February 2026

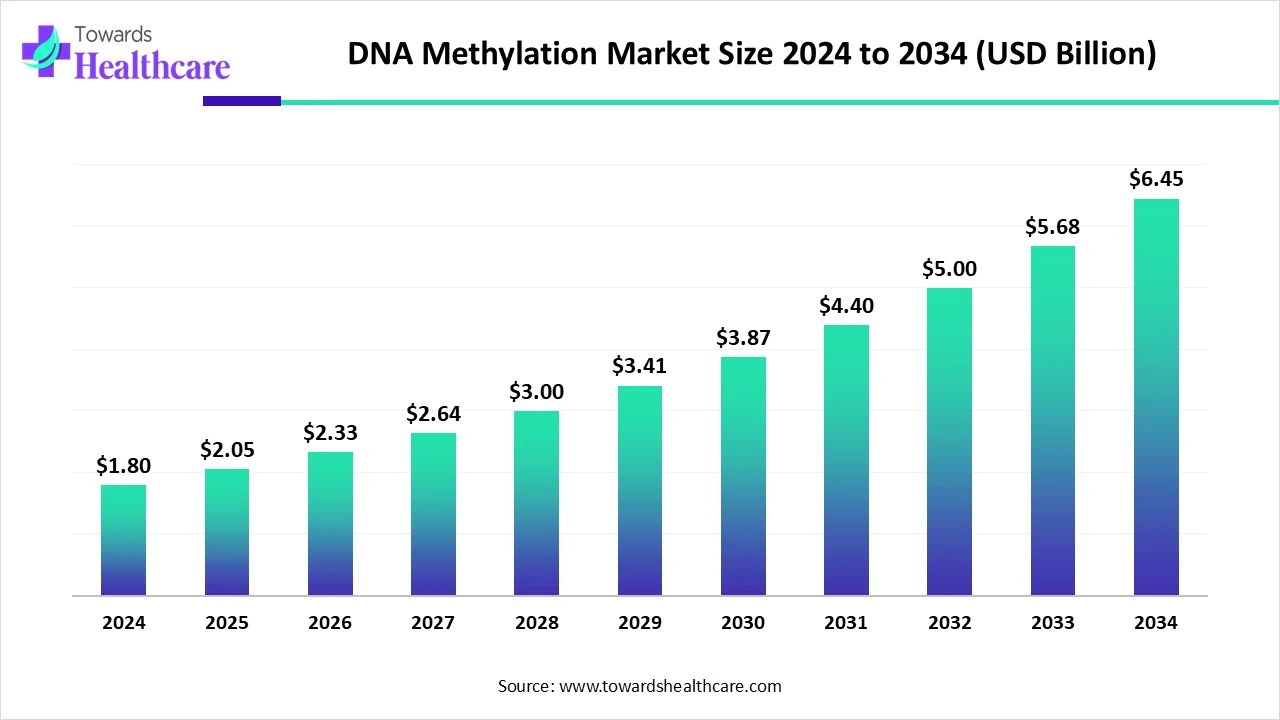

The global DNA methylation market size reached USD 2.05 billion in 2025, grew to USD 2.33 billion in 2026, and is projected to hit around USD 7.36 billion by 2035, expanding at a CAGR of 13.64% during the forecast period from 2025 to 2034.

DNA methylation is essential for the regulation of tissue-specific gene expression, X-chromosome inactivation, silencing retroviral elements, and genomic imprinting. It contributes to the regulation of gene expression. There are cost-effective solutions for high-throughput enzymatic DNA methylation sequencing. These solutions are valuable in addressing key concerns in medical genomics, geroscience, and evolutionary biology. Illumina Inc., Bio-Rad Laboratories, PacBio, Thermo Fisher Scientific, etc., are some of the leading companies in the DNA methylation field. These top companies introduced several technologies and products for DNA methylation analysis. These solutions include bioinformatics software, sequencing platforms, and PCR assays.

