February 2026

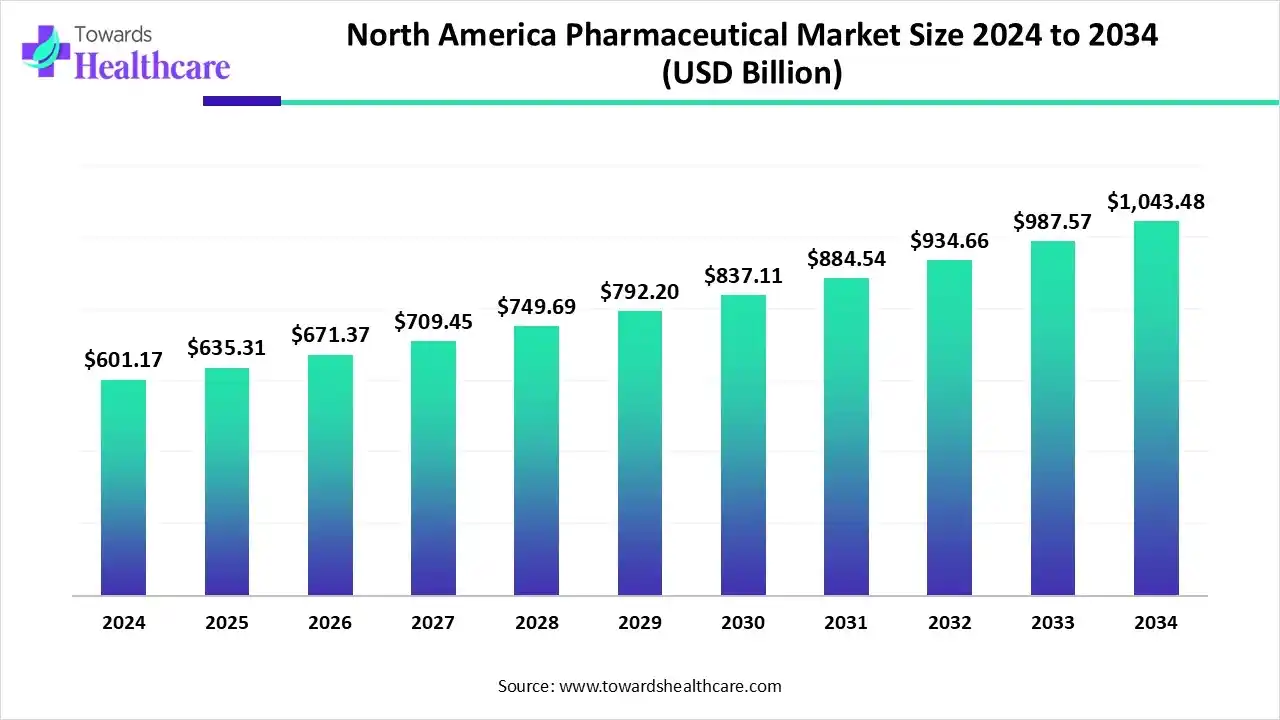

The North America pharmaceutical market size is calculated at US$ 601.17 billion in 2024, grew to US$ 635.31 billion in 2025, and is projected to reach around US$ 1043.48 billion by 2034. The market is expanding at a CAGR of 5.67% between 2025 and 2034.

The rising aging population, increasing incidence of chronic diseases, and advances in biologics and gene therapy drive the North America pharmaceutical market. Moreover, the market’s growth is accelerated by technological integration, the shift towards personalized medicine, and the growth of generics and biosimilars. The rising R&D costs, stringent regulations, supply chain resilience, and mergers and acquisitions fuel the market’s expansion in North America.

| Table | Scope |

| Market Size in 2025 | USD 635.31 Billion |

| Projected Market Size in 2034 | USD 1043.48 Billion |

| CAGR (2025 - 2034) | 5.67% |

| Market Segmentation | By Product Type, By Therapeutic Area, By Channel/Distribution, By Business Model/Revenue Stream, By Buyer/Payer Type, By Region |

| Top Key Players | Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., AbbVie Inc., Bristol Myers Squibb, Eli Lilly and Company, Amgen Inc., Gilead Sciences, Novartis AG, Roche , Sanofi, AstraZeneca, Novo Nordisk, Biogen Inc., Regeneron Pharmaceuticals, Vertex Pharmaceuticals, Moderna, Inc., Takeda Pharmaceutical, Bayer, Teva Pharmaceutical Industries |

The North America pharmaceutical market comprises prescription medicines (small molecules and biologics), vaccines, OTC medicines, generics and biosimilars, and advanced therapeutics (cell & gene therapy). It includes R&D, clinical development, manufacturing, distribution, and commercialization activities. The region dominated by the U.S. is the world’s largest pharma revenue pool, driven by a high share of specialty/oncology drugs, advanced biologics, strong payer markets, and large clinical-trial activity.

