February 2026

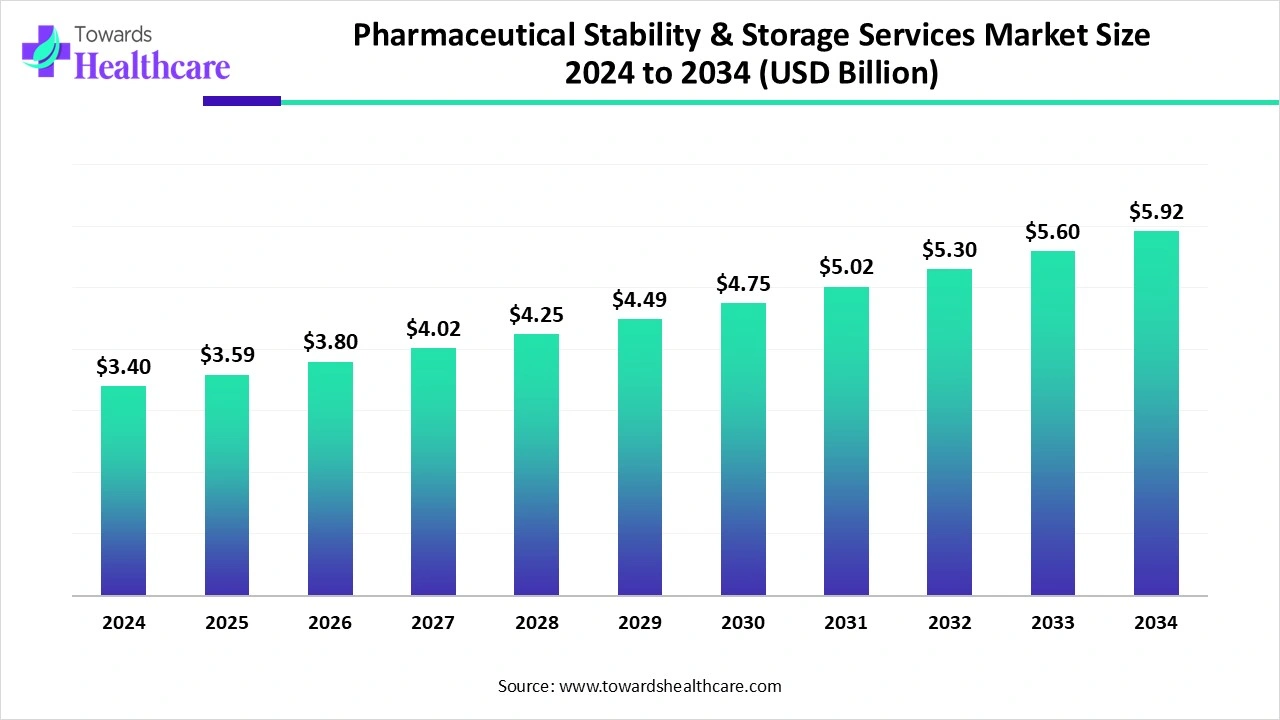

The global pharmaceutical stability & storage services market size is calculated at US$ 3.4 billion in 2024, grew to US$ 3.59 billion in 2025, and is projected to reach around US$ 5.92 billion by 2034. The market is expanding at a CAGR of 5.7% between 2025 and 2034.

The pharmaceutical stability & storage services market is influenced by various services and technology trends, including stability testing services and storage solutions. The stability testing services revolve around automation, analytical techniques, and advanced techniques, while storage solutions are related to cold chain logistics, technological integration, and customization. The major market players like Catalent Inc., Alcami Corporation, Charles River Laboratories, Eurofins Scientific, Cold Chain Technologies, and many others are dedicated to expanding their global footprint and service offerings through acquisitions and strategic investments. This market remains a crucial segment of the life sciences industry that focuses on the quality, safety, and efficacy of drug products.

