December 2025

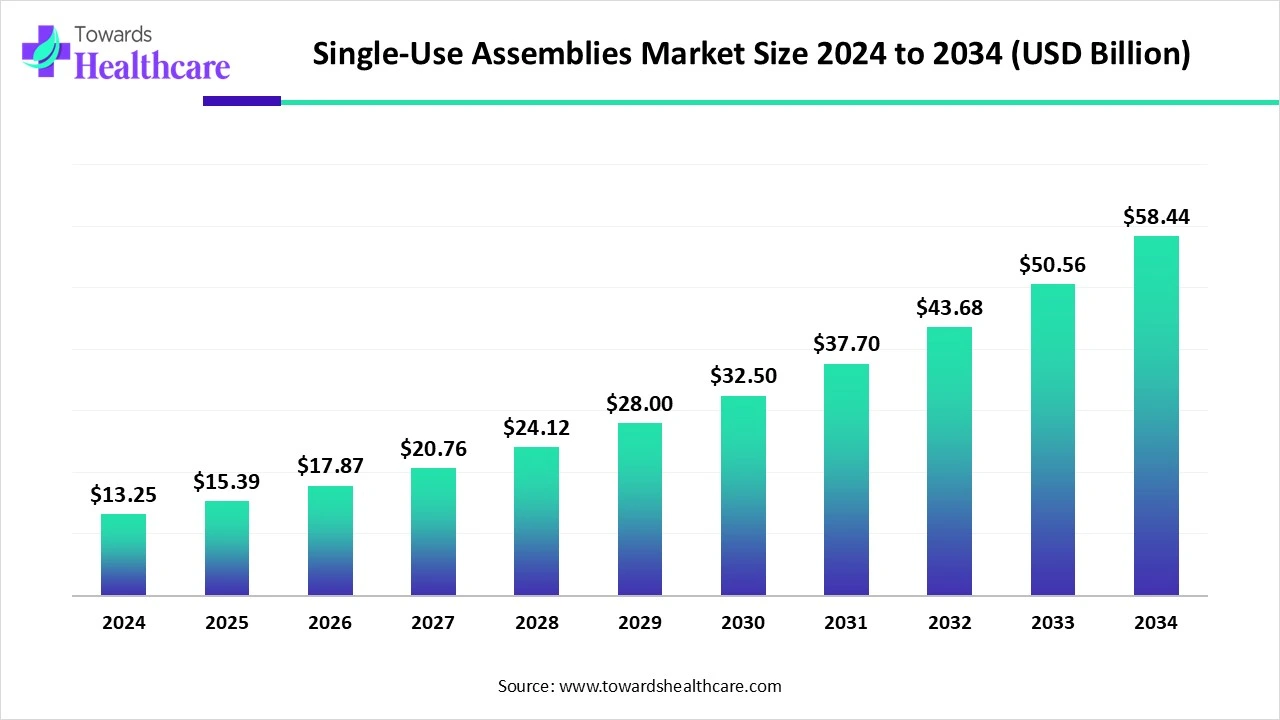

The global single-use assemblies market size is calculated at USD 13.25 billion in 2024, grow to USD 15.39 billion in 2025, and is projected to reach around USD 58.44 billion by 2034. The market is expanding at a CAGR of 16.15% between 2025 and 2034.

The single-use assemblies market is experiencing strong global growth, driven by rising biopharmaceutical and vaccine production, which demand sterile, flexible, and cost-effective processing solutions. These assemblies reduce contamination risks, enhance operational efficiency, and support faster turnaround in manufacturing. Technological advancements, along with supportive regulatory frameworks and increasing adoption in emerging markets, are further fueling market expansion across research labs, contract manufacturers, and pharmaceutical companies.