Advancements in diabetes and obesity medications, expansion of biologics and gene therapy, and the growing demand for monoclonal antibodies led to the massive growth of pharmaceuticals in North America. The continuous mergers and acquisitions, domestic supply chain initiatives, and growth in specialty pharmaceuticals have expanded the North America pharmaceutical market. The novel research on drug types, molecule types, and therapeutic areas is supported by research funding and significant R&D investments.

AI enhances decision-making, improves creativity, and increases the effectiveness of research and clinical trials. AI helps in the production of new tools that benefit patients, doctors, and healthcare regulators. It helps in drug design methods and can identify target proteins. AI reduces the potential health risks related to preclinical studies and lowers healthcare costs. It contributes to precision medicine development and the design of personalized treatment approaches.

| Sr. No. | Name of the Company | Services |

| 1 | Product Life Group (PLG) LLC North America | To support biotechnology sponsors and international and domestic pharma for FDA and Health Canada filings. |

| 2 | Halloran, a PLG Company | To create solutions and strategies through consulting services to bring lifesaving advancements to the market. |

| 3 | DSI-DS Inpharmatics | To supply senior consultants in CMC, regulatory affairs, and quality assurance, solve drug development issues, and implement solutions |

The branded small-molecule innovative drugs segment dominated the market in 2024, with a revenue share of approximately 34%, owing to the rise of biologic therapies and a high rate of novel approvals. The extensive research on small molecules helps researchers to address significant healthcare needs through versatile applications, innovation, and patient care. Certain therapies and newly approved small-molecule drugs can address previously unmet medical needs through novel mechanisms of action.

The specialty medicines/orphan drugs & advanced therapies segment is expected to grow at the fastest CAGR during the forecast period in the North America pharmaceutical market due to their potential in driving growth and innovation in the pharmaceutical industry. They are introducing precision medicine, personalized treatments, and addressing unmet medical needs. The biosimilars are advancing treatment options and reducing costs for healthcare systems.

The oncology segment dominated the market in 2024, with a revenue share of approximately 28%, owing to the rising innovations in immunotherapy, cell-based therapy, advanced targeted therapy, CAR-T cell therapy, etc. The cancer treatments revolve around therapeutic cancer vaccines, bispecific antibodies, and mutational targeting. Certain initiatives driving the North America pharmaceutical market focus on producing affordable and high-quality generics and biosimilars to expand access to cancer care.

The rare/orphan & gene therapies segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the rising adoption of gene and cell-based therapies. The CRISPR-based therapies, gene therapy approvals, and the growing R&D investments are expanding the pharmaceutical pipeline. The new business models and collaborations with regulatory agencies introduce strategic approaches for pharmaceuticals.

The retail pharmacies segment dominated the North America pharmaceutical market in 2024, with a revenue share of approximately 45%, owing to the expanding pharmaceutical-based services such as medication management, preventative care, point-of-care testing, and treatment. The digital integration, including telepharmacy, remote monitoring, online and omnichannel services, and personalized medicine, has enhanced access to remote healthcare. E-commerce is growing rapidly due to the adoption of omnichannel strategies and efficient home delivery for online orders.

The other channels segment is anticipated to grow at a notable rate in the market during the upcoming period due to combination therapies, enhanced data collection, expanded North America pharmaceutical market access, and pilot programs. The adoption of direct-to-consumer platforms brings convenience and loyalty. These channels can manage complex therapies and support patient advocacy.

The innovator pharmaceutical sales segment dominated the market in 2024, with a revenue share of approximately 62%, owing to its key role in driving patient-centric engagement and new therapeutic solutions. It is vital in key therapeutic areas like oncology, obesity, diabetes, central nervous system disorders, and rare diseases. The investments in cutting-edge R&D, improved sales models, and global collaborations are enhancing customer experience.

The specialty pharmacy & hub services segment is predicted to grow at a rapid rate in the North America pharmaceutical market during the studied period due to flexible contracts, third-party integration, funding, and partnerships. They manage complex therapies and provide patient access and support. They drive personalized patient engagement and expanded clinical insights.

