February 2026

The Europe pharmaceutical market size is calculated at US$ 467.59 billion in 2024, grew to US$ 494.63 billion in 2025, and is projected to reach around US$ 820.05 billion by 2034. The market is expanding at a CAGR of 5.78% between 2025 and 2034.

The growing incidence of various diseases in Europe is increasing the use of different types of pharmaceutical products. This, in turn, is increasing their production, as well as their research and development, which are being supported by government funds and investment from companies. Moreover, they are utilizing AI technologies to accelerate their development and drug discoveries along with their clinical trials. At the same time, the companies are actively developing, collaborating, and launching numerous products, which is promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 494.63 Billion |

| Projected Market Size in 2034 | USD 820.05 Billion |

| CAGR (2025 - 2034) | 5.78% |

| Market Segmentation | By Product Type, By Therapeutic Area, By Channel/Distribution, By Country |

| Top Key Players | Bayer AG, Merck KGaA, Boehringer Ingelheim, Novo Nordisk, Takeda, Pfizer, Johnson & Johnson (Janssen), Bayer/consumer health divisions, Teva Pharmaceutical, Ipsen, UCB, Lonza, BioNTech, CureVac/German biotech cluster firms, Grifols |

The Europe pharmaceutical market is driven by growth in the aging population, a strong focus on innovative therapies, and increasing chronic diseases. The Europe pharmaceutical covers prescription medicines (small molecules and biologics), vaccines, generics and biosimilars OTC/consumer health products, and advanced therapies (cell & gene, RNA). It includes R&D, clinical development, manufacturing, distribution, and commercialization across EU member states, the UK, Switzerland, and other European markets. Europe combines large, established markets (Germany, UK, France) with strong biotech hubs, significant public payer systems, and a mature generics/biosimilars adoption environment.