| Metric | Details |

| Market Size in 2025 | USD 15.39 Billion |

| Projected Market Size in 2034 | USD 58.44 Billion |

| CAGR (2025 - 2034) | 16.15% |

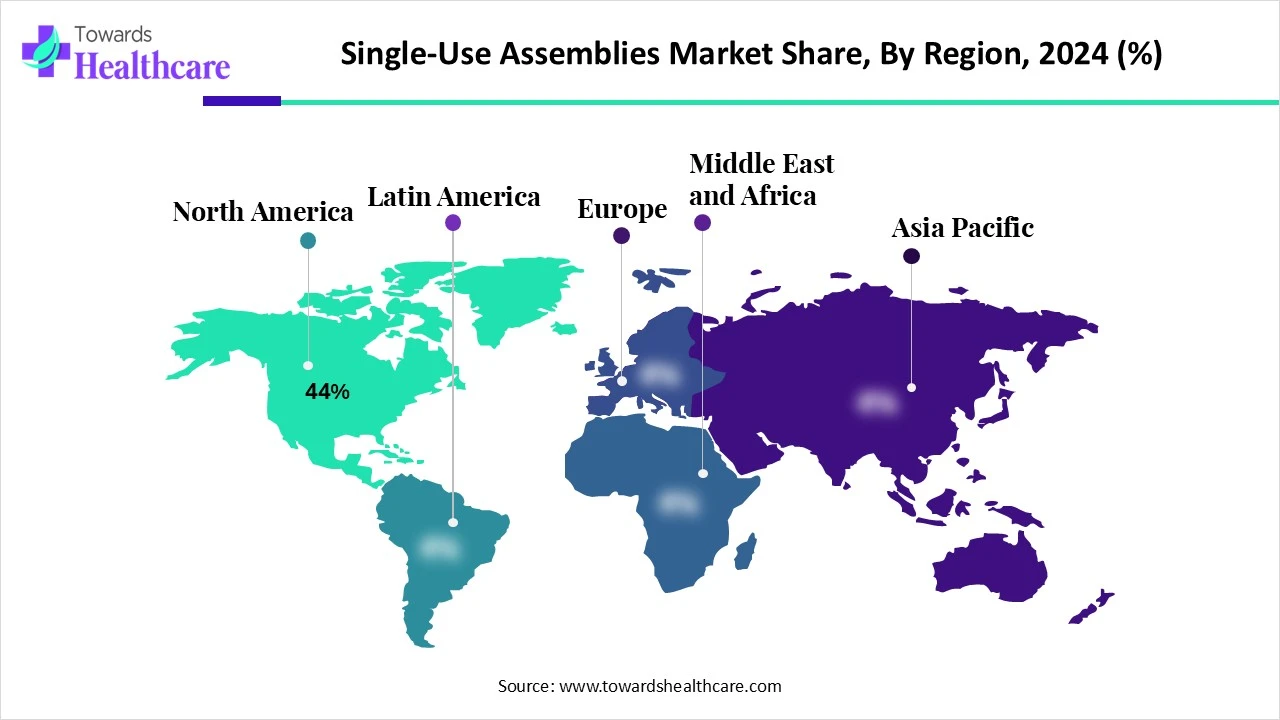

| Leading Region | North America share by 44% |

| Market Segmentation | By Solution Type, By Product Type, By Application, By End User, By Bioprocessing Stage, By Region |

| Top Key Players | Sartorius AG, Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Danaher Corporation (Cytiva), Saint-Gobain Life Sciences, Avantor, Inc., Pall Corporation, Entegris, Inc., Repligen Corporation, Meissner Filtration Products, Parker Hannifin Corporation, EWPS (formerly Colder Products Company - CPC), KBI Biopharma, Eppendorf AG, ILC Dover LP, FlexBiosys Inc., Gore & Associates, ZETA GmbH, ABEC, Inc., Asahi Kasei Medical Co., Ltd. |

The Market refers to the market for pre-assembled, sterile fluid path systems designed for biopharmaceutical and biologics manufacturing processes. These assemblies integrate components such as tubing, connectors, clamps, filters, and sensors into ready-to-use systems that eliminate the need for cleaning, sterilization, and validation between batches. Single-use assemblies offer benefits such as reduced cross-contamination risk, faster turnaround time, improved operational flexibility, and lower operational costs.

As biologics and cell & gene therapies expand, demand for these disposable solutions continues to surge across upstream and downstream bioprocessing workflows. The single-use assemblies market is evolving rapidly, driven by increasing adoption in biologics and vaccines manufacturing. Innovation like integrated sensors, modular plug-and-play systems, and analytics-enabled disposables is enhancing flexibility, reducing contamination risk, and improving process efficiency.

AI can significantly impact the market by enhancing process optimization, predictive maintenance, and quality control. Through data analytics and machine learning, AI enables real-time monitoring of manufacturing workflows, reducing downtime and minimizing contamination risks. It also supports smarter supply chain management and accelerates innovation in design and production, making single-use systems more efficient, reliable, and adaptable to the evolving needs of biopharmaceutical manufacturing.

Rising Demand for Biopharmaceuticals and Vaccines

The surge in demand for biopharmaceuticals and vaccines is driving the adoption of single-use assemblies, as they offer flexible, sterile, and scalable solutions ideal for biologics production. These systems minimize contamination risks, reduce downtime, and eliminate the need for extensive cleaning, making them highly efficient for high-throughput manufacturing. With biologics becoming a central focus in modern medicine, single-use technologies are increasingly preferred for their ability to streamline production and meet growing global healthcare needs.