The commercial payers/insurers segment dominated the market in 2024, with a revenue share of approximately 48%, owing to their role in direct and indirect cost management, managing specialty drug costs, and driving biosimilar adoption. They facilitate utilization management, value-based contracts, and integration with behavioral health. They focus on mitigating the financial impact of pharmaceutical expenditure in the North America pharmaceutical market.

The other segment is expected to grow at the fastest CAGR in the market during the forecast period due to the focus on underserved areas, drug development for rare diseases, and the reduction of development risks. They strengthen supply chains and set standards for quality assurance in procurement. They enhance digital capabilities and adopt decentralized trials.

North America dominated the market in 2024, owing to the increased focus of governments on pharmaceutical pricing, drug manufacturing, R&D funding, and improved access to novel medicines and effective treatments. The North America pharmaceutical market includes top pharmaceutical companies across North America, including Pfizer, Johnson & Johnson, Novo Nordisk, Novartis, Bristol Myers Squibb, AbbVie, AstraZeneca, Roche Diagnostics, and many more. These companies are expanding and achieving massive growth through strategic collaborations and investments in R&D facilities, manufacturing, and the pharmaceutical division. They are advancing their clinical trials to diagnose, prevent, and treat incurable diseases through novel approaches like stem cell-based research, regenerative medicine, precision medicine, and quantum computing. North American governments are enabling pharmaceutical hubs to grow and expand through transparency and resilience in supply chains and logistics.

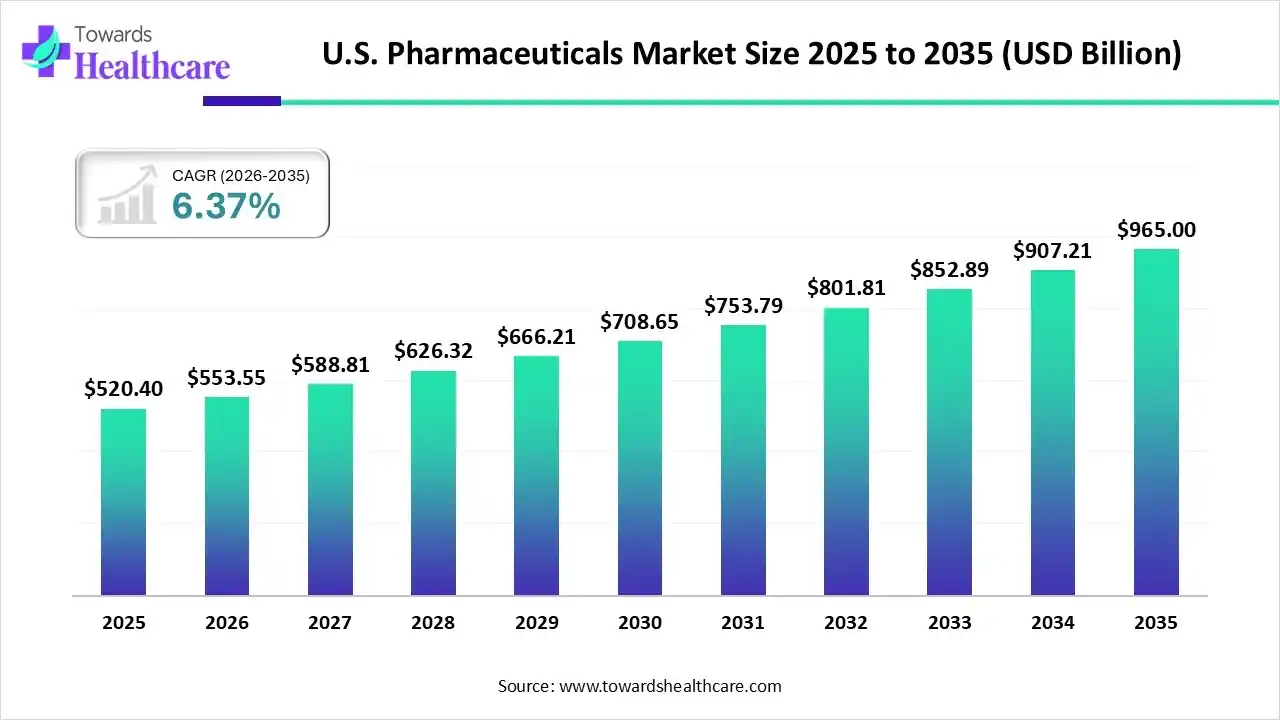

The U.S. pharmaceutical market size is calculated at USD 520.4 billion in 2025, grew to USD 553.55 billion in 2026, and is projected to reach around USD 965 billion by 2035. The market is expanding at a CAGR of 6.37% between 2026 and 2035.