| Table | Scope |

| Market Size in 2025 | USD 3.59 Billion |

| Projected Market Size in 2034 | USD 5.92 Billion |

| CAGR (2025 - 2034) | 5.7% |

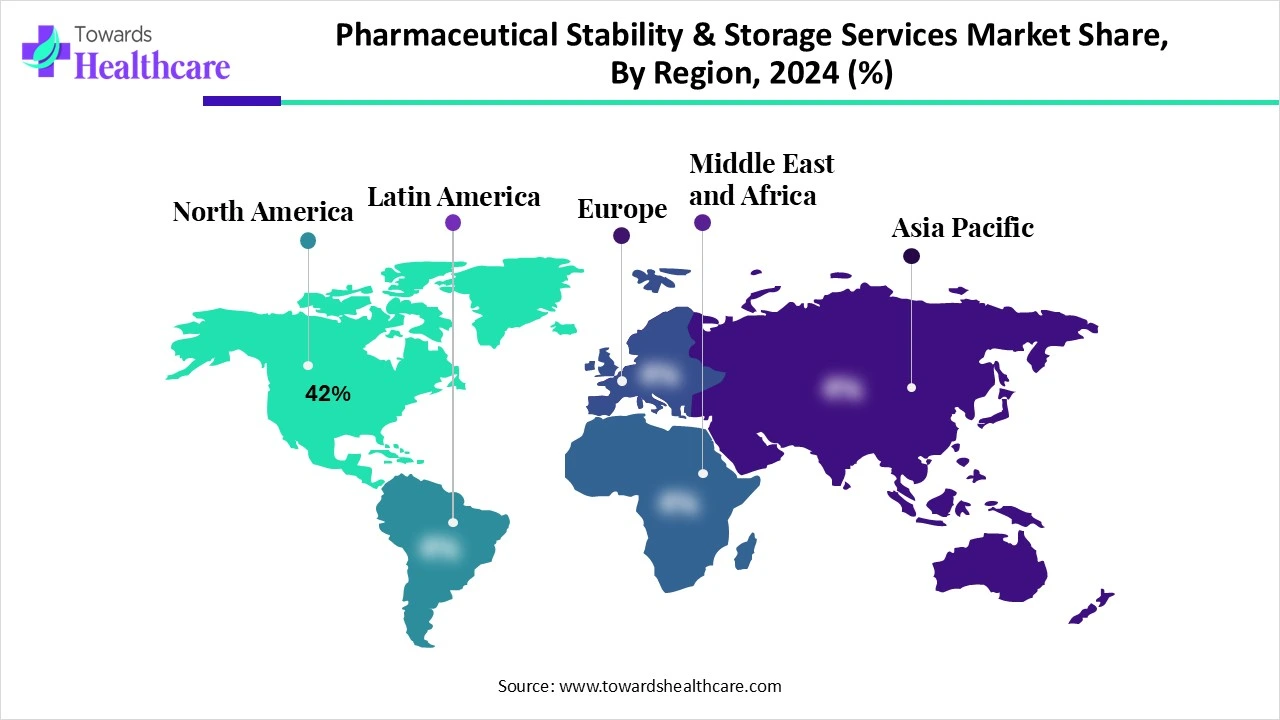

| Leading Region | North America 42% |

| Market Segmentation | By Service Type, By Molecule Type, By End User, By Storage Condition, By Region |

| Top Key Players | Catalent, Inc., Charles River Laboratories, Eurofins Scientific, Intertek Group plc, SGS SA, Labcorp Drug Development, PCI Pharma Services, Thermo Fisher Scientific (Patheon), Almac Group, WuXi AppTec, Syngene International Ltd., Piramal Pharma Solutions, Medpace Holdings, Inc., IQVIA, BioStorage Technologies (Brooks Life Sciences), Biocair International Ltd., Nelson Labs (Sotera Health), QPS Holdings, SGS Life Science Services, MicroConstants, Inc. |

The pharmaceutical stability & storage services market includes contract services provided by CROs, CDMOs, and specialized laboratories that support pharmaceutical, biotechnology, and medical device companies in ensuring product quality, safety, and regulatory compliance throughout shelf life. These services encompass stability testing (ICH and non-ICH conditions), controlled storage, environmental monitoring, accelerated testing, photostability, and forced degradation studies. Demand is driven by increasing drug development pipelines, complex biologics and cell and gene therapies, stringent global regulatory standards (FDA, EMA, ICH), and outsourcing trends. Specialized facilities with temperature/humidity-controlled chambers (e.g., -80°C freezers, LN2 storage, walk-in stability rooms) are critical.

