February 2026

The U.S. residual DNA testing market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The U.S. residual DNA testing Market is expanding due to the rising adoption of biosimilars and biologics in pharmaceutical manufacturing, and the government's increasing scrutiny of testing in biotech products to ensure safety and compliance with regulatory standards like the FDA and EMA. Growing technological advancements in the life science sector and stringent quality guidelines, the presence of a strong network of contract research organizations, which is increasing demand for residual DNA testing.

The U.S. residual DNA testing market pertains to the market for analytical assays, kits, and instruments used to detect, quantify, and characterize residual host cell DNA (rcDNA) present in biopharmaceutical products, especially biologics produced via microbial, yeast, or mammalian cell lines. Regulatory bodies such as the FDA and EMA mandate limits on residual DNA in final drug products due to potential safety concerns. Residual DNA testing ensures compliance with these safety thresholds using techniques such as qPCR, Southern blotting, and hybridization assays. It is a critical part of the quality control and release testing in biologics manufacturing, especially for monoclonal antibodies, vaccines, cell and gene therapies, and biosimilars.

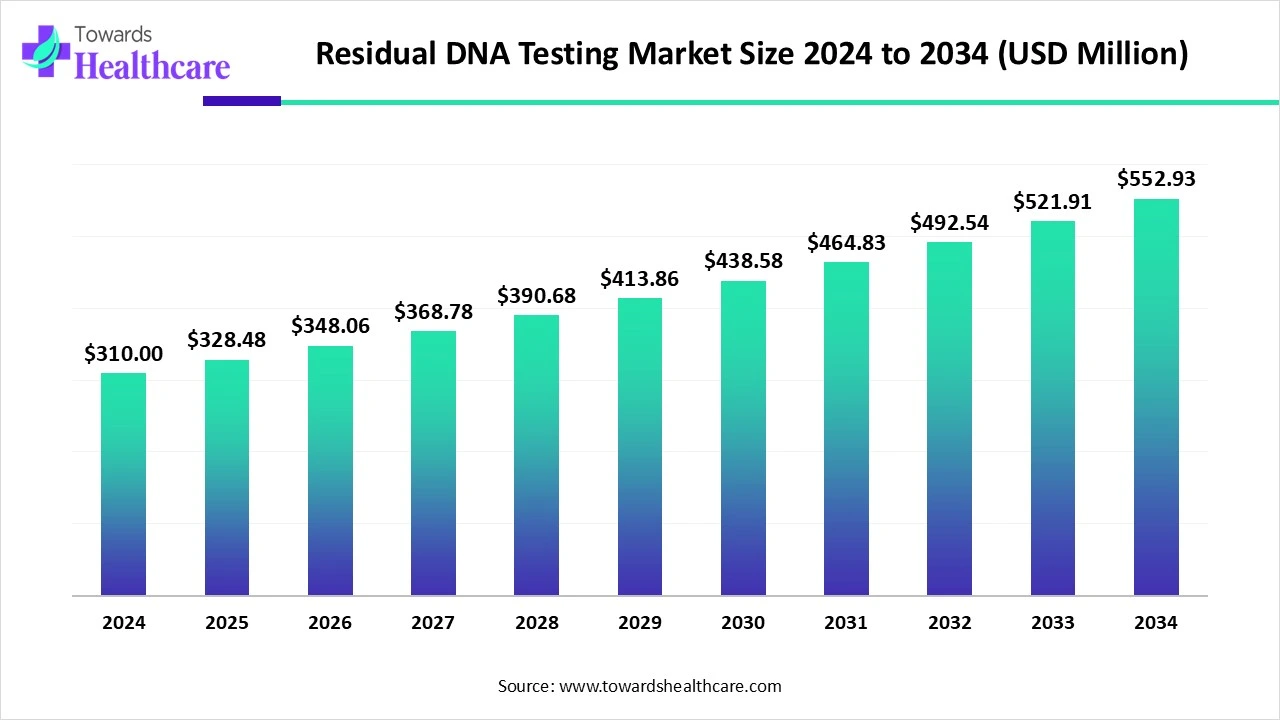

The global residual DNA testing market was valued at US$ 310 million in 2024 and increased to US$ 328.48 million in 2025. It is projected to grow steadily, reaching US$ 552.93 million by 2034, with a compound annual growth rate (CAGR) of 5.96% from 2025 to 2034.

Increasing trend of early newborn screening tests, which help in detecting and preventing severe health conditions, ensuring a healthy start for the baby, which is increasing demand for residual DNA testing.

For instance,

Growing healthcare partnership, professionals adapt drug therapies to personalized genetic profiles, ensuring lower side effects and more efficient results. This supports enhancing patient experience and satisfaction and builds a truthful relationship, which drives the growth of the market.

For Instance,

Integration of AI in the residual DNA testing drives the growth of the market as the AI-driven residual testing is a combination of convolutional neural networks and residual neural networks to efficiently extract hierarchical characteristics and comprehensive patterns from multifaceted amino acid genomic data. This supports increasing the speed of diagnosis and lowers the expenses without compromising testing accuracy and quality. AI-based testing precisely detects genomic profile mutations from multiple clones. This testing also offers a quantitative framework for examining the connection between network features and severe diseases. AI-powered algorithms streamline genomic interpretation, classifying and detecting genetic variants within seconds rather than weeks or months, enhancing diagnostic yield for genetic diseases, which drives the growth of the market.

Increasing Demand for Residual DNA

Increasing demand for residual DNA to ensure the safety and effectiveness of biopharmaceuticals goes beyond careful manufacturing. It is significant to comply with international regulatory standards to reduce risks from high residual DNA levels in products. Residual DNA typically appears in biological products when host cells are needed for production, which also contributes to the growth of the U.S. residual DNA testing market.

