February 2026

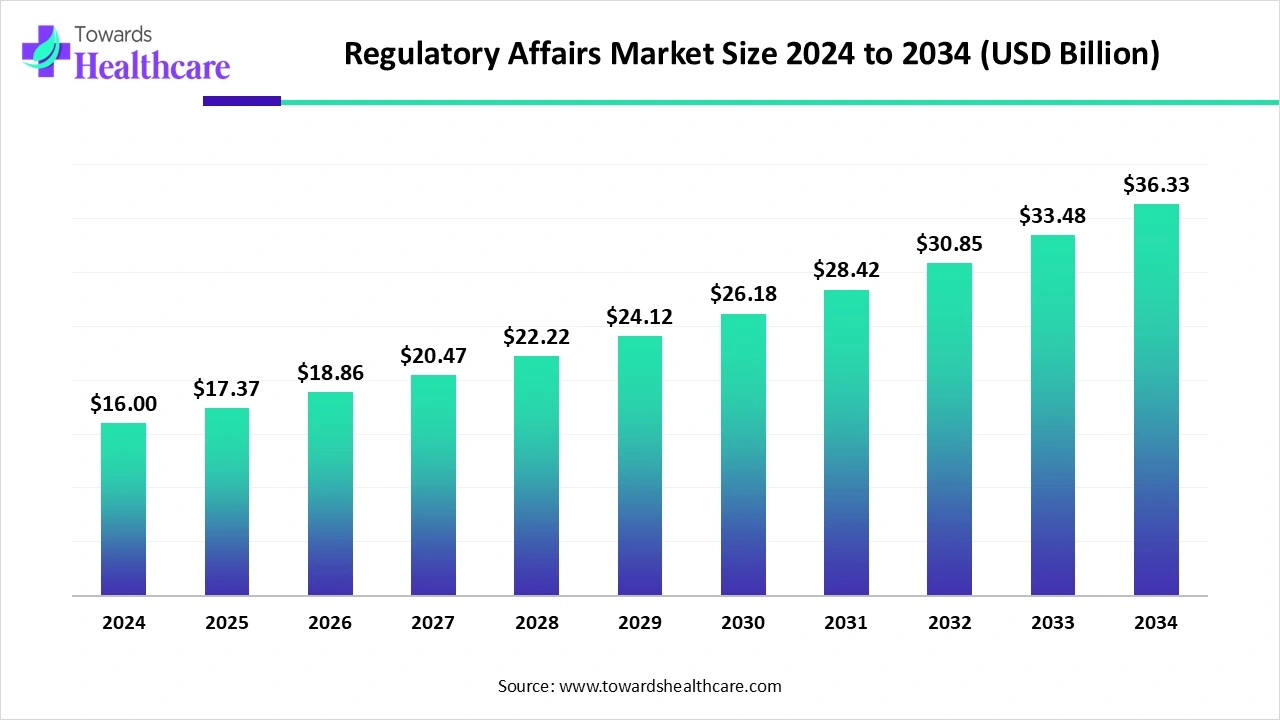

The global regulatory affairs market size is calculated at US$ 16 billion in 2024, grew to US$ 17.37 billion in 2025, and is projected to reach around US$ 36.33 billion by 2034. The market is expanding at a CAGR of 8.55% between 2025 and 2034.

An aging population is experiencing a huge burden of chronic and rare diseases, like cancers, diabetes, and neurological issues, which are boosting the development of drug molecules and personalized treatments. This further expands the emergence of a strong regulatory landscape for monitoring, evaluating the safety, efficacy of these evolving drugs. The regulatory affairs market is imposing the widespread adoption of digital solutions, like AI tools and other cloud-based software for faster and efficient regulatory submissions to agencies, like the FDA &EMA.

| Table | Scope |

| Market Size in 2025 | USD 17.37 Billion |

| Projected Market Size in 2034 | USD 36.33 Billion |

| CAGR (2025 - 2034) | 8.55% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Category, By Product Type, By End-User/Client Segment, By Delivery Mode/Technology Enablement, By Region |

| Top Key Players | Accenture, ArisGlobal, Bioclinica, Certara, Charles River Associates, Covance, Deloitte, Freyr Solutions, ICON plc, IQVIA, Parexel International, PharmaLex, ProPharma Group, PPD, Veeva Systems |

The regulatory affairs market encompasses professional services, technology platforms, and outsourced solutions that support pharmaceutical, biotechnology, and medical device companies in complying with evolving health authority regulations worldwide. This market covers activities across clinical development, product registration, labeling, lifecycle management, and post-marketing compliance. Offerings include in-house functions, outsourced consulting and CRO partnerships, and software platforms for regulatory information management (RIM). The market is driven by stringent regulatory frameworks, global harmonization needs, faster drug/device approvals, and increasing reliance on digital systems for compliance documentation and submissions.

