February 2026

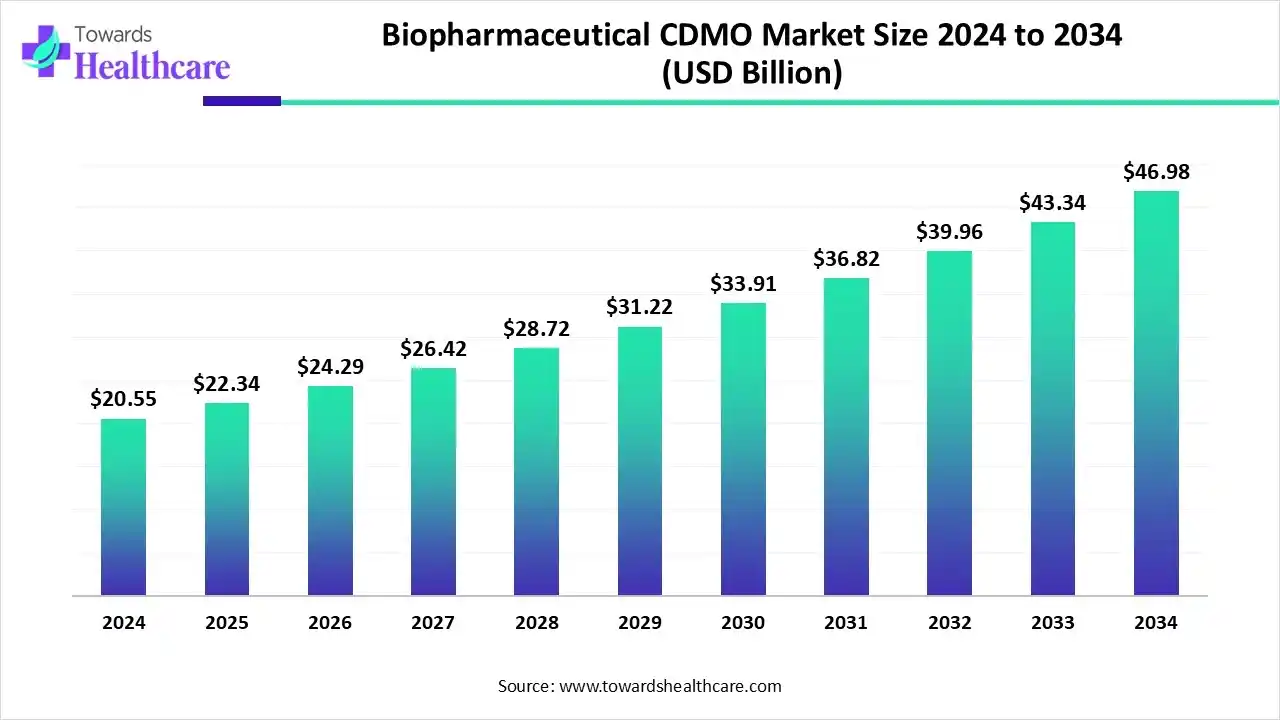

The global biopharmaceutical CDMO market size is calculated at US$ 20.55 billion in 2024, grew to US$ 22.34 billion in 2025, and is projected to reach around US$ 46.98 billion by 2034. The market is expanding at a CAGR of 8.73% between 2025 and 2034.

The growing demand for biologics, advanced therapies, and vaccines is increasing the demand for biopharmaceutical CDMOs. This, in turn, is increasing their use for various purposes for the development of a variety of products. AI is also being used to enhance their workflow, where companies are also developing and using new AI platforms. These advancements are driving the use of these services across various regions. The companies are also collaborating and launching their new products, which, in turn, are contributing to the market growth.