For Instance,

Limited Reusability and Environmental Concerns Due to Plastic Waste

The disposable nature of single-use assemblies contributes to increasing plastic waste, which raises sustainability challenges and attracts environmental scrutiny. As industries and regulators push for eco-friendly manufacturing practices, concerns over waste management and the limited recyclability of medical-grade plastic make adoption more complex. This growing environmental pressure can hinder the market's expansion, especially in regions with strict waste disposal regulations and sustainability goals.

Expansion for Personalized Medicine and Cell & Gene Therapies

The growing focus on personalized medicine and cell and gene therapies presents a significant opportunity for the single-use assemblies market. These therapies require flexible, small-batch, and contamination-free manufacturing processes, which single-use systems are well-suited to provide. Their modular design, ease of customization, and reduced cross-contamination risk make them ideal for producing individualized treatments. As demand for precision therapies rises, the need for scalable and adaptable manufacturing solutions will further drive the adoption of single-use technologies.

For Instance,

In 2024, the standard assemblies segment led the market due to their widespread availability, lower cost, and ease of integration into existing bioprocess workflows. These ready-made solutions are preferred for routine operations, reducing setup time and ensuring consistency across batches. Their reliability and shorter lead times make them ideal for large-scale biopharmaceutical manufacturing, especially where speed and cost-efficiency are critical, contributing to their dominant share in the global market.

The custom assemblies segment is expected to see the fastest growth as biopharma companies increasingly seek specialized solutions to match unique manufacturing requirements. These assemblies allow greater flexibility in system design, making them ideal for complex and small-batch production, such as in cell and gene therapies. As the industry shifts towards more personalized and high-value treatments, demand for tailored single-use systems that ensure precision and process compatibility continues to accelerate, driving the market expansion.

For Instance,

The bag assemblies segment dominated the single-use assemblies market in 2024 because of its growing application in fluid handling, storage, and transfer across biopharmaceutical production. These systems are favored for their adaptability, space-saving design, and ability to maintain sterile conditions throughout processing. As demand for efficient and contamination-free manufacturing solutions increased, bag assemblies became the preferred choice for both small-and large-scale operations, driving their strong market performance during the year.

The filtration segment led the market in 2024, driven by its vital function in maintaining product safety and quality during bioprocessing. With biologics and vaccines requiring strict microbial control, filtration systems became essential for removing impurities throughout production. Single-use filtration setups are preferred for their ease of integration, reduced cleaning needs, and enhanced efficiency, making them a top choice across upstream and downstream processes in pharmaceutical manufacturing.

The fill-finish segment is projected to witness the fastest growth in the single-use assemblies market as pharmaceutical manufacturing shifts towards more efficient and sterile solutions for final drug packing. Single-use systems offer enhanced flexibility, reduced risk of cross-contamination, and faster changeovers, which are essential for handling sensitive biologics and small-batch production. Their ability to simplify compliance and support rapid scale-up makes them increasingly favored in modern aseptic processing environments.

The biopharmaceutical & biotech companies segment led the single-use assemblies market in 2024 as these organizations increasingly embraced single-use assemblies to streamline complex biologics production and reduce turnaround times. Their need for adaptable, sterile systems to support high-throughput workflows, especially in the development of advanced therapies, boosted adoption. With a growing focus on innovation, speed to market, and minimizing cross-contamination risks, these companies played a major role in driving revenue within the single-use assemblies space.

For Instance,

The contract manufacturing organizations (CMOs) segment is projected to grow rapidly as more pharmaceutical companies rely on external partners to meet rising production demands and shorten time-to-market. Single-use assemblies offer CMOs the flexibility to manage diverse projects efficiently while minimizing downtime and contamination risks with the increasing downtime and contamination risks. With the increasing need for adaptable, small-batch manufacturing, especially in biologics and advanced therapies, CMOs are expanding their use of single-use systems to remain competitive and meet client expectations.

For Instance,

The upstream processing segment led the market in 2024, driven by its vital role in initial biomanufacturing activities like cell growth and media handling. These stages demand sterile, flexible systems that reduce the risk of contamination and support rapid production cycles. With growing biologics output and the shift toward disposable technologies, single-use solutions became the preferred choice for upstream workflows, contributing significantly to the market dominance.

The fill & finish operations segment is projected to grow at the fastest CAGR in the single-use assemblies market due to increasing demand for sterile, flexible, and efficient final drug packing solutions. Single-use systems reduce the risk of contamination, lower cleaning validation requirements, and support quick batch changeovers, key advantages for aseptic processing. As biologics and personalized therapies require high precision and safety in final dosing, manufacturers are increasingly adopting single-use technologies to streamline fill & finish operations and meet regulatory standards.