Diverse pharmaceutical and biopharmaceutical companies are focusing on R&D enhancements, expansion of their facilities is fueling the respective market growth.

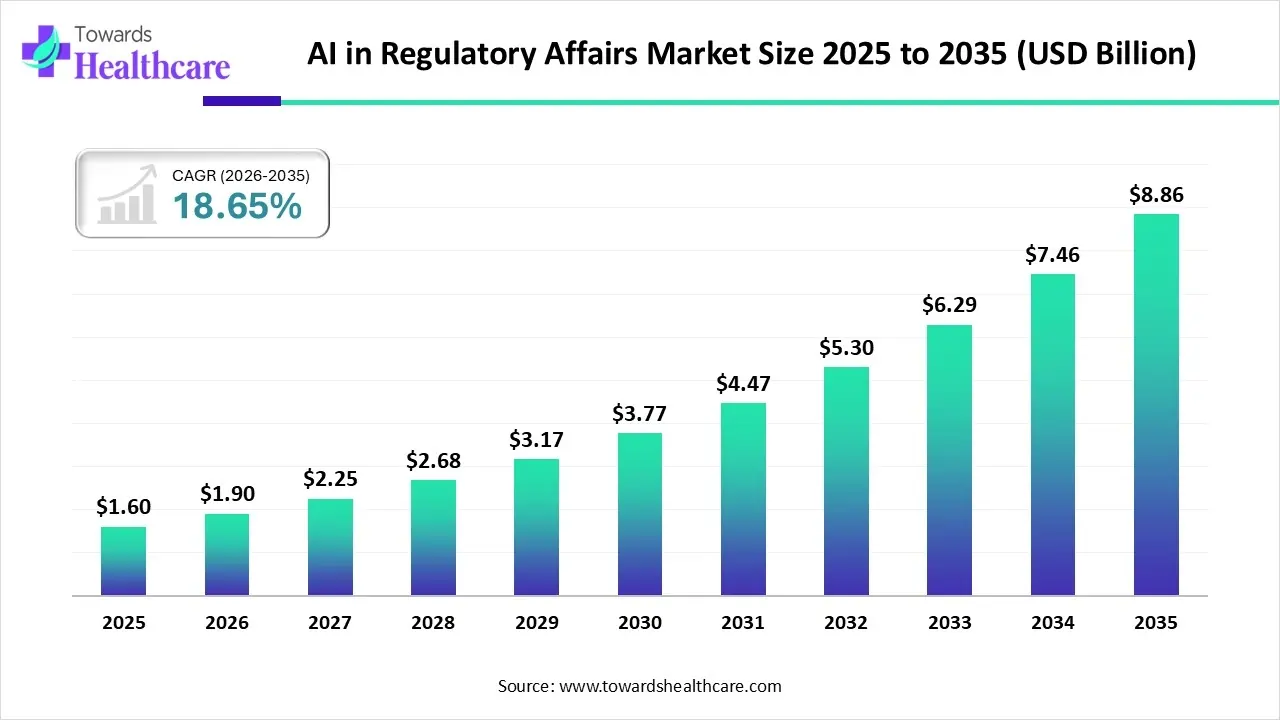

Currently, AI-powered approaches are playing a crucial role in diverse markets, including the regulatory affairs sector. Nowadays, researchers are applying generative AI for intelligent assistants and regulatory co-pilots for automating documentation and submissions, boosting Regulatory Intelligence (RI) by aligning with real-time data and trends. This further allows more effective and proactive compliance monitoring.

For instance,

The global AI in regulatory affairs market size is calculated at US$ 1.6 in 2025, grew to US$ 1.9 billion in 2026, and is projected to reach around US$ 8.86 billion by 2035. The market is expanding at a CAGR of 18.65% between 2026 and 2035.