Major Limitation of Cell-Based Assay

Major challenges in the development and validation of residual DNA analytical assays in gene therapy. Development of these assays for complex and precise quantitation of host cell DNA and other DNA residuals needs dedicated expertise, it takes more time, and requires developing multiple documents, including method standard operating procedure (SOP), preparation qualification of significant reagents, which limits the growth of the U.S. residual DNA testing market.

Increasing Advancement in Digital Droplet PCR (ddPCR)

Residual DNA testing is essential for assessing the quality and safety of biologics, as well as for process validation, batch-to-batch variation, and GMP lot release. While real-time qPCR is the standard method for residual DNA analysis, digital droplet PCR (ddPCR) offers several key advantages. These include high sensitivity and specificity, absolute quantification without the need for a standard curve, excellent reproducibility, tolerance to PCR inhibitors, and greater efficiency compared to traditional molecular techniques. These benefits are driving growth in the U.S. residual DNA testing market.

By product type, the kits & reagents segment led the U.S. residual DNA testing market, as residual DNA kits and reagents are designed for applications of molecular biology in pharmaceutical product testing. These are not used for the prevention, diagnosis, or treatment of a disease. It is applied in delicate and rapid real-time PCR quantification of residual host cell genomic DNA using dual-labeled hydrolysis. Kit comprises reagents for duplex real-time PCR identification of CHO residual host cell DNA, and certain internal controls. It enables sensitive and reliable identification and quantification of residual genomic DNA (gDNA), which is significant for the manufacturing of safe and reliable biopharmaceuticals.

On the other hand, the software & services segment is projected to experience the fastest CAGR from 2025 to 2034, as this provides actionable insights significant for biopharmaceutical production. This software and services integrate simply with a validated workflow, which uses sample preparation, real-time PCR, data analysis, and report generation for accurate contaminant and adulteration assessment.

The testing services sub-segment is dominant in the software & services segment as CROs and CDMOs offer inclusive residual DNA testing services, it has high specificity and sensitivity to meet stringent industry guidelines. It also provides strong reproducibility, ensuring reliable results and high-throughput abilities for effective large-scale testing.

By technology, the quantitative PCR (qPCR) segment is dominant in the U.S. residual DNA testing market in 2024, as qPCR is considered the ideal standard for residual DNA quantification. Its affordable sequence-derived amplification makes it supreme for pinpointing exact sequences. Its capability to offer quantitative data that is sensitive and specific, making it possible to identify low-abundance transcripts in multifaceted biological samples.

The next-generation sequencing (NGS) segment is projected to grow at the fastest CAGR from 2025 to 2034, as it enables scientists to decode DNA at an extraordinary speed and scale, creating a major opportunity for ground-breaking discoveries. With NGS, investigators sequence millions of DNA fragments from hundreds of samples all on a single sequencing run, making NGS a wild, affordable method for advanced genomic technology. The significant benefits of next-generation sequencing (NGS) using genomic DNA as input are stability, individuality of gene expression levels, and the ability to identify any NPM1 variant in an assay.

By application, the biologics manufacturing segment led the U.S. residual DNA testing Market in 2024, as accurate, sensitive, and reproducible detection of residual DNA is significant to government compliance and product safety in the manufacturing of biologics. Residual DNA tests are important to confirm that the end products are free of hazardous or unwanted DNA residues that pose potential health challenges to patients. Residual DNA tests are used during the production of biopharmaceuticals when bacterial, animal, or human host cells are used to produce recombinant proteins, monoclonal antibodies, or vaccines. In these manufacturing procedures, host cells are characteristically lysed to extract the desired therapeutic proteins.

The cell & gene therapy products segment is projected to experience the fastest CAGR from 2025 to 2034, as residual DNA testing plays a significant role in cell and gene therapy. It applies to checking product quality and safety assessment, process validation, evaluating batch-to-batch variation, and GMP lot release. Precise identifications of residual DNA levels confirm that biologics meet regulatory requirements and are harmless to the patients.

By end user, the biopharma & biotech companies segment led the U.S. residual DNA testing market in 2024, as it ensures the purity and safety of biopharmaceutical products, so it is used by biopharma & biotech manufacturing companies. These tests are important for regulatory compliance and preserving product quality during the manufacturing process. Manufacturing proper host cell residual DNA assays helps to monitor the production process.

On the other hand, the contract development and manufacturing organizations (CDMOs) segment is projected to experience the fastest CAGR from 2025 to 2034, as CDMOs use residual DNA testing to confirm the quality and safety of pharmaceutical products, predominantly those derived from mammalian cell lines. It also offers ultra-sensitive detection of genomic DNA from multiple species, and high sensitivity and accuracy.

The U.S. pharmaceutical sector is experiencing noteworthy growth due to the growing demand for innovative and personalized treatments. Increasing advanced research and development is significant for emerging novel drugs that treat and manage various types of diseases, and create novel medicines and vaccines, which increases the demand for residual DNA testing. Growing early adoption of advanced technology, such as NGS, qPCR, and digital PCR, for accurate testing. Increasing healthcare institution and contract research centers also drives the growth of the market. As of 2024, there were 4,321 CRO businesses in the United States.

For Instance,

In April 2025, Shakti Ramkissoon, M.D., Ph.D., vice president, medical lead for oncology at Labcorp, stated, “With the expansion of our portfolio to include Labcorp Plasma Detect for clinical use and the availability of PGDx elio plasma focus Dx to support patient treatment selection, we're advancing care across the oncology spectrum, solidifying our commitment to transforming cancer diagnostics and improving patient outcomes.”

By Product Type

By Technology

By Application

By End User

February 2026

February 2026

January 2026

January 2026