North America dominated the market share by 44% in 2024, due to the strong presence of biopharmaceutical companies, increased adoption of advanced technologies, and robust investments in biologics and vaccine production. The region benefits from well-established healthcare infrastructure, favorable regulatory support, and a growing focus on personalized medicine. Additionally, the rising demand for flexible manufacturing processes and the need to reduce contamination risks further propelled the use of single-use systems across bioprocessing facilities in North America.

The U.S. market is expanding due to the increasing demand for biologics, growing investments in biopharmaceutical R&D, and the need for cost-effective, flexible manufacturing solutions. The country’s strong regulatory framework, presence of key market players, and advancements in vaccine and cell therapy production also contribute to market growth. Additionally, the shift toward disposable technologies to reduce contamination risks and downtime is further driving adoption.

For Instance,

Canada's market is increasing due to rising demand for efficient and contamination-free bioprocessing solutions. Growing investments in biologics manufacturing, supportive government initiatives, and expanding biopharmaceutical infrastructure are key drivers. The presence of skilled professionals and collaborations with global players are also enhancing market development. Additionally, the shift toward single-use technologies for flexible and scalable production processes is accelerating adoption across Canadian biotech and pharmaceutical sectors.

For Instance,

Asia-Pacific is anticipated to grow at the fastest pace in the market due to the rapid expansion of the biopharmaceutical sector, increasing government support, and rising investments in healthcare infrastructure. Countries like China, India, and South Korea are enhancing their manufacturing capabilities and adopting advanced bioprocessing technologies. Additionally, the growing demand for vaccines, biosimilars, and personalized therapies, along with a surge in clinical research activities, is driving the adoption of single-use systems in the region.

For Instance,

China’s market is growing due to a booming biopharmaceutical sector supported by strong government incentives and rising R&D investments. The nation is expanding manufacturing capacity with global partnerships and domestic suppliers for bags, tubing, and connectors, reducing lead times and lowering costs. Furthermore, increased demand for biologics, biosimilars, and advanced manufacturing, alongside regulatory alignment with cGMP standards, drives the adoption of flexible, contamination-resistant disposable systems across China.

India’s market is expanding due to the increasing focus on domestic biologics and vaccine production, along with rising partnerships between local and global biopharma companies. The government's supportive initiatives, like Make in India and investments in biomanufacturing infrastructure, have accelerated adoption. Additionally, the need for scalable, cost-effective, and contamination-free production technologies is pushing pharmaceutical companies and contract manufacturers to shift toward single-use systems across their production processes.

Europe is accelerating its market through a combination of industry investments, regulatory backing, and innovation in biomanufacturing. Governments are funding biotech infrastructure and biosimilars R&D, prompting major biopharma players and CDMOs to adopt modular single-use technologies. Advanced automation, materials innovations, and integration of process analytics support continuous and hybrid bioprocessing. Sustainability mandates such as EU eco-design directives and water-saving targets further encourage adoption, while expansion of new biomanufacturing hubs in Germany, the UK, and Switzerland bolsters regional uptake.

For Instance,

In 2023, the UK market generated approximately USD 575.8 million, driven by strong demand in filtration and rapid growth in cell culture and mixing applications. The country accounted for about 4.8% of the global market. With expanding biopharmaceutical manufacturing, rising adoption of flexible production systems, and strong government and private investments, the UK is expected to register the highest growth rate in Europe through 2030.

Germany’s market is rising due to its dominant pharmaceutical and biotechnology infrastructure, extensive R&D investments, and strong presence of global and domestic players like Merck KGaA and Sartorius AG. Leading CDMOs are expanding capacity using disposable systems to meet growing demand for biologics and biosimilars, ensure compliance with EUGMP standards, and streamline production flexibility and contamination control.

In April 2024, SaniSure, a global leader in single-use bioprocessing solutions, recently introduced Fill4Sure, a customizable single-use filling system aimed at improving efficiency, consistency, and speed in drug product filling. Designed to tackle key industry challenges like high costs and slow production, Fill4Sure offers clean 2D surge bags, durable silicone overmolding, precision tubing, and contamination-free needles. Dr. Alex Van Hagen emphasized that Fill4Sure reflects their innovative approach and dedication to supporting customers through personalized, consultative design partnerships. (Source - Contract Pharma)

By Solution Type

By Product Type

By Application

By End User

By Bioprocessing Stage

By Region

December 2025

November 2025

November 2025

February 2026