The Make in India initiative is transforming India’s global pharmaceutical footprint. For instance, in April 2025, the Department of Pharmaceuticals, under the Ministry of Chemicals and Fertilizers, reported that India has remained the largest vaccine supplier of UNICEF for the past 6-7 years, which contributes 55% to 60% of the total volume procured. It has also been reported that India contributes 99%, 52% and 45% of the WHO demand for DPT, BCG, and measles vaccines.

The Government of India is driving cost-to-innovation-based growth by robust research activities. For instance, in July 2025, the Ministry of Chemicals and Fertilizers announced that the Promotion of Research and Innovation in Pharma MedTech Sector (PRIP) scheme was launched with an expenditure of ₹ 5,000 crore to transform the Pharma MedTech sector of India.

The integration of artificial intelligence into pharmaceutical stability testing results in data centralization, predictive modelling, vision automation, and regulatory automation. AI/ML models are trained on massive datasets of drug structures, storage conditions, and past stability studies. AI models help in the simulation of real-time long-term stability curves with more accuracy.

What are the Major Drifts in the Pharmaceutical Stability & Storage Services Market?

The emerging trends in this market include technological advancements such as IoT-enabled monitoring systems, blockchain-based traceability, advanced packaging solutions, etc. There is an increased shift towards specialized solutions, which involves the growing demand for biologics and temperature-sensitive drugs. The industries are making efforts on personalized medicine, small-batch production, and cryogenic storage solutions.

What are the Potential Challenges in the Pharmaceutical Stability & Storage Services Market?

Certain challenges arise from complex drug therapies, biologics, advanced drug therapies, personalized medicine, and combination products. Moreover, technological and operational challenges are associated with costly technologies, integrating technologies, counterfeit products, and sustainability demands. Some difficulties arise while adopting digital solutions, utilizing outsourcing, and improving data analysis.

What is the Future of the Pharmaceutical Stability & Storage Services Market?

There are numerous growth opportunities in advancing biologics, advanced therapies, and complex drug formulations. There are advances in science and digital technology that accelerate R&D with data, AI, and patient-centric trials. The industries are focusing on optimizing supply chains for sustainability and resilience.

The stability testing segment dominated the market in 2024, owing to the importance of solutions like stability chambers for pharmaceuticals and medical devices. The stability testing associated with different assessment parameters, such as potency, purity, pH, sterility, etc., drives the adoption of these solutions. The urgent need for the pharmaceutical industries to ensure safety, efficacy, quality, and multidisciplinary standards fuels the expansion of stability testing services.

The storage services segment is expected to grow at the fastest CAGR in the market during the forecast period due to the primary role of storage services in GMP-compliant warehousing, cold chain logistics, ultra-low temperature storage, and environmental control for stability testing. There is a growing demand for biopharma services and the expansion of global supply chains. The increased outsourcing and sustainability focus drive the need for improved storage services.

The small molecules segment dominated the market in 2024, owing to the trends and innovations in stability and storage services, which include advanced drug delivery systems, nanocarriers, and self-emulsifying systems. The higher stability of small molecules than larger biological molecules makes them key elements in pharmaceuticals. The innovations in stability testing, advanced drug delivery systems, and supply chain technologies are crucial parameters to ensure the safety and efficacy of pharmaceutical drugs.

The biologics segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the expansion of the biopharma pipeline and growth of specialized therapies. Research on biologics focuses on patient safety and outsourcing. The increased complexity and volume of the sensitive drugs drive research on biologics. Biologics contribute to enhanced cold chain management and advanced analytical and testing techniques.

The pharmaceutical companies segment dominated the market in 2024, owing to the significance of ensuring the safety, quality, and efficacy of drug products. The biopharmaceutical companies focus on meeting stringent regulatory requirements and adapting to industry trends. They support clinical trials and drug development while ensuring economic viability and brand reputation.