| Table | Scope |

| Market Size in 2025 | USD 22.34 Billion |

| Projected Market Size in 2034 | USD 46.98 Billion |

| CAGR (2025 - 2034) | 8.73% |

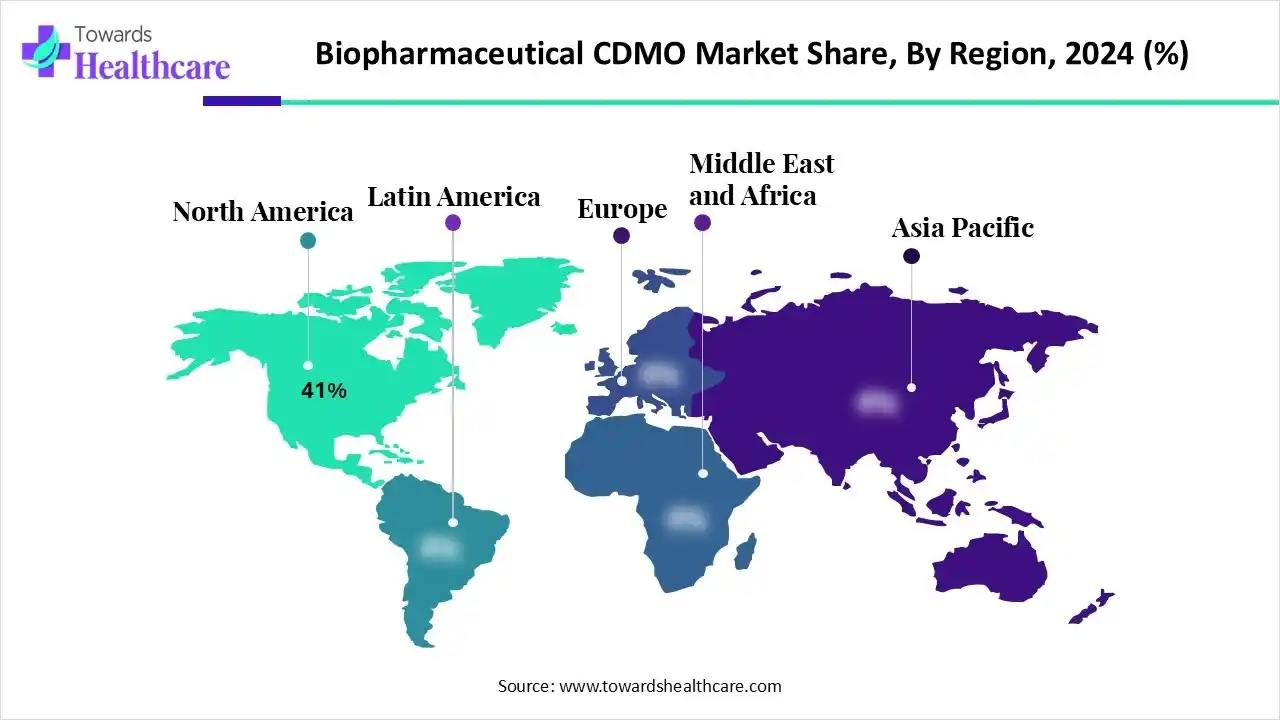

| Leading Region | North America by 41% |

| Market Segmentation | By Service Type, By Product Type, By Technology Platform, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific (Patheon), Boehringer Ingelheim BioXcellence, Rentschler Biopharma SE, AbbVie Contract Manufacturing, AGC Biologics, Charles River Laboratories (Biologics CDMO arm), Emergent BioSolutions, ICONOVO Biologics, Vibalogics (Recipharm), KBI Biopharma, Ajinomoto Bio-Pharma Services, Samsung Bioepis (collaborative manufacturing), Minaris Regenerative Medicine, Binex Co., Ltd., Evotec SE (Biologics CDMO division) |

The biopharmaceutical CDMO market is driven by growth in the demand for specialized manufacturing capabilities and increasing complexities of biologic drugs. The Biopharmaceutical Contract Development and Manufacturing Organization (CDMO) provides outsourced services across the development and production lifecycle of biopharmaceuticals and offers expertise in biologics such as monoclonal antibodies, recombinant proteins, vaccines, cell & gene therapies, and RNA-based therapies. Their services span cell line development, process optimization, analytical testing, clinical and commercial-scale manufacturing, fill–finish, and packaging.

The market is driven by rising demand for biologics, growing biotech start-ups with limited in-house manufacturing, cost-efficiency of outsourcing, complex biomanufacturing processes, and rapid innovation in advanced therapies. Increasing regulatory scrutiny and the trend toward modular and flexible facilities also shape the CDMO landscape.

The use of AI platforms in the biopharmaceutical CDMO is increasing to predict the drug potency and safety. At the same time, it is also being used for drug discovery and development, as well as for quality control. Moreover, it also enhances the packaging and production of large molecules, as well as conducts automated visual inspection.

For instance,

Growing innovations: The growth in the development of biologics, biosimilars, vaccines, etc, is increasing the demand for biopharmaceutical CDMO services. Additionally, growing advanced therapies are also increasing their use for expertise and advanced facilities. These advancements are further supported by the investments and new collaborations among the companies.

For instance,

| Company | Awards | Reason | Source |

| Estizen Bio |

|

Outstanding achievements in global GMP approval and strategic cooperation with global pharmaceutical companies | STzen Bio Wins 2 Portions of 2025 Asia-Pacific Biopharmaceuticals CDMO Awards |

| WuXi Biologics |

|

Brilliance in cutting-edge R&D, biomanufacturing, strategic partnerships, and technological innovation | WuXi Biologics Achieves "CDMO of the Year" Among Three Prestigious IMAPAC Awards |

| AGC Biologics |

CDMO Leadership Awards:

|

Provides cGMP-compliant CDMO services | AGC's Pharmaceutical CDMO Division Won Four Awards at the CDMO Leadership Awards 2025 | News | AGC |

| Amaran Biotech | Best CDMO in Automated Aseptic Filling | Advancing automated aseptic filling solutions, contributing to the biopharmaceutical sector | Amaran Biotech Wins "Best CDMO in Automated Aseptic Filling" |

| Samsung Biologics | CDMO Leadership Awards | Outstanding development and manufacturing service providers | Samsung Biologics named winner of 2025 CDMO Leadership Awards |

| Porton Pharma Solutions Ltd. | Global Small Molecule API Award | Exceptional end-to-end services across the global small molecule drug lifecycle | Porton Pharma Wins 2025 CDMO Leadership Award | Porton Pharma |