Emerging Demand and Regulatory Framework

Day by day, the pharma area is transforming due to several ongoing advances, such as AI-powered drug development, digital health, and customized medicine, which further merge with newer regulatory complexities. So this raises wider investments in regulatory professionals and overall regulatory affairs market services. Alongside, developing companies, like small and mid-sized ones, are highly demanding for outsourcing regulatory affairs, which facilitates specialized professionals, lowers expenses, and maintains focus on core business activities. Consistent modifications in regulatory frameworks and guidelines around various areas and for numerous product types are boosting demand for regulatory intelligence and expertise.

QC and Intellectual Property Issues

The growing requirements in regulatory affairs outsourcing are facing barriers regarding the preservation of their proprietary information and intellectual property. Also, the market has been impacted by the need for maintenance of continuous quality control and adherence among outsourcing partners for all regulatory standards, which possibly results in non-compliance.

Regulatory Harmonization in Dx and Blockchain Technology

The worldwide rise of digitization is mainly fueling the emergence of newer regulatory requirements in the coverage of digital therapeutics (Dx). Along with this, the regulatory affairs market will have revolutionary opportunities in mobile health apps and remote monitoring tools to improve their safety, efficacy, and data security. Additionally, innovations in blockchain technology will enable ensuring the traceability and security of clinical data throughout the drug development process. Furthermore, harmonized regulatory landscapes will be helpful in approving tailored medicines that are customized to individual genetic markers.

The product registration segment dominated with the biggest share of the market in 2024. The segment is driven by the accelerating clinical trials, especially for new biologics and gene therapies, and more drug approvals are enhancing the requirements for regulatory submissions and market authorization. In this era, the growing applications of AI and ML in regulatory operations to simplify submissions and analysis, along with an emphasis on regional regulatory harmonization, are propelling the segmental developments. Also, consistent post-market surveillance is assisting in ensuring ongoing compliance.

Moreover, the post-marketing surveillance & pharmacovigilance support segment is estimated to witness the fastest expansion. Developing novel drug molecules is propelling the efforts in the detection of rare adverse events, the growth of regulatory bodies' requirements, and escalating patient populations with complex comorbidities are supporting the push in PMS. These robust PMS/PV services necessitate strong coordination among regulatory affairs, manufacturing, and other departments, along with higher engagement with healthcare providers and consumers, which helps the comprehensive collection and reporting of safety information.

In 2024, the in-house regulatory affairs departments segment accounted for the largest share of the regulatory affairs market. The segment is fueled by the establishment of internal teams by highly developed companies for managing complex and high-stakes submissions, including BLAs and INDs, ensuring feasible integration with R&D and clinical departments. Global companies are stepping into structured, electronic submissions, which streamlines monitoring, updating, and reviewing documents with lower time and expenditures.

And, the outsourced segment is predicted to expand rapidly during 2025-2034. The combination of factors, like the expanding oncology developments, widespread digital transformations, is fueling the effective outsourcing approaches. Currently, the raised focus on strategic, end-to-end partnerships with Contract Development and Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs) which are propelled by spending pressures, the growth of biologics and injectables, and the integration of digital technologies.

The pharmaceuticals segment captured the dominant share of the market in 2024. Across the globe, there is a huge burden of chronic illness cases, particularly cancers, heart issues, and diabetes are boosting the development of novel treatments with a robust regulatory landscape. Involvement of complexities of small molecules strongly emphasizes deeper CMC (Chemistry, Manufacturing, & Controls) data, which comprises impurity determination, stability studies, and method validation, to meet global standards. Ongoing expiration of patents of branded molecules is introducing new opportunities in the progress and sale of inexpensive generic small molecule drugs.

Whereas the biologics & biosimilars segment is estimated to expand rapidly in the coming era. Primarily, the expanding healthcare expenditures and the need for highly cost-effective treatments are driving the demand for biosimilars, which give more comparable versions of reference biologics at an affordable price. A wide range of efforts by regulatory bodies, mainly the FDA, are involved in the increasing number of approvals of biosimilars, coupled with the acquisition of interchangeability designations, enabling them to be automatically substituted for the reference product.

The large multinational pharmaceutical & biotech companies segment held a major share of the regulatory affairs market in 2024. Nowadays, the pharmaceutical hub is focusing on enhancing patient safety and highly efficacious treatments for rare diseases (orphan drugs) and other specialty therapies, which drives the requirements for specialized regulatory assistance to meet unique demands. A significant emphasis on cybersecurity of emerging devices, including pacemakers and insulin delivery systems, which utilize cloud and Bluetooth, regulatory affairs must play a vital role in data security and anti-hacking regulations to protect patients.