The biotechnology companies segment is anticipated to grow at a notable rate in the market during the upcoming period due to the significant growth of biotechnology industries in areas like gene therapies, biologics, and advanced therapeutics. The industries make efforts to manage global supply chains and resolve complexities in logistics and storage. They ensure regulatory compliance and adhere to quality assurance standards.

The refrigerated (2–8°C) segment dominated the market in 2024, owing to the need for preservation of efficacy and stability of biosimilars, biologics, vaccines, and insulin. The proper storage conditions of 2-8 degrees Celsius help to mitigate risks and financial losses. They prevent drug waste, ensure patient safety, and reduce financial losses. They facilitate clinical trials and support global distribution of pharmaceutical products.

The ultra-cold & cryogenic (<-150°C, LN2) segment is predicted to grow at a rapid rate in the market during the studied period due to the vital role of ultra-cold and cryogenic storage in the preservation of biologics and advanced therapies. These storage conditions ensure the viability of drugs and vaccines and contribute to stability testing. The liquid nitrogen applications result in cryogenic freezing, preservation, vapor-phase storage, and cryosurgery.

North America dominated the market share 42% in 2024, owing to Strong FDA-driven compliance demand and the presence of large CRO/CDMOs (e.g., Catalent, Charles River). The government-led initiatives focused on improving domestic manufacturing, making strong supply chains, and updating regulations. The pandemic and epidemic cases across this region led to these government plans to boost national self-reliance in medicine production.

The U.S. government focused on regulatory compliance and pharmaceutical readiness. The government programs aim to boost the U.S. drug manufacturing and domestic supply chain resilience. These efforts are driven by creating a regulatory framework to overcome regulatory challenges.

Health Canada is putting its efforts into implementing the updated international guidelines to ensure the stability of pharmaceutical products. It focuses on the updates of clinical trial regulations and International Council for Harmonisation (ICH) guidelines. Canada adopted this harmonized approach to ensure the stability and storage testing.

Asia Pacific is expected to be the fastest-growing region in the market during the studied period due to growth in India, China, Singapore, and CDMOs, and cost-effective outsourcing. Several Asian Pacific countries implemented the regulations and programs to improve pharmaceutical stability, manufacturing standards, and supply chain efficiency. This regional growth in the pharmaceuticals industry is driven by the adoption of international standards and the harmonization of regulations.

The Central Drugs Standard Control Organization (CDSCO) and Good Distribution Practices (GDP) released guidelines for medical products. The various schemes offer subsidies to pharmaceutical manufacturing units. The government provides financial assistance to states for the development of healthcare infrastructure facilities.

The regulatory reforms by China's National Medical Products Administration (NMPA) resulted in significant regulatory changes to align with international standards. The ASEAN and other partners contribute to revised trade agreements. The Good Pharmacovigilance Practice (GVP) regulations focus on monitoring drug safety.

Europe is expected to grow at a notable rate in the market in 2024. This regional growth is attributed to the EMA/ICH compliance, high biotech R&D in Germany, the UK, and Switzerland. Several government initiatives, new regulations, and funding focused on resolving drug shortages and increasing domestic manufacturing. The efforts to make strong supply chains and updates on good manufacturing practices (GMP) boost the manufacturing of essential medicines.

The major government actions of France include mandatory reporting, mandatory stockpiling, and strict penalties. The private equity investments in the French pharmaceutical industry are significant. They improve logistics and services and drive market-driven developments.

Germany experiences the implementation of pharmaceutical legislation and drives supply chain initiatives. The research incentives, drug pricing, and critical medicine supply drive the expansion of the pharmaceutical industries in Germany.

In December 2024, Kasim Kutay, CEO of Novo Holdings, announced that the company feels delighted to invite Alessandro and the talented Catalent team to the Novo Holdings family. Catalent Inc. plays a significant role in accelerating product development, product launch, and supply solutions for pharmaceutical, biotechnology, and consumer health companies. He also reported that the company’s mission aligns with the goal of Novo Holdings to invest for the well-being of people and planet.

By Service Type

By Molecule Type

By End User

By Storage Condition

By Region

February 2026

February 2026

February 2026

January 2026