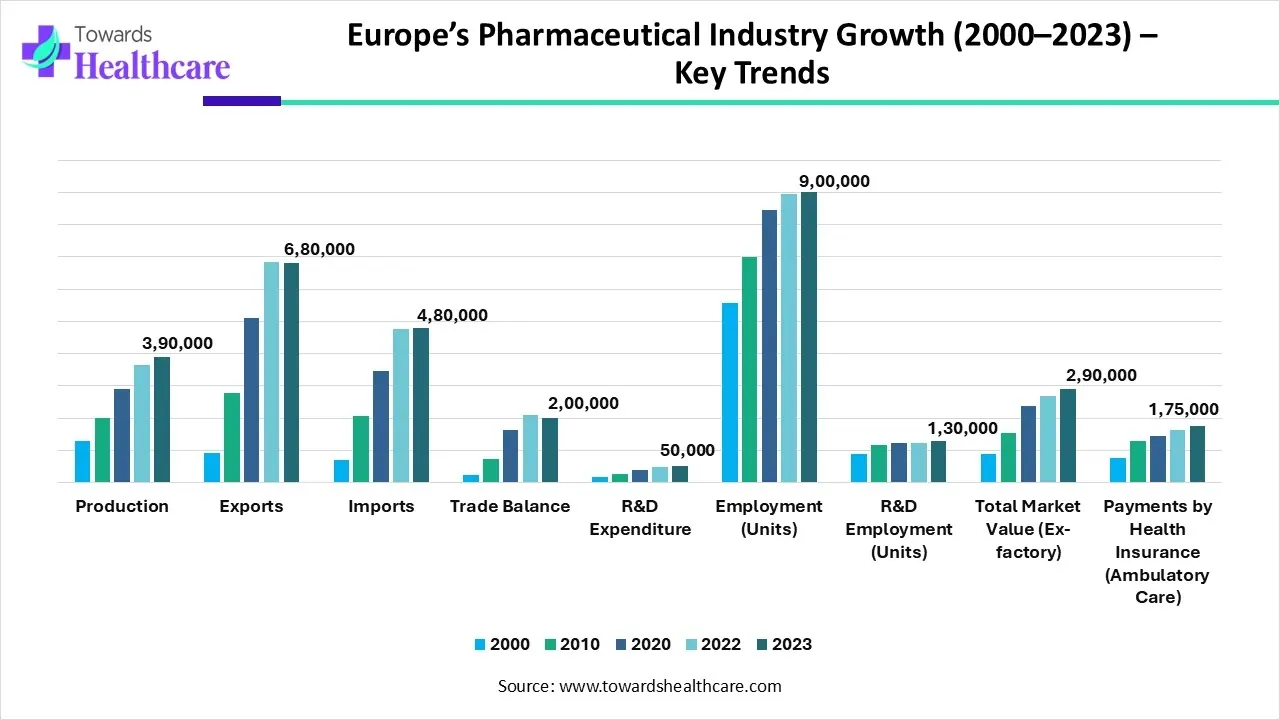

| Category | 2000 | 2010 | 2020 | 2022 | 2023 |

|---|---|---|---|---|---|

| Production | 127,504 | 199,730 | 290,309 | 363,300 | 390,000 |

| Exports | 90,935 | 276,357 | 509,828 | 683,375 | 680,000 |

| Imports | 68,841 | 204,824 | 347,124 | 475,277 | 480,000 |

| Trade Balance | 22,094 | 71,533 | 162,704 | 208,098 | 200,000 |

| R&D Expenditure | 17,849 | 27,920 | 39,442 | 47,010 | 50,000 |

| Employment (Units) | 556,506 | 699,059 | 846,282 | 894,406 | 900,000 |

| R&D Employment (Units) | 88,397 | 116,253 | 121,717 | 123,465 | 130,000 |

| Total Market Value (Ex-factory) | 89,449 | 153,685 | 236,401 | 269,365 | 290,000 |

| Payments by Health Insurance (Ambulatory Care) | 76,909 | 129,464 | 145,262 | 163,813 | 175,000 |

Between 2000 and 2023, Europe’s pharmaceutical industry experienced consistent and significant growth. Production, exports, and overall market value increased strongly over this period, establishing Europe as a leading global supplier of medicines. Research and development spending also rose steadily, demonstrating a sustained commitment to innovation and new drug development. In addition, employment; especially in research-related roles; expanded, reflecting the industry’s contribution to high-skilled job creation. Overall, the sector has become an important pillar of Europe’s economic

There is a growth in the use of AI in the European pharmaceutical sector, as it provides various applications. It helps in accelerating drug discovery and development as it provides suitable drug development pathways. It also helps in predicting the drug efficacy and toxicity along with their pharmacokinetic and pharmacodynamic profiles. This helps in the optimization of the drugs, which in turn increases the adoption of AI platforms by companies such as Eli Lilly, BioNTech, and Sanofi.

For instance,

Increasing R&D: There is a growth in R&D to develop novel treatment options for the rising diseases across Europe. This, in turn, is driving the development of various drugs as well as therapies for complex diseases. Additionally, these growing innovations are supported by investment from various pharmaceutical companies as well as from government funding.

For instance,

| Company | Approved Drugs | Type of Cancer | Source |

| Biocon Biologics |

Vevzuo Evfraxy |

Cancer-related bone issues | Biocon Biologics gets EU approval for 2 drugs to treat bone cancer, osteoporosis, and bone loss - Industry News | The Financial Express |

| Aurobindo Pharma | Dazublys | Breast and gastric cancer | Aurobindo Pharma gets European Commission's nod to market cancer drug, Dazublys - Industry News | The Financial Express |

| GlaxoSmithKline (GSK) | Blenrep | Relapsed or treatment-resistant forms of cancer | GSK's blood cancer drug gets EU approval | Reuters |

| AstraZeneca | Imfinzi (durvalumab) | Bladder cancer | AstraZeneca’s Imfinzi approved in Europe for muscle-invasive bladder cancer - Pharmaceutical Technology |

| Bayer | Nubeqa | Advanced prostate cancer | Bayer Receives EU Approval for Advanced Prostate Cancer Treatment | Morningstar |

| AbbVie | Elahere | Ovarian cancer | AbbVie to Launch Ovarian Cancer Drug in the UK at US Price |

By product type, the branded innovative small molecules & biologics segment held the largest share of approximately 38% in the market in 2024, due to growth in the research and development activities. This, in turn, increased the development of patented products. At the same time, the growing demand for biologics also increased their production. Additionally, the growing rare diseases also promoted their use.