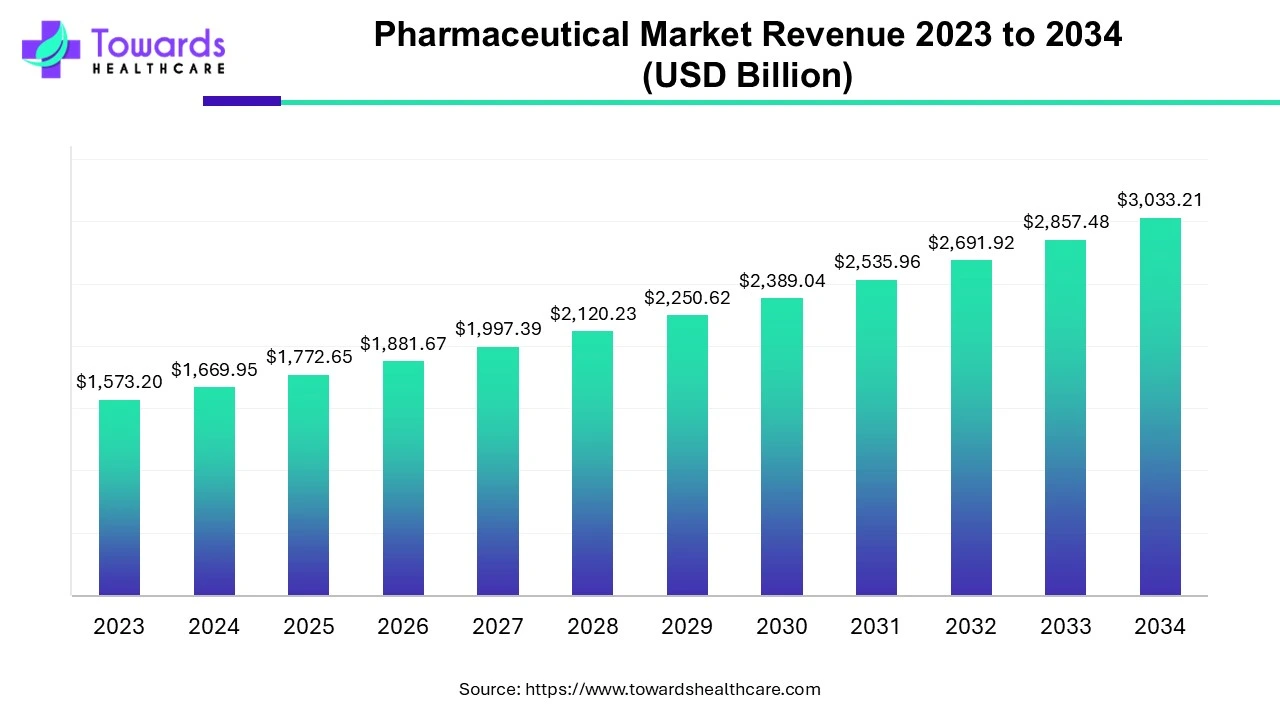

The global pharmaceutical market was valued at approximately US$ 1,573.20 billion in 2023 and is expected to reach US$ 3,033.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.15% between 2024 and 2034.

The R&D process for pharmaceuticals includes several stages, such as drug discovery and development, preclinical research, clinical research, regulatory review and approval, and post-market monitoring.

Key Players: Johnson & Johnson, AbbVie, AstraZeneca, Bristol Myers Squibb, Merck & Co., Novartis, Pfizer, Eli Lilly, Roche, Sanofi, GlaxoSmithKline.

The growing need for specialty and high-value drugs drives the distribution of pharmaceuticals to hospitals and pharmacies.

Key Players: McKesson Corporation, Cardinal Health, Walgreens Boots Alliance.

The growing integration of digital health services like mobile health applications, wearables, patient portals, and digital patient engagement tools boosts supportive patient care.

Key Players: Johnson & Johnson, AbbVie, AstraZeneca, Bristol Myers Squibb, Merck & Co., Novartis, Pfizer, Eli Lilly, Roche, Sanofi.

By Product Type

By Therapeutic Area

By Channel/Distribution

By Business Model/Revenue Stream

By Buyer/Payer Type

By Region

February 2026

February 2026

February 2026

February 2026