By service type, the commercial manufacturing segment led the market with approximately 44% share in 2024, due to growing demand for biologics driving their production rates. At the same time, the growing outsourcing trends to minimize operational costs have also increased their use. Moreover, to comply with the GMP standards, they were preferred.

By service type, the fill–finish & packaging segment is expected to show the highest growth during the predicted time. Due to the growing development of gene therapies, vaccines, and other injectables, the use of biopharmaceutical CDMO for these services is increasing. Additionally, growing demand for personalized treatment options and outsourcing trends are increasing their use.

By product type, the monoclonal antibodies (mAbs) segment held the dominating share of approximately 40% in the market in 2024, as they were used for the treatment of a wide range of diseases. This increased their production and distribution, which increased the demand for biopharmaceutical CDMOs. Moreover, their growing innovations also contributed to their increased use.

By product type, the cell & gene therapies segment is expected to show the fastest growth rate during the predicted time. These therapies are providing curative options to various rare diseases, which is increasing their demand. This, in turn, is increasing the use of biopharmaceutical CDMO services to accelerate the R&D and production.

By technology platform type, the mammalian cell culture segment dominated the market with approximately 47% share in 2024, as they were essential for biopharmaceutical development. They also enhanced the quality and action of the proteins developed. Thus, they were used in the development of a wide range of products.

By technology platform type, the cell & gene therapy platforms segment is expected to show the highest growth during the upcoming years. Due to the growing use of these therapies, their use is increasing, which is enhancing the demand for their platforms. They are also being used for clinical trials.

By end user, the large pharmaceutical companies segment held the largest share of approximately 49% in the market in 2024, driven by the growth in R&D. At the same time, the expanding biologic and biosimilar pipeline is also increasing the use of biopharmaceutical CDMO services. They also supported the product's large-scale manufacturing.

By end user, the biotechnology companies segment is expected to show the fastest growth rate during the upcoming years. The growth in the innovations of advanced therapies is increasing the use of biopharmaceutical CDMO services. They are being used for product manufacturing, R&D, and growing outsourcing trends.

North America dominated the biopharmaceutical CDMO market with approximately a 41% share in 2024. North America consisted of well-developed, large biopharmaceutical ecosystems, which increased the use of biopharmaceutical CDMOs. At the same time, growing R&D and healthcare investments also encouraged their use. Moreover, the presence of advanced infrastructure also increased the production of various biologics, which contributed to the market growth.

Due to the growing production of biologics in the U.S., the demand for biopharmaceutical CDMO services is increasing, along with their manufacturing. They are also used to develop products that comply with regulatory standards, as they provide expertise. Moreover, the government support is also promoting their use.

The biopharmaceutical services are being used for R&D in Canada. At the same time, to enhance their GMP manufacturing, clinical trials, etc., are also increasing their use. Additionally, the growth in the use of cell and gene therapies and R&D investments is increasing their demand for various purposes.

Asia Pacific is expected to host the fastest-growing biopharmaceutical CDMO market during the forecast period. Asia Pacific is experiencing an expansion in the biopharmaceutical industry, which in turn is increasing the demand for biopharmaceutical CDMO services. This growth is due to the growing demand for advanced therapies, vaccines, and biologics. The growing government and private sector investments are also encouraging their use. Thus, this is promoting the market growth.

The R&D of biopharmaceutical CDMO focuses on process development, formulation improvement, manufacturing techniques enhancements, and optimization of new modalities like cell and gene therapies.

Key Players: Lonza Group, WuXi Biologics, Thermo Fisher Scientific, Catalent Inc.

The use of unique identifiers for individual drug packages to ensure end-to-end traceability and authenticity throughout their supply chain to ensure regulatory compliance and prevent counterfeiting is involved in the biopharmaceutical CDMOs.

Key Players: Lonza Group, WuXi Biologics, Thermo Fisher Scientific, Catalent Inc.

The biopharmaceutical CDMO does not directly provide patient support and services, but the client company offers various patient support programs.

Key Players: Lonza Group, WuXi Biologics, Thermo Fisher Scientific, Catalent Inc., Samsung Biologics.

By Service Type

By Product Type

By Technology Platform

By End User

By Region

February 2026

February 2026

February 2026

February 2026