By product type, the specialty & advanced therapies segment is expected to show the highest growth during the predicted time. To deal with the growing incidence of cancer and autoimmune diseases the there is a rise in the use of advanced therapies. Moreover, their growing advancements and increasing adoption of advanced technologies are accelerating the development of cell and gene therapies. Furthermore, the presence of reimbursement policies is attracting patients.

By therapeutic area type, the oncology segment led the market with approximately a 27% share in 2024, driven by its increasing incidence. This, in turn, increased the R&D, which was further supported by the healthcare investments. At the same time, the companies are focused on developing personalized medicines as per the patient's demands. Additionally, advanced technologies were also used due to their targeted action.

By therapeutic area type, the rare/orphan & advanced therapies segment is expected to show the fastest growth rate during the upcoming years. Their innovations are increasing due to high unmet need, as they have curative potential. At the same time, growing awareness is increasing the diagnostic rates, which is increasing the demand for advanced therapies. Moreover, their use and development are also being supported by the government.

By channel/distribution type, the retail pharmacies segment held the largest share of approximately 46% in the market in 2024, as these pharmacies show widespread accessibility. This, in turn, increased their use, where they also provided guidance about the use of any medication. They also provided products for the chronic management of diseases. The presence of OTC drugs also attracted the patients.

By channel/distribution type, the e-commerce/direct-to-patient/online segment is expected to show the highest growth during the forthcoming years. These platforms are enhancing patient convenience, and they are providing home deliveries of the pharmaceutical products. At the same time, the growing geriatric population is shifting towards their use to enhance their comfort. Moreover, the growing digitalization is also providing e-prescriptions, enhancing their use.

Europe is expected to show significant growth in the market due to growing innovations. The industries as well as the institutes present in Europe are developing various pharmaceutical products to tackle the growing chronic diseases, which in turn are supported by the investments from various sources and government funds. This, in turn, is increasing their clinical trials as well as approval of the products, which is encouraging new developments. They are also focusing on developing new curative and preventive treatment options, where their use is supported by the reimbursement policies, promoting the Europe pharmaceutical market growth.

The presence of a strong healthcare system in Germany is increasing the use of various pharmaceutical products, where the advanced therapies are backed by reimbursement policies. At the same time, the growing aging population and increasing incidence of cardiovascular diseases are increasing their use, promoting their production rates. Additionally, the companies are focusing on developing gene therapies, vaccines, along other technologies to enhance remote patient monitoring.

Nordics consist of robust health care systems, which are enhancing their access with the use of digital platforms. Moreover, they are focusing on providing preventive care along with remote care with the use of online or digital platforms. The companies are also developing novel solutions for diabetes, genetic diseases, and obesity, which are funded by the government. Furthermore, AI models are also being used to accelerate the drug discovery and development process.

In February 2025, £82.6 million was introduced by the UK government as a new flexible form of research funding, and a new commitment to UK researchers to access computing resources to unlock the power of AI. This, in turn, will enhance the use of AI to enhance the treatment and diagnostic approaches for diseases such as Alzheimer’s and cancer.