Eventually, the start-ups & emerging biopharma segment is anticipated to witness rapid growth. Factors, like leveraging digital solutions, the number of clinical pipelines, and enhanced demand for immunotherapies and other crucial treatments, are revolutionizing the developments in these start-ups and emerging biopharma companies. Various startups should incorporate regulatory planning from the early stages of development, many times collaborating with specialized consultancies or employing global capability centers in hubs, particularly India, to handle complex submissions and ensure patient safety and product quality.

The regulatory information management (RIM) software platforms segment captured the biggest share of the market in 2024. These types of platforms provide a single, centralized repository for all regulatory data, further supporting real-time visibility and better decision-making. The market encompasses sophisticated platforms, like DDiSmart and Freyr Digital, which expand trends consisting of AI, cloud computing, and predictive analytics to leverage proactive compliance and simplified workflows for life sciences and medical device companies.

Although the AI/automation in the regulatory intelligence segment will register the fastest growth, the use of AI helps in scanning regulatory databases, health authority portals, and industry publications for updates, new demands, and changes to present rules. Whereas NLP supports in extracting key information from large volumes of regulatory documents, translations, and submissions to detect related modifications and insights, ultimately minimizing manual review time. The emergence of cloud-based platforms, mainly RegIntel, uses advanced AI to continue complex global regulations into streamlined, actionable insights and intelligence for regulatory teams.

In the regulatory affairs market, North America accounted for a major share in 2024. As this region is the largest area that imposes the FDA-centric demands, and also possesses a robust CRO hub. Alongside the growing number of complex clinical trials and groundbreaking products (comprising biologics and personalized medicine), this results in a significant demand for specialized expertise to navigate strict regulations from agencies, like the FDA.

For instance,

In November 2024, Quantiphi, an AI-first digital engineering company, and DDReg, a global company in regulatory expertise, partnered with a focus on addressing regulatory limitations faced by pharmaceutical, biotechnology, medical device, and cosmetics manufacturers.

The Canadian market comprises the execution of a new biocide regulatory landscape for disinfectants and sanitizers, with strong efforts toward outsourcing, and global trends, such as the adoption of AI, data integration, and IDMP standards within the pharmaceutical and health product sectors. A huge support of the official website, like Canada.ca, acts as a prominent source for regulatory updates and notices related to drug and health product regulations.

During 2025-2034, the Asia Pacific is predicted to register rapid growth in the regulatory affairs market. Primarily, this region is experiencing a major transformation in biopharma companies, clinical trials, and harmonization of regulations. This further impels the broader adoption of digitalization and AI algorithms in application screening, safety monitoring, and the complete effectiveness, especially in India, Singapore, Japan, and China. The co-regulator, like AI, supports the regulatory approval process, including granting and monitoring, to make processes quicker and greater data-driven.

In August 2025, Singapore and Hong Kong signed a memorandum of understanding that fosters cooperation among their regulatory agencies to handle concerns regarding health products, like pharmaceuticals, medical devices, advanced therapy products, and traditional medicines.

In June 2025, Mitsubishi Research Institute, Inc. and Astellas Pharma Inc. entered into a memorandum of understanding to offer drug-discovery startups in Japan support in their efforts to go global.

The European regulatory affairs market is experiencing a notable expansion. A rise in negotiations supporting for evolution of a novel legislative framework, which will optimize access, cost-effectiveness, and supply of medicines across the EU. Thus, the other approaches by the European Medicines Agency (EMA) are unveiling a new platform that will assist in monitoring and managing medicine shortages and issuing the latest guidelines for companies.

For this market,

In January 2025, Medical Regulation Gate (MRG) and the Regulatory Affairs Professionals Society (RAPS) announced a new collaboration to address the growing and emerging regulatory training requirements of Saudi Arabia and the broader Middle East region. Mohsen Al Muslimani, Chief Executive Officer of Medical Regulation Gate (MRG), stated that this accelerates the growth of the largest global organization of professionals involved in regulatory and quality assurance for healthcare products, enhancing offerings and support for this vital community of professionals.

By Service Type

By Category

By Product Type

By End-User/Client Segment

By Delivery Mode/Technology Enablement

By Region

February 2026

February 2026

February 2026

February 2026