This step includes phases I–III clinical trials, regulatory submissions, and approvals from authorities to ensure safety and efficacy.

Organizations/Companies Involved: FDA (U.S.) – Regulatory approvals, EMA (Europe) – Conditional marketing authorizations, Health Canada – Regulatory oversight, Novartis, Gilead Sciences, Bluebird Bio – Conducting multi-center clinical trials, CROs like ICON plc and Parexel – Contract research for clinical trial management

Focuses on cell expansion, viral/non-viral vector production, purification, and fill-finish operations. May involve CDMO partnerships or in-house facilities.

Organizations/Companies Involved: Lonza – CGT contract manufacturing, WuXi AppTec – End-to-end CGT manufacturing, Fate Therapeutics – In-house cell therapy manufacturing, and Samsung Biologics – Process scale-up and manufacturing

Encompasses therapy administration, follow-up, post-marketing safety monitoring, and reimbursement support. Patient engagement and education are crucial due to the personalized therapy complexity.

Organizations/Companies Involved: Novartis Patient Assistance Program – Kymriah therapy support, Gilead Sciences Patient Support – Kite Pharma CAR-T therapies, BioMarin – Genetic disorder therapy support programs, and Local hospitals and oncology centers – Administer and monitor therapy

In December 2024, Kerstin Dolph, Corporate Senior Vice President, Global Manufacturing, Charles River, announced the introduction of the Charles River Incubator Program (CIP), which focuses on assisting early-stage biotechnology companies in the discovery, development, and phase-appropriate manufacturing of advanced therapies.

By Therapy Type

By Vector / Delivery Type

By Mode of Manufacturing

By Manufacturing Workflow

By Region

January 2026

January 2026

January 2026

January 2026