| Table | Scope |

| Market Size in 2025 | USD 2.05 Billion |

| Projected Market Size in 2035 | USD 7.36 Billion |

| CAGR (2026 - 2035) | 13.64% |

| Leading Region | North America |

| Market Segmentation | By Product & Offering, By Detection / Technology, By Application / Use Case, By End-User / Buyer, By Region |

| Top Key Players | Illumina, Inc., Thermo Fisher Scientific, QIAGEN N.V., New England Biolabs, Zymo Research Corporation, Active Motif, Inc., Diagenode S.A., Merck KGaA, Agilent Technologies, Roche Diagnostics, Pacific Biosciences, Oxford Nanopore Technologies, Bio-Rad Laboratories, Abcam plc, EpiGentek Group, Inc., PerkinElmer, Inc., BGI / MGI , Exact Sciences, Epigenomics AG, EpigenDx |

The DNA methylation market covers technologies, reagents, consumables, instruments, assays, and services used to detect, quantify, and interpret DNA methylation (5-methylcytosine and related modifications) across genomes. It includes laboratory workflows (bisulfite conversion and enrichment methods), sequencing and array platforms, targeted methylation assays, clinical diagnostic tests (methylation biomarkers for cancer and other diseases), bioinformatics/biomarker interpretation, and CDMO/CRO services for assay development and clinical validation. Growth is driven by research into epigenetic biomarkers, clinical diagnostics (notably oncology screening and liquid-biopsy methylation tests), and advances in long-read and direct-detection sequencing technologies that simplify methylation profiling.

The newly developed AI models can potentially predict the patterns of the human genome by a molecular mark on DNA called methylation. Artificial intelligence and deep learning algorithms are ideally used for epigenetic sequence analysis. AI models that are trained on epigenomic data can address issues related to gene expression, prediction of disease markers, chromatin states, and enhancer-promoter interaction.

What are the Various Trends Observed in the DNA Methylation Market?

The major growth drivers of the market are technological advancements, which include next-generation sequencing, methylation microarrays, single-cell methylation analysis, nanopore sequencing, and non-bisulfite sequencing methods. There is a major role of AI and machine learning in DNA methylation analysis. The expanding research areas beyond cancer also contribute to the market’s progress.

What are the Potential Challenges in the DNA Methylation Market?

There are certain limitations associated with cost, complexity, data interpretation, standardization, and clinical validation. Some challenges are related to the off-target effects of therapies.

What is the Future of the DNA Methylation Market?

DNA methylation biomarkers are clinically investigated for their potential in the early diagnosis and detection of cancer, autoimmune conditions, and neurological disorders. DNA methylation analysis also allows us to prescribe tailored therapies and personalized medicine to patients. DNA methylation analysis using cell-free DNA from liquid biopsies is gaining traction for early cancer detection and management.

The assay kits & reagents segment dominated the market in 2024, owing to the ready-to-use forms, simplified protocols, and reduced preparation time offered by assay kits and reagents. They offer standardized protocols to researchers and facilitate high-quality control. Scientific projects are conducted using optimized reagents, precise measurements, and minimized errors with high sensitivity and accuracy.

The clinical tests/kits segment is expected to grow at the fastest CAGR in the market during the forecast period due to the benefits of clinical tests/ kits in early disease detection and diagnosis, and more targeted treatments. They offer at-home testing options and increased privacy, which promote accessibility and convenience for patients. They are ideally suitable for the treatment, monitoring, and management of several health conditions.

The bisulfite-based methods segment dominated the market in 2024, owing to the versatile applications of these methods in DNA methylation analysis techniques, targeted bisulfite sequencing, methylation arrays, etc. They offer high-throughput capabilities and facilitate personalized medicine. These techniques present high resolution, accuracy, and gene regulation potential.

The long-read direct detection segment is expected to grow at the fastest CAGR in the market during the forecast period due to the significance of long-read direct detection in sequencing for comprehensive variant detection and accurate haplotype phasing. It gives insights into epigenetic and epitranscriptomic profiling that regulate gene expression. It simplifies de novo genome assembly and overcomes the limitations of short-read sequencing.

The oncology segment dominated the market in 2024, owing to the pivotal role of DNA methylation in cancer detection and diagnosis. DNA methylation patterns serve as potential diagnostic and prognostic biomarkers and are ideal for therapeutic targeting. These DNA methylation patterns are vital in immune modulation and can impact antitumor immune response.