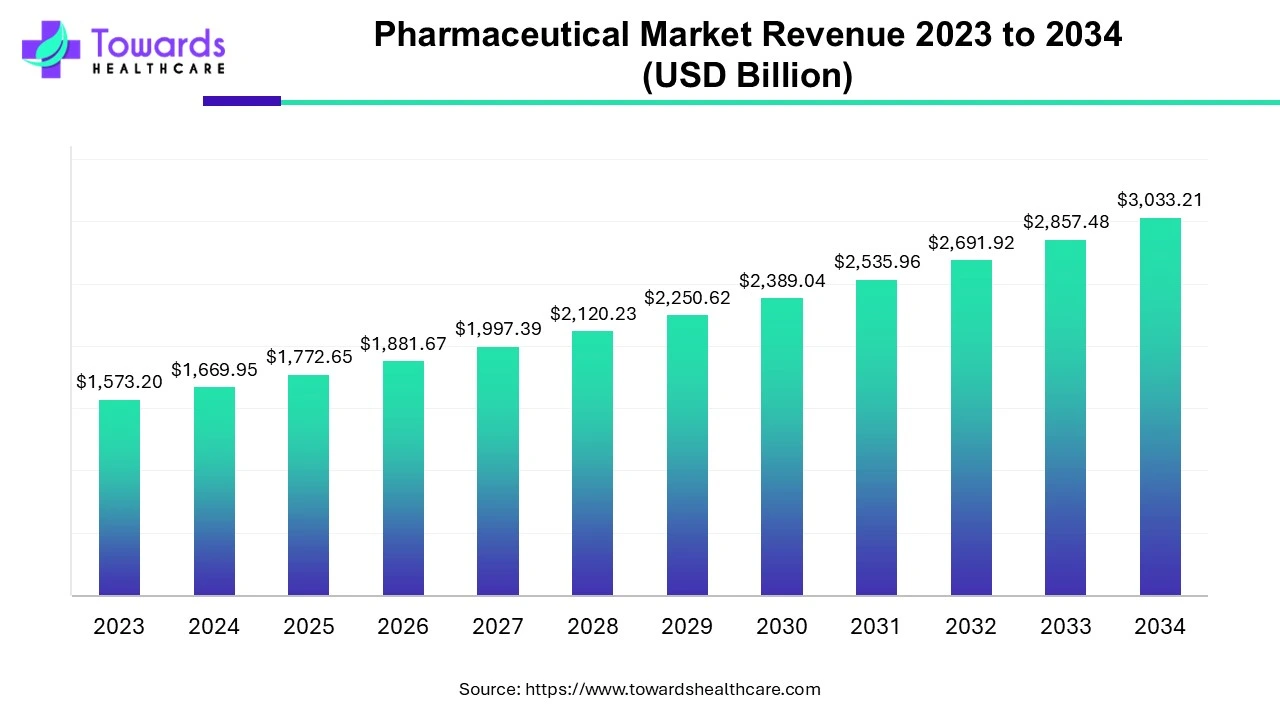

The global pharmaceutical market was valued at approximately US$ 1,573.20 billion in 2023 and is expected to reach US$ 3,033.21 billion by 2034, growing at a CAGR of 6.15% between 2024 and 2034.

The development of biopharmaceutical innovations, advanced therapies like cell and gene therapies, and the utilization of AI to enhance drug discovery are the main focus of the R&D for Europe pharmaceuticals.

Key Players: AstraZeneca, GlaxoSmithKline, Novartis, Bayer AG, Sanofi, Novo Nordisk, BioNTech, UCB, Merck KGaA.

The clinical trials and regulatory approval for Europe pharmaceuticals involve the product’s safety, efficacy, and quality evaluation.

Key Players: Roche, AstraZeneca, GlaxoSmithKline, Novartis, Bayer AG, Sanofi, Novo Nordisk.

In Europe, the companies provide patient support and services by offering accurate and accessible medicine-related information through medical information services, providing resources and programs, and improving patient adherence.

Key Players: Roche, AstraZeneca, GlaxoSmithKline, Novartis, Sanofi, Merck KGaA.

By Product Type

By Therapeutic Area

By Channel/Distribution

By Country

February 2026

February 2026

February 2026

February 2026