The liquid-biopsy methylation assays for multi-cancer early detection and the MRD segment are expected to grow at the fastest CAGR in the market during the forecast period due to the numerous advantages of liquid biopsies in early cancer detection and minimal residual disease monitoring. DNA methylation liquid biopsies are minimally invasive, feasible, and highly specific in nature. These advanced cancer detection techniques offer specificity, sensitivity, stability, and dynamic monitoring of treatment response.

The pharma & biotech segment dominated the market in 2024, owing to the major role of DNA methylation in biomarker development, drug discovery and development, and precision medicine. These techniques help researchers in the pharma and biotech industries to understand disease mechanisms and explore gene expression regulation. DNA methylation and several other techniques help in diagnosis and early detection, prognosis, and prediction of treatment response.

The clinical diagnostic labs & pathology networks segment is expected to grow at the fastest CAGR in the market during the forecast period due to improved diagnostic accuracy and early disease detection and screening. The clinical diagnosis and research are advancing precision medicine and expanding liquid biopsy capabilities. These advancements prevent misdiagnosis and improve clinical trial outcomes.

North America dominated the market in 2024, owing to the emerging trends in biotechnology, which include personalized medicine, cell therapies, gene therapies, laboratory sustainability, mRNA-based therapeutics, and many more. Biotechnology advancements are flourishing across this region and globally through several cutting-edge technologies like multi-omics, AI-powered data analysis, laboratory automation, cancer research models, and many others. In February 2025, the Government of Canada launched a Canadian Genomics strategy to foster innovations and economic growth.

The U.S. Economic Research Service reported the adoption of genetically engineered crops in the U.S. The U.S. Department of Agriculture introduced the Biotechnology Risk Assessment Grants Program to support and assist federal regulatory agencies with new information to make science-based decisions. These decisions are associated with the introduction of genetically engineered organisms into the environment.In January 2024, the U.S. Department of Defense announced the launch of the distributed bioindustrial manufacturing program to strengthen domestic supply chains.

The National Human Genome Research Institute reported that the Human Genome Project was one of the revolutionary innovations that united several international researchers to generate the first sequence of the human genome. In May 2025, the National Institute of Health reported the significance of the All of Us Research Program in accelerating health research and medical innovations. U.S. Government leaders are making efforts to develop and expand the biotechnology workforce while developing private-public partnerships to advance biotechnology innovations.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the empowering scientific innovations in this region. The public acceptance of new innovations and investments in early-stage technologies fosters economic growth. Moreover, infrastructure development and regulatory support drive the regional growth. The prominent Asian Pacific countries like Singapore and China are committed to scientific innovations, intellectual property protection, regulatory alignment, and political regulations. The Asia Pacific region is positioning itself as the global innovation hub. The future of the Asian Pacific biotechnology sector is driven by global pharmaceutical companies, biotechnology firms, and national governments. The partnerships between big pharmaceutical companies and small biotechnology firms support early-stage research. Furthermore, co-funding initiatives accelerate private investments while governments align streamlined regulatory processes.

In September 2024, the Information Technology and Innovation Foundation declared the rapidly growing position of China while becoming a leading innovator in advanced industries.

The R&D process for DNA methylation includes key aspects such as defining a research hypothesis, selection of a methylation detection method, sample collection, sample preparation, execution of the methylation detection method, and several other key considerations.

Key Players: Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., New England Biolabs, Agilent Technologies Inc.

Hospitals and pharmacies contribute to the acceptance of specialized kits, reagents, instruments, software, etc., from the distribution channels and the leading companies like Zymo Research, Thermo Fisher Scientific Inc., Illumina Inc., and QIAGEN.

Key Players: Exact Sciences, Agilent Technologies, Bio-Rad Laboratories, New England Biolabs.

DNA methylation plays a key role in early diagnosis of health conditions, risk assessment, guiding personalized treatments, disease monitoring, patient education, and counseling.

Key Players: Freenome, Inherent Biosciences, Inc., Nucleix Ltd., GRAIL, DNA Labs India.

In January 2024, Dominic John, Vice President, QIAGEN Digital Insights, proclaimed that the launch of Ingenuity Pathway Analysis (IPA) stands as a breakthrough in molecular data analysis, which combines human expertise and AI technology.

By Product & Offering

By Detection / Technology

By Application / Use Case

By End-User / Buyer

By Region

February 2026

February 2026

February 2026

February 2026